Tapestry (NYSE:TPR) reported better-than-expected fourth-quarter financial results on Thursday.

The company reported fourth-quarter adjusted earnings per share of 92 cents, beating the analyst consensus of 88 cents. Quarterly sales of $1.59 billion (down 2%) beat the $1.58 billion estimate.

In fiscal 2025, Tapestry said it expects to maintain its annual dividend rate of $1.40 per common share. The company declared a quarterly cash dividend of 35 cents per common share, payable on September 23.

Tapestry anticipates FY25 revenue of around $6.7 billion, slightly below the $6.8 billion estimate, and expects EPS between $4.45 and $4.50, compared to the $4.49 estimate.

Tapestry anticipates FY25 revenue of around $6.7 billion, slightly below the $6.8 billion estimate, and expects EPS between $4.45 and $4.50, compared to the $4.49 estimate.

oanne Crevoiserat, Chief Executive Officer of Tapestry, Inc., said, "Our fourth quarter results exceeded expectations, capping a successful year. This is a testament to our passionate global teams whose creativity and exceptional execution continue to fuel our brands and business. Importantly, through an unwavering focus on powering innovation and consumer connections, we meaningfully advanced our strategic agenda in fiscal year 2024, delivering strong financial results against a dynamic backdrop. From this position of strength, we have a bold vision for the future and a steadfast commitment to drive growth and shareholder value for years to come."

Tapestry shares gained 0.3% to trade at $39.31 on Friday.

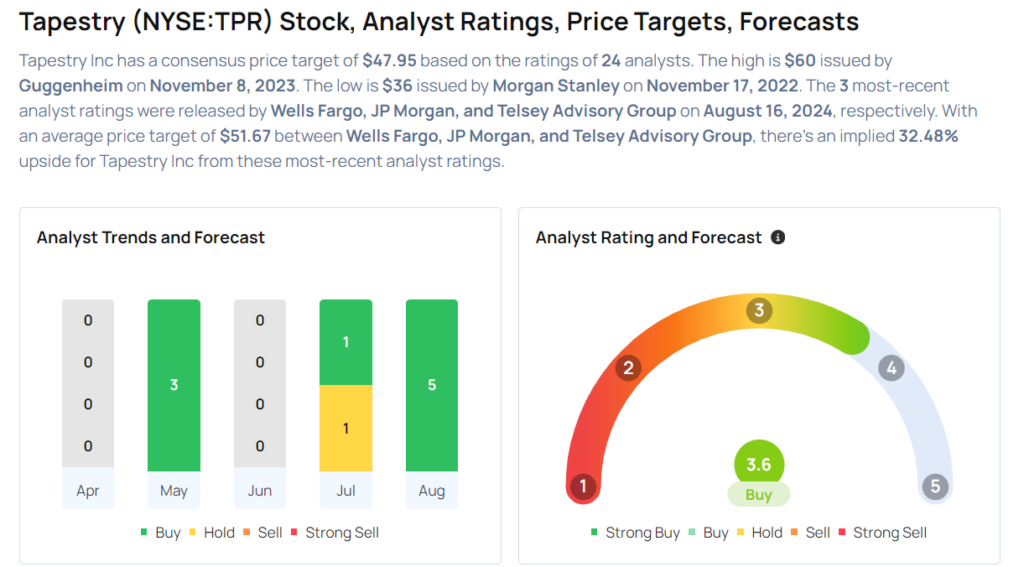

These analysts made changes to their price targets on Tapestry following earnings announcement.

- Wells Fargo analyst Ike Boruchow maintained Tapestry with an Overweight and lowered the price target from $52 to $50.

- JP Morgan analyst Matthew Boss maintained the stock with an Overweight and cut the price target from $54 to $51.

- Telsey Advisory Group analyst Dana Telsey maintained Tapestry with an Outperform and maintained a $54 price target.

Considering buying TPR stock? Here's what analysts think:

Read More:

- More Than $30M Bet On This Stock? Check Out These 3 Stocks Insiders Are Buying