Check Out What Whales Are Doing With META

Check Out What Whales Are Doing With META

Deep-pocketed investors have adopted a bullish approach towards Meta Platforms (NASDAQ:META), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in META usually suggests something big is about to happen.

资本雄厚的投资者对meta平台(NASDAQ:META)采取了看好的态度,这是市场参与者不能忽视的事情。我们在Benzinga的公共期权记录跟踪中发现了这个重大的举动。这些投资者的身份仍然未知,但META的如此重大的举动通常意味着即将发生一些重要事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Meta Platforms. This level of activity is out of the ordinary.

我们从观察到的情况中得到了这些信息,当Benzinga的期权扫描器突显出Meta平台的15项非凡的期权活动时。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 33% bearish. Among these notable options, 11 are puts, totaling $495,232, and 4 are calls, amounting to $128,978.

这些重量级投资者的普遍心情是分裂的,46%看好,33%看淡。在这些值得注意的期权中,有11份认购,总额为495,232美元,4份认沽,总额为128,978美元。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $520.0 and $540.0 for Meta Platforms, spanning the last three months.

经评估交易量和未平仓合约量后,我们可以看出主要市场运动者正在关注Meta平台在520.0美元至540.0美元价格区间之间的价格,这已持续了三个月。

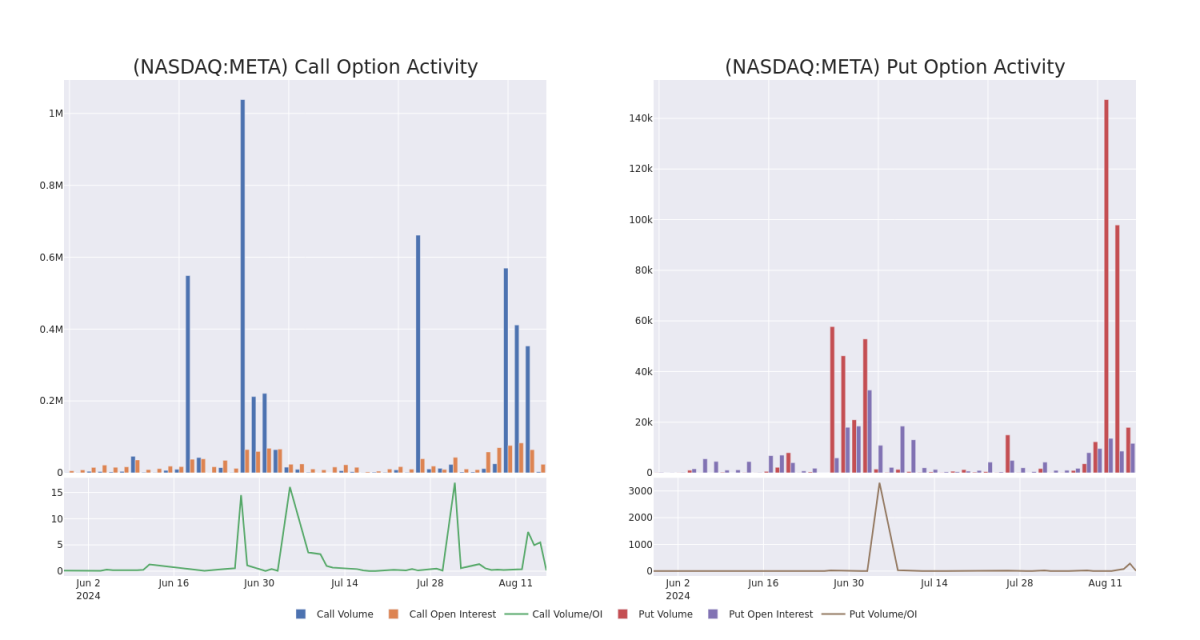

Volume & Open Interest Trends

成交量和未平仓量趋势

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Meta Platforms's options for a given strike price.

这些数据可以帮助您跟踪给定到期日的meta平台期权的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Meta Platforms's whale activity within a strike price range from $520.0 to $540.0 in the last 30 days.

下面,我们可以观察到过去30天Meta平台所有鲸鱼活动的认购和认沽的成交量和未平仓合约量的演变,这些活动都在520.0美元至540.0美元的执行价格范围内。

Meta Platforms Call and Put Volume: 30-Day Overview

Meta Platforms:看涨期权和看跌期权成交量:30天概述

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | PUT | SWEEP | NEUTRAL | 08/16/24 | $2.8 | $2.74 | $2.74 | $532.50 | $85.8K | 1.1K | 596 |

| META | PUT | SWEEP | BULLISH | 08/16/24 | $5.0 | $4.6 | $4.6 | $535.00 | $73.6K | 4.2K | 425 |

| META | PUT | SWEEP | BULLISH | 08/16/24 | $4.6 | $4.3 | $4.3 | $535.00 | $49.6K | 4.2K | 437 |

| META | PUT | TRADE | BULLISH | 08/16/24 | $4.8 | $4.55 | $4.55 | $535.00 | $45.5K | 4.2K | 1.3K |

| META | PUT | TRADE | BULLISH | 08/16/24 | $4.7 | $4.45 | $4.5 | $535.00 | $45.0K | 4.2K | 1.8K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| meta platforms | 看跌 | SWEEP | 中立 | 08/16/24 | $2.8 | $2.74 | $2.74 | $532.50 | $85.8K | 1.1千 | 596 |

| meta platforms | 看跌 | SWEEP | 看好 | 08/16/24 | $5.0 | $4.6 | $4.6 | $535.00 | 73.6K | 4.2千 | 425 |

| meta platforms | 看跌 | SWEEP | 看好 | 08/16/24 | $4.6 | $4.3 | $4.3 | $535.00 | 49.6K美元 | 4.2千 | 437 |

| meta platforms | 看跌 | 交易 | 看好 | 08/16/24 | $4.8 | 4.55 | 4.55 | $535.00 | $45.5K | 4.2千 | 1.3K |

| meta platforms | 看跌 | 交易 | 看好 | 08/16/24 | $4.7 | $4.45 | $4.5 | $535.00 | $45.0K | 4.2千 | 1.8K |

About Meta Platforms

关于meta平台

Meta is the world's largest online social network, with nearly 4 billion family of apps monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. The firm's ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm's total revenue, with more than 45% coming from the US and Canada and over 20% from Europe.

Meta是世界上最大的在线社交网络,拥有近40亿月活跃用户。用户以不同的方式进行互动,交换消息并分享新闻事件、照片和视频。该公司的生态系统主要由脸书应用程序、Instagram、Messenger、WhatsApp以及围绕这些产品的许多功能组成。用户可以在移动设备和台式机上使用Facebook。广告收入占公司总收入的90%以上,其中超过45%来自美国和加拿大,超过20%来自欧洲。

Present Market Standing of Meta Platforms

Meta Platforms的现有市场地位

- With a trading volume of 1,673,143, the price of META is down by -0.96%, reaching $532.18.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 68 days from now.

- META的交易量为1,673,143,价格下跌了0.96%,跌至532.18美元。

- 当前RSI值表明该股票可能接近超买状态。

- 下一份财报将于68天后发布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $520.0 and $540.0 for Meta Platforms, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $520.0 and $540.0 for Meta Platforms, spanning the last three months.