Financial giants have made a conspicuous bullish move on TG Therapeutics. Our analysis of options history for TG Therapeutics (NASDAQ:TGTX) revealed 8 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $72,578, and 6 were calls, valued at $252,764.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $20.0 for TG Therapeutics over the recent three months.

Volume & Open Interest Development

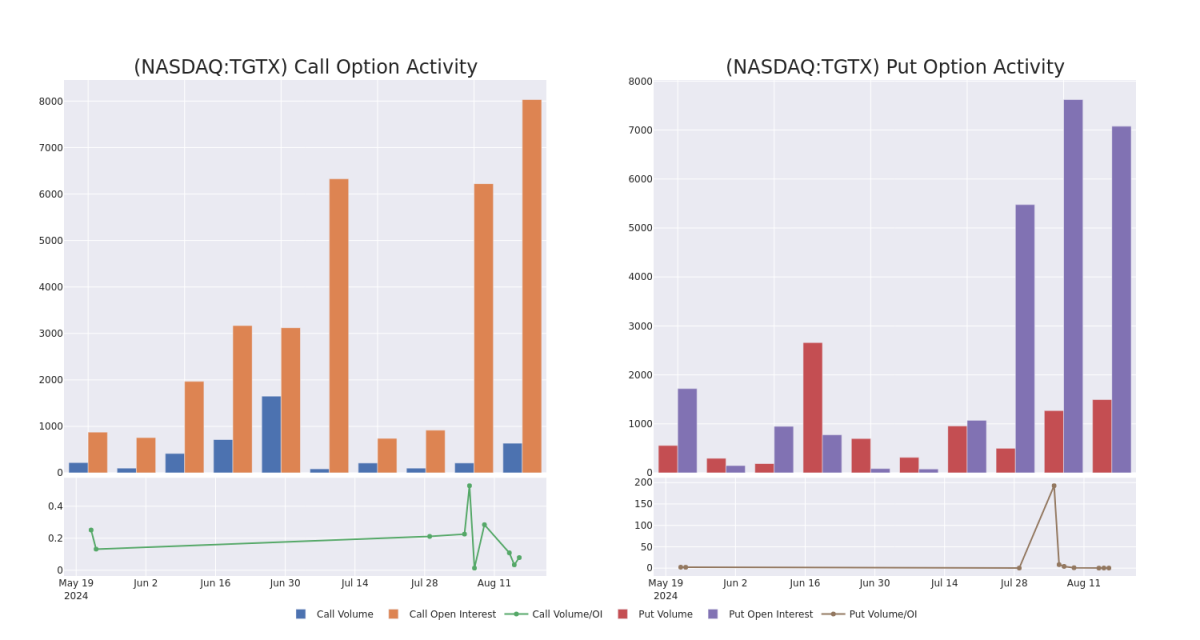

In today's trading context, the average open interest for options of TG Therapeutics stands at 3021.6, with a total volume reaching 2,130.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in TG Therapeutics, situated within the strike price corridor from $15.0 to $20.0, throughout the last 30 days.

In today's trading context, the average open interest for options of TG Therapeutics stands at 3021.6, with a total volume reaching 2,130.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in TG Therapeutics, situated within the strike price corridor from $15.0 to $20.0, throughout the last 30 days.

TG Therapeutics Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGTX | CALL | SWEEP | BULLISH | 01/16/26 | $10.9 | $10.4 | $10.9 | $15.00 | $81.7K | 651 | 77 |

| TGTX | PUT | SWEEP | BEARISH | 09/20/24 | $1.15 | $0.95 | $1.15 | $19.00 | $44.1K | 7.0K | 618 |

| TGTX | CALL | SWEEP | BULLISH | 08/16/24 | $6.0 | $5.9 | $6.0 | $15.00 | $42.6K | 835 | 122 |

| TGTX | CALL | TRADE | BULLISH | 01/17/25 | $5.3 | $4.9 | $5.27 | $20.00 | $38.9K | 5.6K | 114 |

| TGTX | CALL | TRADE | NEUTRAL | 08/16/24 | $6.4 | $6.2 | $6.3 | $15.00 | $31.5K | 835 | 172 |

About TG Therapeutics

TG Therapeutics Inc is a fully integrated, commercial-stage, biopharmaceutical company focused on the acquisition, development, and commercialization of novel treatments for B-cell diseases. The company has received approval from the U.S. Food and Drug Administration (FDA) for BRIUMVI (ublituximab-xiiy) for the treatment of adult patients with relapsing forms of multiple sclerosis (RMS). and the company is developing TG-1701 (BTK inhibitor) and TG-1801 (anti-CD47/CD19 bispecific mAb) for B-cell disorders which are under Phase 1 trial.

Having examined the options trading patterns of TG Therapeutics, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is TG Therapeutics Standing Right Now?

- Trading volume stands at 2,245,178, with TGTX's price up by 5.23%, positioned at $22.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 75 days.

Expert Opinions on TG Therapeutics

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $34.333333333333336.

- An analyst from B. Riley Securities has decided to maintain their Buy rating on TG Therapeutics, which currently sits at a price target of $34.

- An analyst from Goldman Sachs persists with their Neutral rating on TG Therapeutics, maintaining a target price of $20.

- An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $49.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.