Snowflake Unusual Options Activity For August 16

Snowflake Unusual Options Activity For August 16

Financial giants have made a conspicuous bullish move on Snowflake. Our analysis of options history for Snowflake (NYSE:SNOW) revealed 44 unusual trades.

金融巨頭們對Snowflake做出了明顯的看漲舉動。我們對Snowflake (紐交所:SNOW)的期權歷史進行分析後發現44筆不尋常的交易。

Delving into the details, we found 45% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 23 were puts, with a value of $1,938,874, and 21 were calls, valued at $1,113,699.

具體來看,我們發現45%的交易者看漲,而45%的交易者看跌。在我們發現的所有交易中,有23筆看跌,價值1938874美元,21筆看漲,價值1113699美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $80.0 to $210.0 for Snowflake over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,似乎鯨魚們在過去的3個月裏一直瞄準了Snowflake在80.0到210.0美元的價格區間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

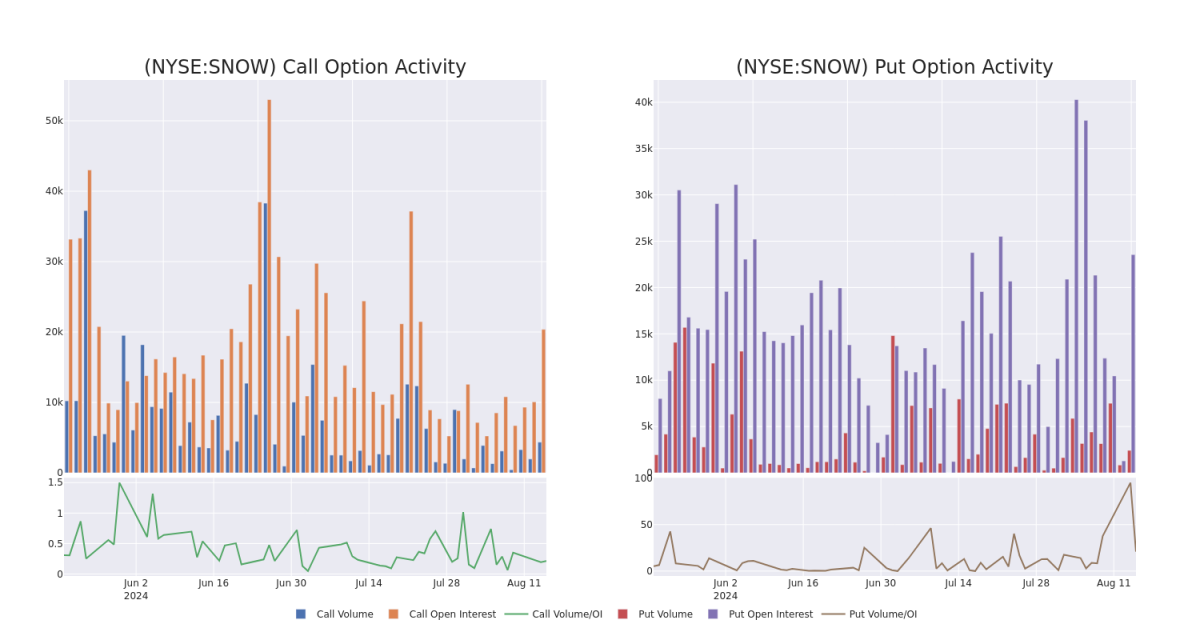

In today's trading context, the average open interest for options of Snowflake stands at 887.23, with a total volume reaching 19,311.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $80.0 to $210.0, throughout the last 30 days.

在今天的交易背景下,Snowflake期權的平均未平倉合約爲887.23手,總成交量達到了19311.00手。伴隨的圖表描述了Snowflake的看漲和看跌期權成交量和未平倉合約在過去30天內在80.0到210.0美元的行權價格區間內的高價值交易的進展。

Snowflake Option Volume And Open Interest Over Last 30 Days

雪花期權成交量和未平倉合約過去30天的情況

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | PUT | TRADE | BEARISH | 02/21/25 | $15.7 | $15.45 | $15.6 | $125.00 | $421.2K | 51 | 270 |

| SNOW | PUT | TRADE | BULLISH | 06/20/25 | $18.85 | $17.45 | $17.8 | $120.00 | $320.4K | 1.2K | 360 |

| SNOW | CALL | SWEEP | BULLISH | 10/18/24 | $10.65 | $10.6 | $10.6 | $130.00 | $273.5K | 507 | 458 |

| SNOW | PUT | TRADE | NEUTRAL | 10/18/24 | $3.95 | $3.85 | $3.9 | $110.00 | $136.5K | 696 | 496 |

| SNOW | PUT | TRADE | BEARISH | 10/18/24 | $15.3 | $15.25 | $15.3 | $135.00 | $122.4K | 545 | 80 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | 看跌 | 交易 | 看淡 | 02/21/25 | 15.7 | $15.45 | $15.6 | $125.00 | $421.2K | 51 | 270 |

| SNOW | 看跌 | 交易 | 看好 | 06/20/25 | $18.85 | $17.45 | $17.8 | $120.00 | $320.4K | 1.2K | 360 |

| SNOW | 看漲 | SWEEP | 看好 | 10/18/24 | $10.65 | $10.6 | $10.6 | $130.00 | $273.5K | 507 | 458 |

| SNOW | 看跌 | 交易 | 中立 | 10/18/24 | $3.95 | $3.85 | $3.9 | $110.00 | $136.5K | 696 | 496 |

| SNOW | 看跌 | 交易 | 看淡 | 10/18/24 | $15.3 | $15.25 | $15.3 | $135.00 | $122.4K | 545 | 80 |

About Snowflake

關於Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Snowflake成立於2012年,是一家數據湖,數據倉庫和共享公司,於2020年上市。到目前爲止,該公司擁有超過3000個客戶,其中近30%是財富500強客戶。Snowflake的數據湖存儲非結構化和半結構化數據,然後可用於分析,創建存儲在其數據倉庫中的見解。Snowflake的數據共享功能使企業可以輕鬆購買和攝取數據,而傳統方式需要數月時間。總的來說,該公司以其數據解決方案可以託管在各種公共雲中而聞名。

After a thorough review of the options trading surrounding Snowflake, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對Snowflake周邊的期權交易進行徹底的審查之後,我們繼續對該公司進行更詳細的評估。這包括對其目前的市場狀況和表現的評估。

Present Market Standing of Snowflake

Snowflake的當前市場地位

- With a volume of 4,195,166, the price of SNOW is up 1.11% at $128.47.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 5 days.

- SNOW的成交量爲4195166手,價格上漲了1.11%,至128.47美元。

- RSI指標暗示該股票可能要超買了。

- 下一次收益預計將在5天發佈。

Expert Opinions on Snowflake

關於Snowflake的專家意見

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $145.0.

在過去30天中,共有2位專業分析師對該股票進行了評估,設定了平均目標價格爲145.0美元。

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on Snowflake with a target price of $160.

- In a cautious move, an analyst from Wells Fargo downgraded its rating to Equal-Weight, setting a price target of $130.

- 在他們的評估中,來自b of A Securities的分析師保持了對Snowflake的中立評級,並設定了160美元的目標價。

- 在慎重考慮後,來自富國銀行證券的分析師將其評級下調至等重,並設定了130美元的價格目標。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snowflake with Benzinga Pro for real-time alerts.

交易期權有更大的風險,但也有可能獲得更高的利潤。精明的交易者通過不斷學習、策略性交易調整,利用各種因子,並時刻關注市場變化來減少風險。使用Benzinga Pro獲取Snowflake最新期權交易的實時提醒。

In today's trading context, the average open interest for options of Snowflake stands at 887.23, with a total volume reaching 19,311.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $80.0 to $210.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Snowflake stands at 887.23, with a total volume reaching 19,311.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $80.0 to $210.0, throughout the last 30 days.