Decoding Okta's Options Activity: What's the Big Picture?

Decoding Okta's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bullish stance on Okta.

拥有大量资金的鲸鱼在Okta上表现出看好态度。

Looking at options history for Okta (NASDAQ:OKTA) we detected 10 trades.

通过查看Okta(纳斯达克:okta)的期权历史交易,我们发现了10笔交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 30% with bearish.

通过考虑每一次交易的具体情况,可以准确地说,有50%的投资者对看涨持乐观态度,30%则看跌。

From the overall spotted trades, 3 are puts, for a total amount of $111,069 and 7, calls, for a total amount of $255,442.

从所有检测到的交易中,有3个看跌期权,总金额为$111,069;7个看涨期权,总金额为$255,442。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $80.0 to $110.0 for Okta during the past quarter.

通过分析这些合约的成交量和未平仓量,看起来大户在过去一个季度里一直关注Okta的价格区间在$80.0至$110.0之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

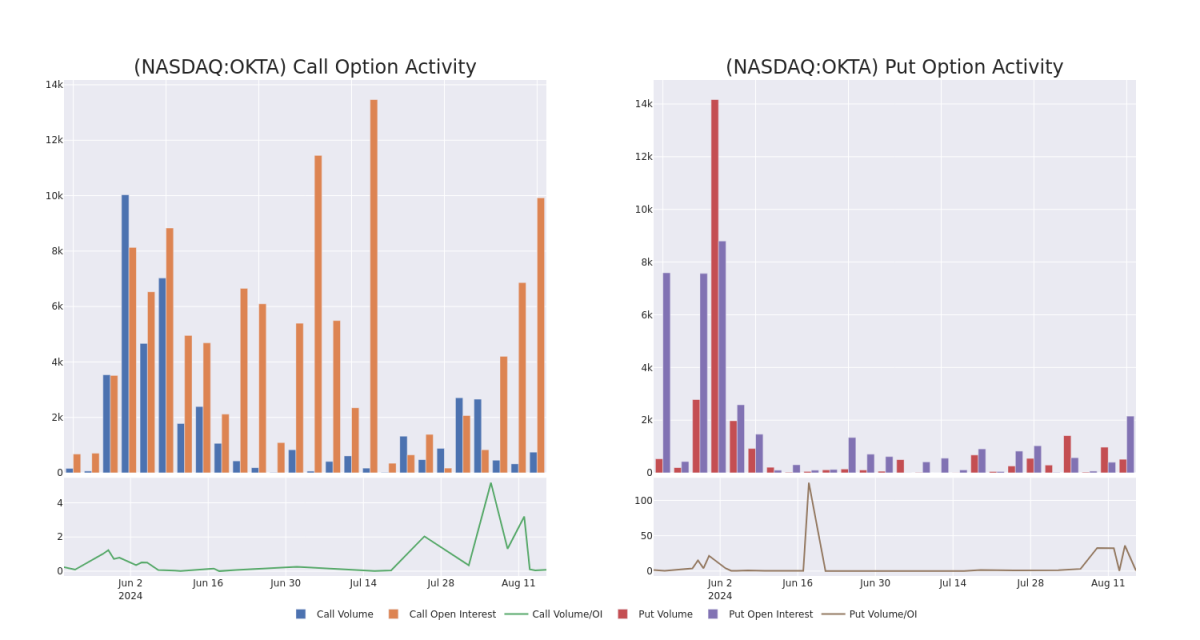

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Okta's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Okta's whale trades within a strike price range from $80.0 to $110.0 in the last 30 days.

当交易期权时,查看成交量和未平仓量是一个有力的策略。此数据可以帮助您跟踪Okta某一行权价格的期权的流动性和兴趣。下面我们可以观察在过去30天里,为申报价格在$80.0至$110.0的所有Okta的鲸鱼交易的看涨期权和看跌期权的成交量和未平仓量的演变。

Okta Option Volume And Open Interest Over Last 30 Days

Okta在过去30天内的期权成交量和持仓量

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OKTA | CALL | SWEEP | BULLISH | 09/20/24 | $3.25 | $3.15 | $3.21 | $105.00 | $72.3K | 1.4K | 296 |

| OKTA | PUT | SWEEP | BEARISH | 09/20/24 | $6.65 | $6.55 | $6.65 | $95.00 | $50.5K | 777 | 196 |

| OKTA | CALL | SWEEP | BULLISH | 09/20/24 | $5.0 | $4.95 | $5.0 | $100.00 | $38.0K | 6.9K | 135 |

| OKTA | PUT | SWEEP | BULLISH | 09/20/24 | $1.63 | $1.57 | $1.62 | $80.00 | $34.6K | 1.0K | 251 |

| OKTA | CALL | SWEEP | BULLISH | 08/16/24 | $2.55 | $2.55 | $2.55 | $92.00 | $30.8K | 343 | 133 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| okta | 看涨 | SWEEP | 看好 | 09/20/24 | $3.25 | $3.15 | $3.21 | $105.00 | $72.3K | 1.4千 | 296 |

| okta | 看跌 | SWEEP | 看淡 | 09/20/24 | $6.65 | $ 6.55 | $6.65 | $ 95.00 | $50.5K | 777 | 196 |

| okta | 看涨 | SWEEP | 看好 | 09/20/24 | $5.0 | $4.95 | $5.0 | $100.00。 | $38.0K | 6.9K | 135 |

| okta | 看跌 | SWEEP | 看好 | 09/20/24 | $1.63 | $1.57 | $1.62 | $80.00 | $34.6K | 1.0K | 251 |

| okta | 看涨 | SWEEP | 看好 | 08/16/24 | $2.55 | $2.55 | $2.55 | 92.00美元 | $30.8K | 343 | 133 |

About Okta

关于Okta

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta's workforce offerings enable a company's employees to securely access its cloud-based and on-premises resources. The firm's customer offerings allow its clients' customers to securely access the client's applications.

Okta是一家云原生安防公司,专注于身份和访问管理。总部位于旧金山的公司于2017年上市,致力于服务两个关键的客户利益相关方群体:员工和客户。Okta的员工服务可以使一家公司的员工安全地访问云端和地面资源。该公司的客户服务使其客户的顾客可以安全地访问客户的应用程序。

Having examined the options trading patterns of Okta, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了Okta的期权交易模式后,我们的关注点现在直接转向公司。这个转变让我们深入了解其当前的市场地位和表现。

Where Is Okta Standing Right Now?

Okta现在的处境如何?

- With a volume of 1,236,784, the price of OKTA is down -0.49% at $95.04.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

- OKTA的成交量为1,236,784,价格为95.04美元,下跌了-0.49%。

- RSI指标暗示该股票可能要超买了。

- 下一次公布的收益预计将在12天后发行。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Okta options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在收益。精明的交易员通过不断地学习、调整自己的策略、监测多个因子并密切关注市场走势来管理这些风险。通过Benzinga Pro的实时提醒,了解最新的Okta期权交易。