On Friday, Nvidia became the number one US stock by trading volume, up 1.40% with a turnover of $36.933 billion. Nvidia rose on all five trading days this week, accumulating an increase of 18.93%. In the past seven trading days, it rose on six days, with a cumulative increase of about 26%. Product structure, 10-30 billion yuan products operating income of 401/1288/60 million yuan respectively.

Eric Schmidt, former CEO of Google, pointed out in a lecture at Stanford University that large tech companies are planning to make large-scale investments in Nvidia, especially in the construction of artificial intelligence data centers, with expected costs of up to $300 billion. Schmidt says, "I'm talking to big companies, and they're telling me they urgently need $20 billion, $50 billion, or even $100 billion."

Schmidt said,"I am talking to big companies, and they are telling me that they urgently need $20 billion, $50 billion, or even $100 billion."

Tesla, the second-ranked, rose 0.92% with a turnover of $19.145 billion. Tesla rose more than 8% this week.

On Friday, reports indicated that the Tesla Cybertruck was the best-selling car in the United States in July 2024, with a price of over $0.1 million. This is the second consecutive month the vehicle has received this honor. Considering the polarized reputation of this pure electric pickup, this result is impressive.

Last month, the high sales of expensive full-size pickups actually pushed up the average transaction price (ATP) of the US auto industry. It turns out that full-size pickups are very popular in the US market, accounting for 14% of US car sales last month. The Ford F series and Chevrolet Silverado were the top-selling models in July in the United States, with the former's ATP exceeding $0.067 million and the latter's ATP exceeding $0.06 million.

Apple, ranked third, rose 0.59% with a turnover of $9.575 billion. Apple has risen about 4.7% this week. According to the latest revelations by renowned industry insiders, Apple plans to make a major update to its Mac product line later this year.

It is rumored that the new generation of MacBook Pro, Mac mini, and iMac will be equipped with M4 series chips. Reports are supported by analysts in the display supply chain who revealed that displays for the new 14-inch and 16-inch MacBook Pro were shipped in July and August, respectively.

Meta Platforms, ranked fifth, fell 1.84%, with a turnover of $7.771 billion. The company has officially released a new application, Quest HDMI Link, targeting Quest 2, Quest 3, and Quest Pro headsets.

AMD, ranked eighth, rose 0.81%, with a turnover of $4.596 billion. This week, the stock has risen more than 10.6%. It was recently reported that AMD will launch new products such as Zen5 EPYC CPUs and MI325X accelerators on October 10th.

Google A-class stock (GOOGL), ranked ninth, rose 10.3%, with a turnover of $3.938 billion. This week, the stock fell 0.4%. Former Google CEO and executive chairman Eric Schmidt publicly apologized for his comments on Google employees not working hard enough.

Earlier, in an event at Stanford University, Schmidt publicly criticized Google employees for their lack of hard work and said it was the reason they were falling behind in competition with OpenAI. The comments sparked controversy.

Applied Materials, ranked twelfth, fell 1.86%, with a turnover of $2.384 billion. The company's net revenue for the third fiscal quarter was $6.778 billion, up 5% year-over-year. Net income was $1.705 billion, up 9% year-over-year. The company expects net revenue in the fourth quarter of fiscal 2024 to be approximately $6.93 billion, up or down $0.4 billion. This week, the stock has risen 8.8%.

Alibaba, ranked 15th, rose 4.58%, with a turnover of $2.096 billion. This week, the stock has risen 4%. Alibaba Group's first-quarter (Q2 2024) performance shows that as the adoption of AI-related public cloud continues to increase, Aliyun's public cloud business quarterly revenue growth rate is in double digits, with AI related product revenue continuing to achieve three-digit year-on-year growth.

The company's first-quarter revenue was RMB 243.236 billion, up 4% year-over-year, with adjusted EBITA (earnings before interest, taxes, and amortization) of RMB 45.035 billion, higher than market expectations.

Brokerage Truist reduced Alibaba's target price from $110 to $100.

Taiwan Semiconductor, ranked 19th, rose 0.33%, with a turnover of $1.856 billion. The stock has risen 4.4% this week.

Citigroup analysts Laura Chen and Jack Chen said in a research report that Taiwan Semiconductor may be aiming to meet the growing demand for AI chips through active investment in advanced packaging.

Taiwan Semiconductor said on Thursday that it had signed a contract with Chunghwa Picture Tubes to purchase the Chung Mei Nanke factory and related facilities in Xinxin District, Tainan City for NTD 17.14 billion (approximately RMB 3.788 billion). Citi expects Taiwan Semiconductor to accelerate expanding its advanced CoWoS packaging capacity. The analysts said production capacity in the fourth quarter may reach between 0.03 million and 0.035 million wafers per month, increasing to more than 0.06 million per month by the end of 2025. They added that Taiwan Semiconductor's capital expenditure may increase to $35 billion next year.

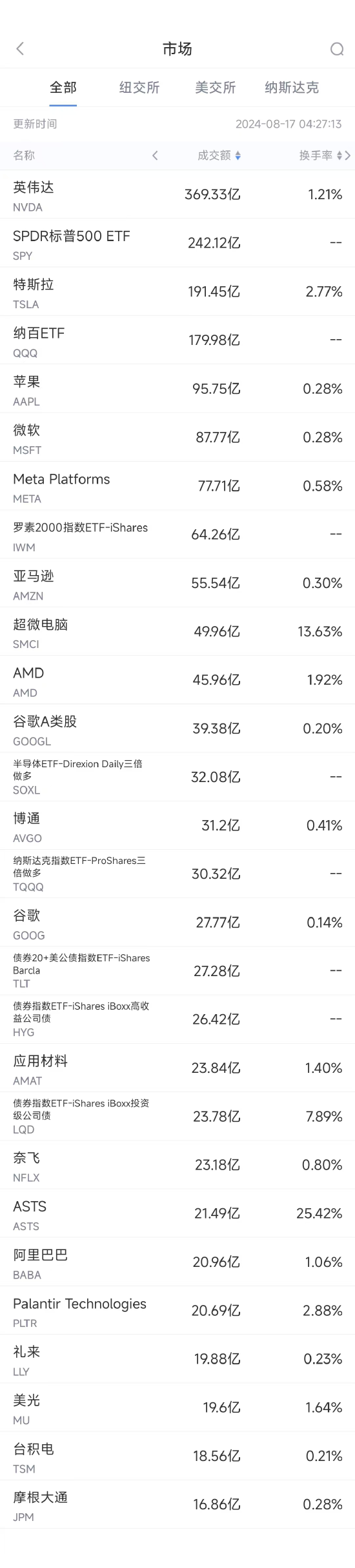

(Screenshot from Sina Finance APP Market section - US Stocks - Market sector, slide left for more data) Download the Sina Finance APP