Jiangsu Gian Technology Co., Ltd. (SZSE:300709) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 32% in the last year.

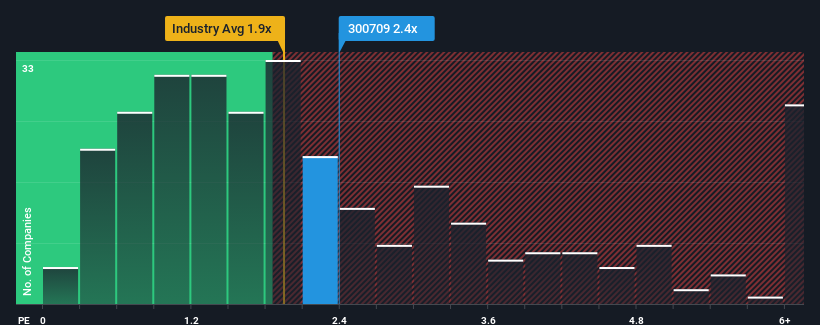

In spite of the firm bounce in price, there still wouldn't be many who think Jiangsu Gian Technology's price-to-sales (or "P/S") ratio of 2.4x is worth a mention when the median P/S in China's Electrical industry is similar at about 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

What Does Jiangsu Gian Technology's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Jiangsu Gian Technology's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Jiangsu Gian Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is Jiangsu Gian Technology's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Jiangsu Gian Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 29% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Jiangsu Gian Technology's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Jiangsu Gian Technology's P/S Mean For Investors?

Jiangsu Gian Technology's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Jiangsu Gian Technology's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Jiangsu Gian Technology.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.