We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Shanghai Shibei Hi-Tech Co.,Ltd. (SHSE:600604) share price dropped 64% over five years. That's an unpleasant experience for long term holders. And we doubt long term believers are the only worried holders, since the stock price has declined 30% over the last twelve months. Furthermore, it's down 19% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 13% in the same period.

If the past week is anything to go by, investor sentiment for Shanghai Shibei Hi-TechLtd isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Shanghai Shibei Hi-TechLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Shanghai Shibei Hi-TechLtd saw its revenue increase by 5.8% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 10% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Shanghai Shibei Hi-TechLtd. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

In the last half decade, Shanghai Shibei Hi-TechLtd saw its revenue increase by 5.8% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 10% for the last five years. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Shanghai Shibei Hi-TechLtd. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

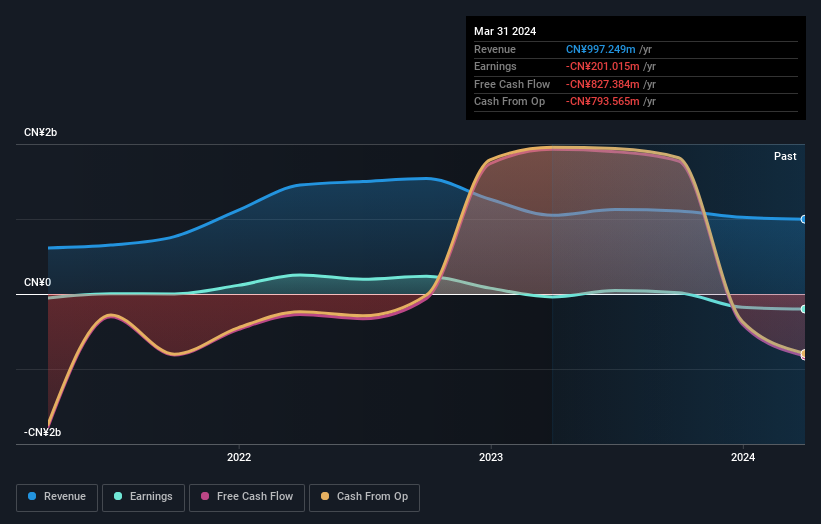

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 16% in the twelve months, Shanghai Shibei Hi-TechLtd shareholders did even worse, losing 30%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Shanghai Shibei Hi-TechLtd that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.