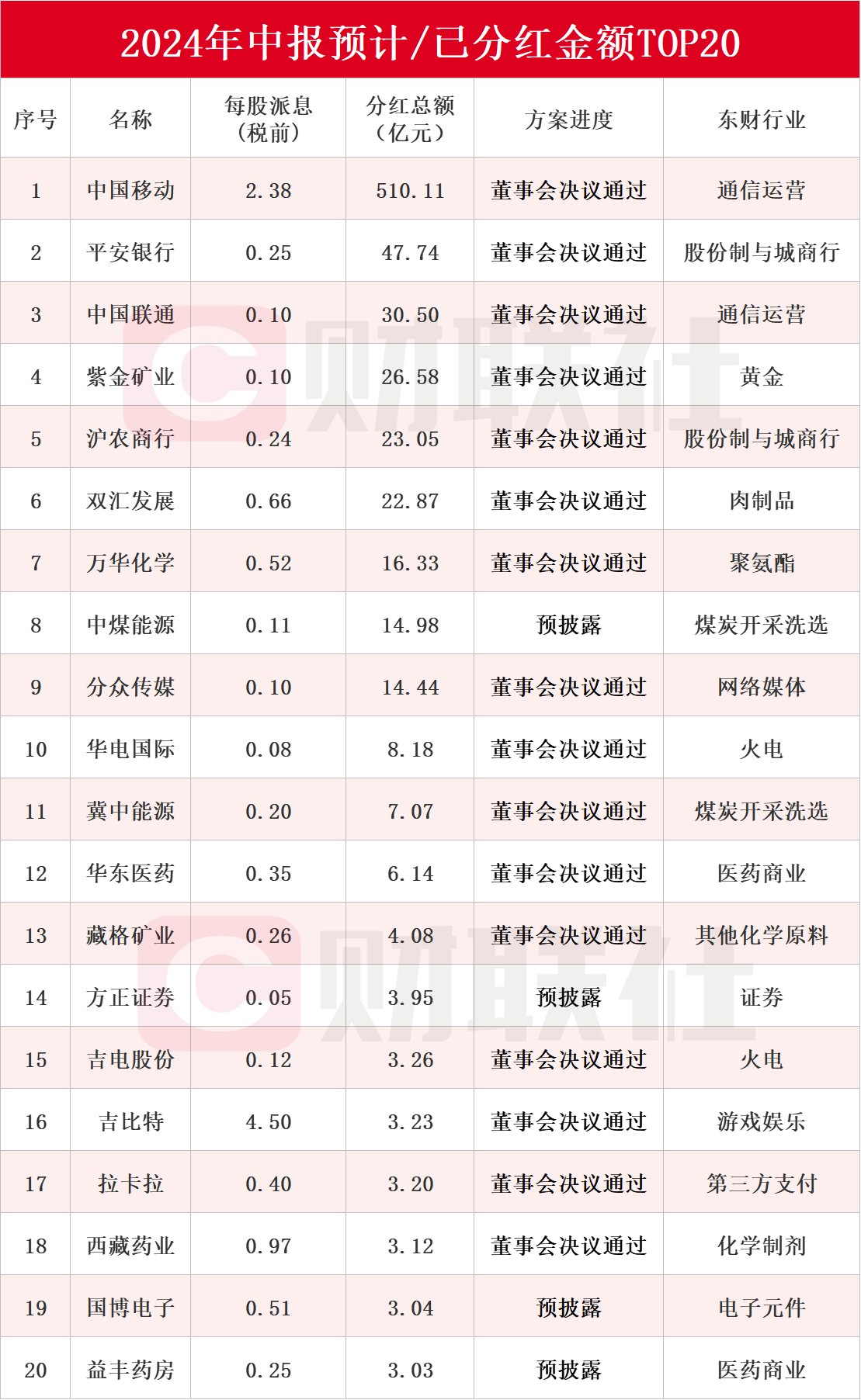

As of now, nearly 650 A-share listed companies have released their half-year reports. Among them, 174 listed companies plan to distribute interim dividends. China Mobile is expected to distribute 5.1 billion yuan for the first half of the year, leading A-shares, along with the Top 20 list of estimated/historical interim dividends in 2024 (see attached table).

The disclosure of the A-share listed companies' 2024 half-year reports is proceeding vigorously. According to choice data, as of the publication of this article, nearly 650 A-share listed companies have released their 2024 half-year reports.

With the release of the interim reports, as of today, 174 listed companies on the A-share market plan to distribute interim dividends. In terms of dividend amount, China Mobile plans to distribute a dividend of 2.38 yuan per share to shareholders (including tax), totaling approximately 51 billion yuan in interim dividends, ranking first. Ping An Bank and China Unicom ranked second and third respectively with planned dividends of 4.774 billion yuan and 3.05 billion yuan. Zijin Mining, Shanghai Rural Commercial Bank, and Shuanghui Development had dividends of 2.658 billion yuan, 2.305 billion yuan, and 2.287 billion yuan, respectively. In addition, Wanhua Chemical, China Coal Energy, and Focus Media have dividends that exceed 1 billion yuan, while Huadian Power International, Jizhong Energy Resources, and Huadong Medicine have dividends that exceed 0.5 billion yuan. In addition, Zangge Mining, Founder Securities, Jilin Electric Power, G-bits Network Technology, Lakala Payment, Tibet Rhodiola Pharmaceutical Holding, China National Electronic Imp & Exp Corp, and Yifeng Pharmacy Chain had dividends exceeding 0.3 billion yuan. Further details are shown in the following table:

The source shows choice data and disclosures made by listed companies.

The source shows choice data and disclosures made by listed companies.

The source shows choice data and disclosures made by listed companies.

On August 8, China Mobile announced a net profit of 80.2 billion yuan for the first half of the year, a YoY increase of 5.3%. With the release of this report, China Mobile also announced its interim dividend plan. According to China Mobile's announcement regarding its 2024 Mid-term Profit Distribution Plan, the company will distribute dividends to all shareholders, which will increase by 7.0% YoY, with A-share dividends paid in RMB at a rate of 2.3789 yuan per share (including tax). As of mid-2024, the total number of shares was 21.443 billion, and a total of approximately 51.011 billion yuan in interim dividends was to be dispensed. On August 14, Shanxi Securities' Gao Yuyang and others released a research report stating that China Mobile is currently in the process of transitioning from a traffic business to new information services, and analysts believe that the company has a solid customer base, data foundation, and computing power foundation, and is expected to accelerate the implementation of new AI drivers. China Mobile is pushing forward with its "3 x 10000" artificial intelligence action, maintaining its advanced position in the domestic AI field. The smart calculation (FP16) in the first half-year was 19.6EFLOPS, a YoY increase of 9.5EFLOPS. It has already developed 23 AI+ products and will provide new impetus to government and enterprise businesses through AI+DICT, and new impetus to mobile cloud businesses through model-based services.

On August 15, Ping An Bank announced that its net profit for the first half of the year was 25.879 billion yuan, a YoY increase of 1.9%. On the same day, Ping An Bank also disclosed its 2024 mid-year profit distribution plan. It plans to distribute cash dividends of 2.46 yuan per 10 shares (including tax), and the total cash dividend amount will be 4.774 billion yuan (including tax). On August 15, Leung Fung Kit and others from Zhejiang Securities released a research report stating that Ping An Bank's revenue momentum had stabilized, its debt cost had significantly improved, and the effectiveness of its business adjustment had already been demonstrated. Looking ahead to the full year, with the continued decline in the base number, it is expected that the drag on profitability caused by the interest rate differential will continue to improve, and the year-on-year revenue decline is expected to continue to narrow slightly, and profits are expected to maintain positive growth.

On August 15, China Unicom announced a net profit of 6 billion yuan for the first half of 2024, a YoY increase of 10.9%. Regarding profit distribution, the board of directors of China Unicom proposed to distribute cash dividends of 0.959 yuan per 10 shares (including tax), a YoY increase of 20.5%, and to distribute a total of approximately 3.05 billion yuan (including tax) to company shareholders. On August 16, Tang Haiqing and others from Tianfeng Securities released a research report stating that China Unicom continued to strengthen the construction of new infrastructure, focused on the three networks of the Internet, computing power, and data, adhered to network synergy and precise investment, completed fixed asset investment of 23.9 billion yuan in the first half of the year (expected to be within 65 billion yuan for the full year), and the investment scale was stable, with a YoY decline of 13.4%. The investment efficiency continued to improve, laying a solid foundation for the high-quality development of the company.

On July 8th, Zijin Mining Group announced that it is expected to achieve net income attributable to shareholders of the listed company of approximately RMB14.55 billion to RMB15.45 billion in the first half of 2024, a year-on-year increase of approximately 41% to 50%. On July 19th, Zijin Mining Group announced that it plans to implement mid-term dividends in 2024, with a cash dividend of RMB1 per 10 shares, totaling a cash dividend of approximately RMB2.658 billion. China Galaxy Huali and others released a research report on July 9th, stating that Zijin Mining Group has made significant breakthroughs in mineral exploration and storage, with strong intrinsic growth momentum. Zijin Mining Group has strong independent exploration capabilities, rich reserves of key mining projects, and is expected to maintain stable growth in copper and gold production in the future, with sufficient long-term growth momentum.

On August 16th, Shanghai Rural Commercial Bank announced a net income of RMB6.971 billion in the first half of the year, a year-on-year increase of 0.62%. The company plans to distribute a cash dividend of RMB2.39 per 10 shares, with a total of RMB2.305 billion, and a dividend ratio of 33.07%. Liang Fengjie and others from Zheshang Securities released a research report on August 17th, stating that considering the clear mid-term dividend plan of Shanghai Rural Commercial Bank, it is expected that the mid-term dividend will be quickly implemented in the subsequent months of the year. In addition, it should be noted that the core Tier 1 capital adequacy ratio of Shanghai Rural Commercial Bank increased by 19bp to 14.68% at the end of Q2 2024, which is at a higher level among listed banks. Shanghai Rural Commercial Bank has sufficient capital to maintain dividends at a high level or even further increase them.

此外,万华化学、中煤能源、分众传媒分红金额均超10亿元,华电国际、冀中能源、华东医药拟分红金额均超5亿元,藏格矿业、方正证券、吉电股份、吉比特、拉卡拉、西藏药业、国博电子、益丰药房分红金额均超3亿元。

此外,万华化学、中煤能源、分众传媒分红金额均超10亿元,华电国际、冀中能源、华东医药拟分红金额均超5亿元,藏格矿业、方正证券、吉电股份、吉比特、拉卡拉、西藏药业、国博电子、益丰药房分红金额均超3亿元。