The overall tone of Powell's speech, rather than a specific statement, will be the key to maintaining market sentiment; the options market is pricing in volatility of over 1% for the S&P 500 index this Friday.

Wall Street investment institutions are generally betting that Federal Reserve Chairman Jerome Powell will fully confirm market expectations at the global central bank annual conference in Jackson Hole, Wyoming, that the Fed will soon start cutting interest rates in September. But as the market debate over whether the Fed will cut interest rates turns from "will they choose to cut" to "how much will they cut", some stock traders may feel resentful or disappointed with Powell's signal.

For the global stock markets, which experienced a so-called "super rebound" last week, the Jackson Hole central bank annual conference on Friday night Beijing time is a "key test." Key policymakers, including Federal Reserve Chairman Powell and Bank of England Governor Bailey, will deliver important speeches. During last Friday's trading session, the options market priced in the high volatility of the S&P 500 index exceeding 1% this Friday, betting that the benchmark index will exceed this threshold regardless of whether it rises or falls this week.

"If traders hear a heavy signal that an interest rate cut is coming, the stock market will give a positive response," said Eric Bailey, executive director of Steward Partners Global Advisory. "However, if traders and investors don't hear the positive information they want, the stock market, which has experienced a big rebound, may face massive selling off."

"If traders hear a heavy signal that an interest rate cut is coming, the stock market will give a positive response," said Eric Bailey, executive director of Steward Partners Global Advisory. "However, if traders and investors don't hear the positive information they want, the stock market, which has experienced a big rebound, may face massive selling off."

The upcoming Jackson Hole central bank annual conference will undoubtedly be a major challenge for fund managers who have just returned to large tech stocks such as Nvidia, Microsoft and Apple, as well as those who have been firmly pushing up the S&P 500 index under the expectation of interest rate cuts and large-scale stock repurchases. Interest rate futures traders are currently pricing in an interest rate cut of 25 basis points at the Fed's policy meeting in September, with almost 100% certainty.

However, some investment institutions are still worried that Powell may easily remain silent on the timing of the interest rate cut or remain tight-lipped about the "timing of interest rate cuts" expected by the market when he speaks on Friday. Moreover, in previous years, Powell had often played the "riddle man" during central bank annual conferences. He has taken a cautious stance in his speeches and has been reticent about how high rates might go during the Fed's interest rate hiking cycle, which is also in line with his character.

"The market is very confident that interest rate cuts are coming," said Bailey of Steward Partners Global Advisory. "If Powell doesn't stress this is the road to the future, it will be a huge detonation point."

The global stock market, after experiencing a super rebound, faces a crucial test.

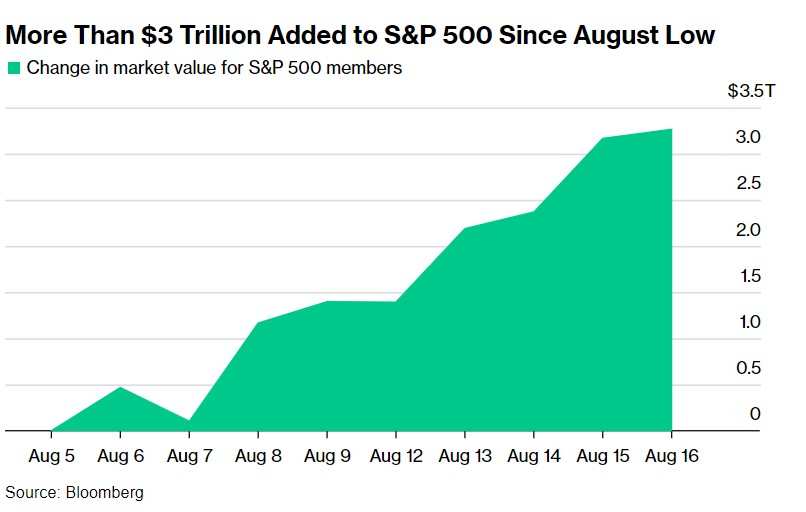

Powell's "unexpected" comments on interest rate cuts could completely overturn the benchmark stock index of US stocks -- the S&P 500 index -- which rebounded crazily in value by up to $3.3 trillion after the global stock market panic in early August.

In Asia, the benchmark stock indexes of Japan and South Korea have regained all their losses from "Black Monday." European stocks continued to rise after opening on Friday, and saw the largest weekly gain in three months, and came closer to the historical highs they had previously set. The MSCI global developed markets stock index also saw its best weekly gain since early November last year.

According to EPFR Global statistics cited by Bank of America, with investors pouring $5.5 billion into the US stock market in the week ending last Wednesday, the long forces in the US stock market have regained control, and the benchmark stock index of the US stock market has risen for seven consecutive trading days.

Since its low point in August, the market capitalization of the S&P 500 index has expanded by over $3 trillion.

However, some Wall Street analysts warn that investors and traders should not expect too much detailed information on interest rate cuts from Powell, nor should they take an overly optimistic position on his comments.

"Looking back at past Jackson Hole annual conferences, we are unlikely to get unconventional comments on rate cuts from Powell," said Tom Hainlin, investment strategy analyst at US Bank Wealth Management.

Former New York Fed Chairman Bill Dudley said that Fed Chairman Powell may suggest that overly tight monetary policy is no longer needed. However, he expects Powell will not suggest the size and specific timeline of the first rate cut, especially since a crucial non-farm payroll and unemployment report will be released on September 6 to provide policy makers with a more comprehensive assessment before making their next policy decision on September 18. Product structure, 10-30 billion yuan products operating income of 401/1288/60 million yuan respectively.

"His tone and the tone of the entire speech are crucial." said Stephanie Lang, Chief Investment Officer at Homrich Berg. "If he surprises the market with an unexpected hawkish monetary policy stance, the stock market will respond very negatively."

It should be noted that traders are almost fully expecting a rate cut at the next meeting of the Federal Reserve. But traders have not yet priced in how big the rate cut will be. They generally believe that the labor market report scheduled to be released in September is crucial to the Fed's rate cut, and if the unemployment rate remains high and employment is weak, the likelihood of a 50 basis point rate cut is expected to be higher than a 25 basis point rate cut. It will also be a focus of the Jackson Hole Annual Meeting whether the future focus and core of Fed policy will be more focused on labor balance rather than combating inflation.

The stock market is already prepared for increased volatility in the S&P 500 index on Friday.

As there are very few Fed officials scheduled to speak in the coming days, Powell's remarks could be quite volatile for the market. Citigroup Inc. has said that's why traders in the U.S. stock options market are predicting volatility of more than 1% in the S&P 500 index on Friday, regardless of whether it rises or falls, based on the cost of at-the-money put and call options.

With the recent large rebound in the S&P 500 index, which has fallen only 2% from its all-time high, Wall Street is almost praying that the pain of this summer is over. Data compiled by institutions shows that traders believe the future market will remain calm rather than VIX index continuing to soar. The scale of open interest in puts betting that the Chicago Board Options Exchange Volatility Index (VIX Index) will fall has been hovering at its highest level since June 2022, while the number of contracts betting on rising volatility is very small.

Of course, some traders have reduced their bets on a 50 basis point cut in September or more, as there have been many signs that the U.S. economy has resilience and a 25 basis point rate cut is likely to be the most reasonable. This means that market risk in Jackson Hole is gradually receding and investors are no longer expecting significant rate cuts like they were earlier in August.

"We want to know what the Fed's rate path will actually be, whether they will choose to lower interest rates at every meeting or still rely on employment and inflation data," said Heynlin from US Bank. "But he may not say that. Traders are more likely to get more detailed information about these issues at the Fed's September meeting."

The Fed chairman's speech at Jackson Hole usually does not have a significant impact on the stock market, unless it is before a significant shift in monetary policy - like now and in August 2022, which traders still remember vividly. Data compiled by Bloomberg Intelligence shows that the S&P 500 Index has averaged a 0.4% increase in the week after the meeting since 2000.

Historical performance of the S&P 500 index after the Jackson Hole meeting - when monetary policy is at a turning point, the US stock market often fluctuates significantly.

Looking back at August 2022, Powell's speech at Jackson Hole was a painful blow to the value of global risk assets such as stocks. At the time, he warned that the Fed needed to maintain restrictive monetary policy for a long time to combat inflation, rather than rapidly lowering interest rates after raising them. On that day, the US stock market plummeted by 3.4%, and US stocks experienced a rare drop in the week after he spoke.

However, this time, market participants hope that the Fed can achieve its goal of a "soft landing" for the US economy without causing serious economic pain by controlling runaway prices.

There are three more Federal Reserve policy meetings in 2024. Traders generally believe that as inflation gradually falls to the 2% target, the Fed may choose to cut interest rates in response to signs of weak labor. In July, U.S. consumer prices fell significantly for the fourth consecutive month, while strong retail sales data indicated that the core driving force of the U.S. economy - consumer spending - was still very strong, giving officials the opportunity to adopt less aggressive interest rate cuts.

"Powell doesn't need to scare the market," said Stephanie Lang, Chief Investment Officer at Homrich Berg. "He needs to convince people that inflation is receding, and Fed officials are happy to adjust restrictive rates to a more neutral level."

“如果交易员们听到降息即将到来的重磅信号,股市将给出积极反应。”Steward Partners Global Advisory财富管理执行董事埃里克·贝利表示。“然而,如果交易员和投资者们都听不到想要听到的积极信息,那么经历大反弹后的股市可能将迎来大规模抛售。”

“如果交易员们听到降息即将到来的重磅信号,股市将给出积极反应。”Steward Partners Global Advisory财富管理执行董事埃里克·贝利表示。“然而,如果交易员和投资者们都听不到想要听到的积极信息,那么经历大反弹后的股市可能将迎来大规模抛售。”