Key Insights

- Ching Lee Holdings will host its Annual General Meeting on 26th of August

- Salary of HK$2.22m is part of CEO Choi Wah Ng's total remuneration

- The total compensation is 377% higher than the average for the industry

- Over the past three years, Ching Lee Holdings' EPS fell by 2.5% and over the past three years, the total loss to shareholders 74%

Shareholders of Ching Lee Holdings Limited (HKG:3728) will have been dismayed by the negative share price return over the last three years. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 26th of August, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's our take on why we think shareholders might be hesitant about approving a raise at the moment.

How Does Total Compensation For Choi Wah Ng Compare With Other Companies In The Industry?

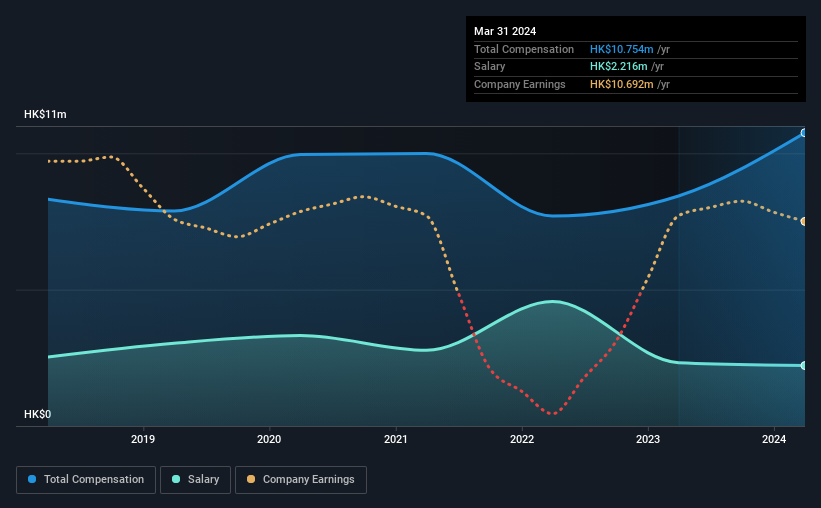

Our data indicates that Ching Lee Holdings Limited has a market capitalization of HK$48m, and total annual CEO compensation was reported as HK$11m for the year to March 2024. That's a notable increase of 28% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$2.2m.

In comparison with other companies in the Hong Kong Construction industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$2.3m. Hence, we can conclude that Choi Wah Ng is remunerated higher than the industry median. What's more, Choi Wah Ng holds HK$34m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$2.2m | HK$2.3m | 21% |

| Other | HK$8.5m | HK$6.1m | 79% |

| Total Compensation | HK$11m | HK$8.4m | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. It's interesting to note that Ching Lee Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. It's interesting to note that Ching Lee Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Ching Lee Holdings Limited's Growth

Over the last three years, Ching Lee Holdings Limited has shrunk its earnings per share by 2.5% per year. It achieved revenue growth of 27% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Ching Lee Holdings Limited Been A Good Investment?

Few Ching Lee Holdings Limited shareholders would feel satisfied with the return of -74% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company's remuneration policies and evaluate if the board's judgement and decision-making is aligned with that of the company's shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Ching Lee Holdings (of which 3 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.