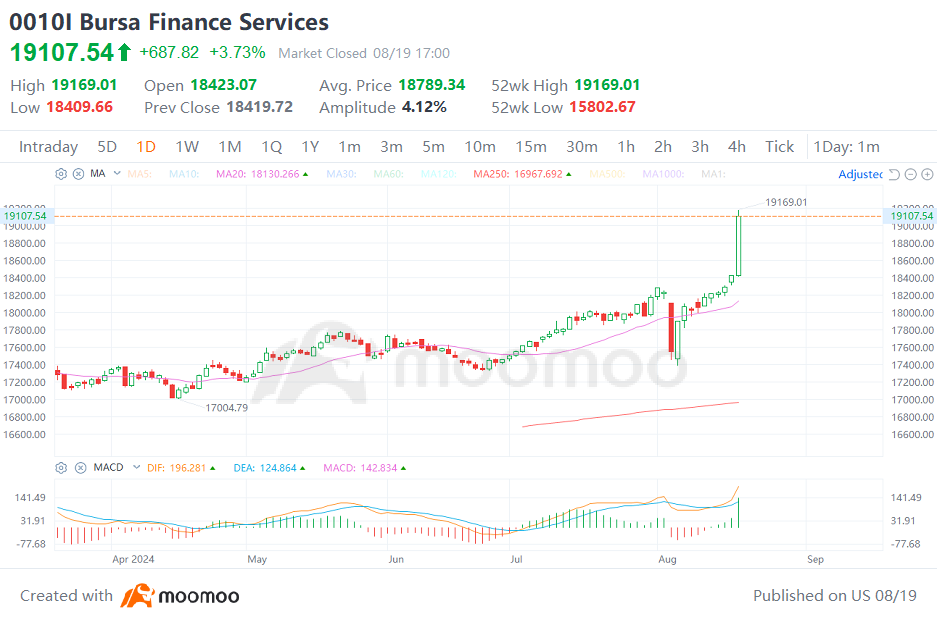

Bursa Finance Index broke record high, leading the market, $MAYBANK (1155.MY)$ rose 34 sen to RM10.60,$CIMB (1023.MY)$ rose 31 sen to RM7.97, $PBBANK (1295.MY)$ rose 25 sen to RM4.54, $RHBBANK (1066.MY)$ rose 18sen to RM5.92.

The positive momentum of the upcoming interest rate cut in the United States boosted investor sentiment on global stock markets. The Malaysian stock market rebounded from the recent plunge, and the composite index soared above the highest level in July in early trading on Monday, setting a four-year high.

Foreign exchange also showed strong momentum, with the Malaysian ringgit rising above 4.4 against the US dollar, rewriting the highest level since February 2023, and currently standing at 4.382. Malaysia's second-quarter economic growth exceeded expectations, and the Federal Reserve is expected to release a signal of interest rate cuts.

In addition, after a sharp sell-off in the previous week, foreign investment in the Malaysian stock market turned net buying again in the week ending August 16, 2024. Last week, foreign investors net bought RM299.6 million of Malaysian stocks.

In addition, after a sharp sell-off in the previous week, foreign investment in the Malaysian stock market turned net buying again in the week ending August 16, 2024. Last week, foreign investors net bought RM299.6 million of Malaysian stocks.