Investors with a lot of money to spend have taken a bullish stance on UnitedHealth Group (NYSE:UNH).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UNH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for UnitedHealth Group.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 37%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $199,354, and 4 are calls, for a total amount of $471,004.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $505.0 to $590.0 for UnitedHealth Group over the last 3 months.

Insights into Volume & Open Interest

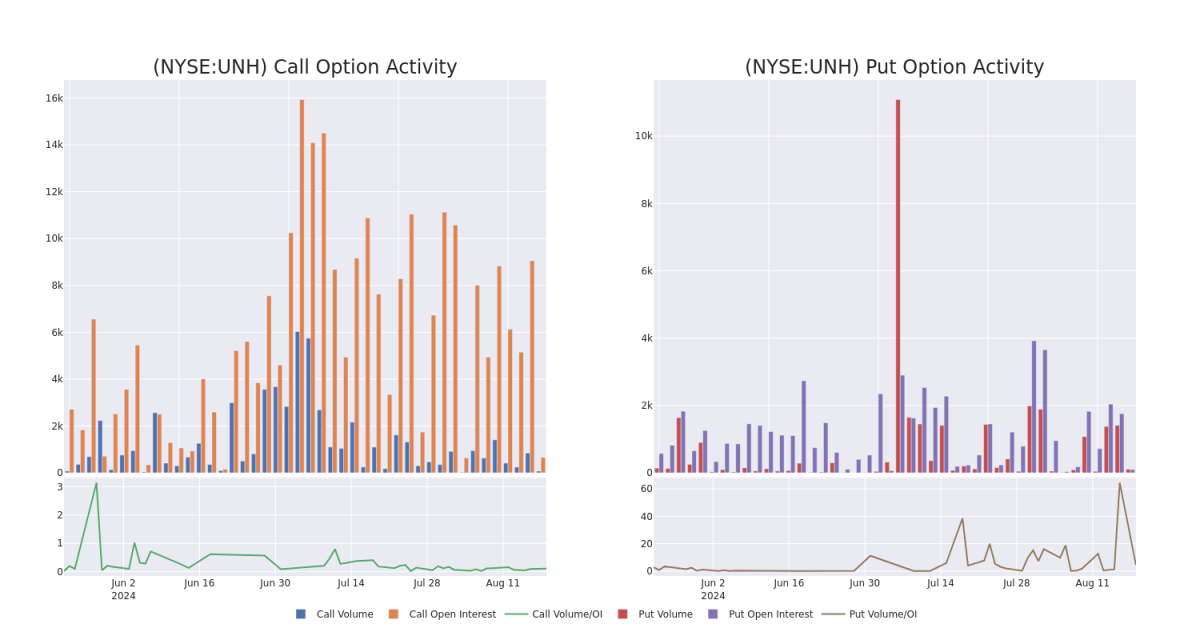

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UnitedHealth Group's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UnitedHealth Group's whale trades within a strike price range from $505.0 to $590.0 in the last 30 days.

UnitedHealth Group 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | SWEEP | BEARISH | 08/30/24 | $77.55 | $75.45 | $76.0 | $505.00 | $182.4K | 50 | 40 |

| UNH | CALL | SWEEP | BULLISH | 06/20/25 | $76.0 | $73.95 | $76.0 | $550.00 | $129.0K | 603 | 5 |

| UNH | CALL | SWEEP | BEARISH | 08/30/24 | $77.45 | $74.35 | $76.0 | $505.00 | $121.5K | 50 | 40 |

| UNH | PUT | SWEEP | BULLISH | 11/15/24 | $32.8 | $31.0 | $31.69 | $590.00 | $57.0K | 23 | 51 |

| UNH | PUT | TRADE | BULLISH | 11/15/24 | $33.2 | $30.9 | $31.66 | $590.00 | $56.9K | 23 | 33 |

About UnitedHealth Group

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of UnitedHealth Group

- With a trading volume of 104,421, the price of UNH is up by 0.35%, reaching $579.68.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 53 days from now.

What Analysts Are Saying About UnitedHealth Group

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $591.0.

- An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $591.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.