Investors with a lot of money to spend have taken a bullish stance on B. Riley Financial (NASDAQ:RILY).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with RILY, it often means somebody knows something is about to happen.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with RILY, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for B. Riley Financial.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 25%, bearish.

Out of all of the options we uncovered, 7 are puts, for a total amount of $1,271,063, and there was 1 call, for a total amount of $35,658.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $17.5 for B. Riley Financial, spanning the last three months.

Volume & Open Interest Trends

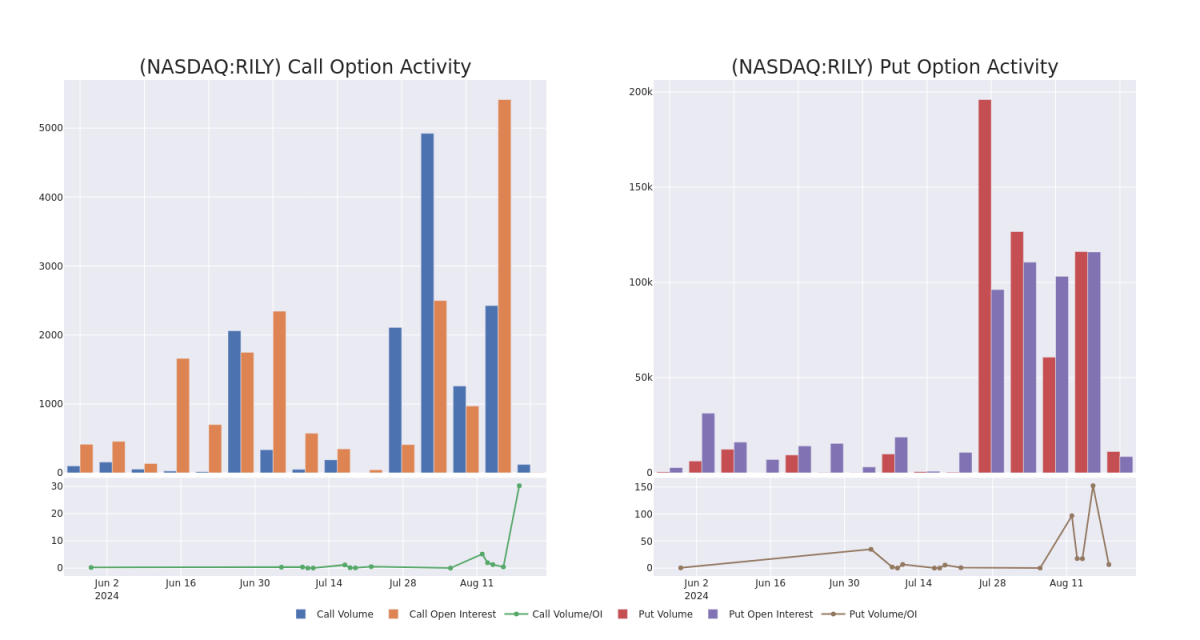

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for B. Riley Financial's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of B. Riley Financial's whale trades within a strike price range from $2.5 to $17.5 in the last 30 days.

B. Riley Financial Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RILY | PUT | TRADE | BULLISH | 10/18/24 | $14.2 | $13.2 | $13.2 | $17.50 | $660.0K | 3.0K | 1.9K |

| RILY | PUT | SWEEP | BULLISH | 10/18/24 | $14.2 | $13.2 | $13.2 | $17.50 | $396.0K | 3.0K | 317 |

| RILY | PUT | SWEEP | BULLISH | 08/23/24 | $0.45 | $0.35 | $0.4 | $4.00 | $75.9K | 3.4K | 3.8K |

| RILY | PUT | TRADE | NEUTRAL | 08/23/24 | $1.15 | $0.8 | $0.95 | $5.50 | $47.4K | 339 | 844 |

| RILY | PUT | TRADE | BULLISH | 08/23/24 | $0.45 | $0.35 | $0.37 | $4.00 | $36.8K | 3.4K | 1.0K |

About B. Riley Financial

B. Riley Financial Inc is a diversified financial services company. The company through its subsidiaries offers investment banking and financial services to corporate, institutional, and high-net-worth clients and also asset disposition, valuation and appraisal, and capital advisory services to retail, wholesale, institutional, lenders, capital providers, private equity investors, and professional services firms in United States, Canada, and Europe. It also provides internet access and subscription services. The reportable operating segments of the company include Capital Markets, Wealth Management, Financial Consulting, Auction and Liquidation, Communications segment, and Consumer products segment.

After a thorough review of the options trading surrounding B. Riley Financial, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of B. Riley Financial

- With a volume of 2,522,879, the price of RILY is down -15.92% at $4.92.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 11 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest B. Riley Financial options trades with real-time alerts from Benzinga Pro.