"Duan Yongping", who travels between the Chinese and English worlds.

In the English investment world, Buffett is a "heroic figure." He has a high level of investment ability, is happy to teach ordinary people, and donates to charity.

In the Chinese investment forums, Duan Yongping is the closest image to "Buffett." He has a recognized investment ability and wealth (although the base number is unknown to the outside world), and is also happy to share his own perspectives and answer questions for investors.

Duan Yongping, who is becoming increasingly famous in the Chinese internet, has recently encountered two things:

Duan Yongping, who is becoming increasingly famous in the Chinese internet, has recently encountered two things:

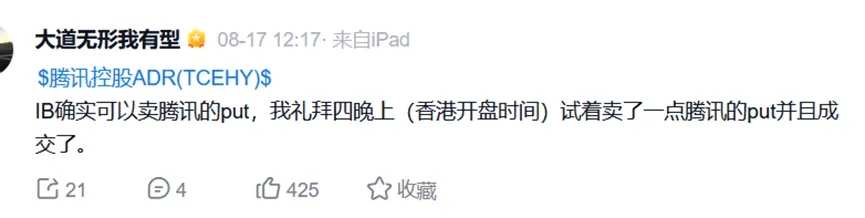

Firstly, in an investment forum, he once again publicly announced his live trading and tried to sell a bit of Tencent's put options (similar to buying stocks, Duan Yongping has been using this method to buy Tencent).

The other news is that the latest institution of H&H International Investment, LLC (hereinafter referred to as "H&H Investment") has a new US stock holding position of 16.632 billion US dollars, an increase of nearly 2.2 billion US dollars compared with the beginning of the year, which is equivalent to about 157 billion yuan.

With a holding of tens of billions of funds, and being able to sustain large-scale "investment gains", Duan Yongping may be the strongest Chinese investor in the past six months.

The total holding scale is nearly 120 billion yuan.

According to the information disclosed publicly by the U.S. Securities and Exchange Commission (SEC), as of June 30, 2024, a company named H&H International Investment, LLC (hereinafter referred to as "H&H Investment") has a new US stock holding position of 16.632 billion US dollars.

The asset scale of this institution is equivalent to nearly 120 billion yuan.

The declaration document shows that this institution is headed by Eric Hu, who appears to be Chinese from his name.

In the business registration information of this investment institution on other platforms, it is stated that the company has two owners, in addition to the aforementioned person, there is also YONGPING DUAN.

Judging from the spelling of the name, it is consistent with the well-known Chinese investor Duan Yongping, and the latter has never publicly confirmed or denied the relationship between the two.

The scale is constantly expanding.

Sorting through the disclosure documents of H&H Investment, it will be found that the financial strength of this institution is very strong.

When this institution first disclosed its US stock holdings to the SEC, it traced back to the end of the fourth quarter of 2018, and the corresponding scale at that time was 0.836 billion US dollars.

Just two years later (at the end of the fourth quarter of 2020), the holding position of H&H Investment had grown to 7.017 billion US dollars.

As of the end of the fourth quarter of 2022, H&H Investment has surpassed the $10 billion mark in holdings and continues to expand.

As an investment company with only two employees, its development curve has such an amazing climbing speed, which makes the outside world full of surprise and expectation.

Where does the funding come from?

Observing the historical holdings of this fund, it can be found that its scale expansion mainly comes from two aspects: external injection of institutional funds and the profits of the holding varieties.

During the injection of capital, the scale of H&H's investment increased eightfold between 2018 and 2020. Given the large amount of funding, it may be too demanding to expect a ninefold increase in two years, and it is reasonable to attribute this to capital injection during the period.

However, from the perspective of the first half of 2024, the vast majority of the value added from the management of assets by this institution should come from investment profits.

It's simple; with its first largest holding, Apple (holding share of more than 80%), the institution increased in value by 10% in the first half of this year.

The second largest holding, BKR (Buffett's flagship investment), increased by nearly 13%.

When other major holdings are included (as shown in the figure below), it is already very close to the institution's asset growth rate.

Why bet on Apple?

So why did H&H bet on Apple?

Recently, Duan Yongping expressed in a Chinese investment community:

"We've been holding onto Apple for so many years, and there's always someone standing nearby saying, 'You're holding onto a tough one!' Am I holding onto a tough one? What's so hard about it? What's easier than this?"

He has also stated that his decision to invest in Apple came after he suddenly realized something, and for this stock, he has also formulated his own selection criteria - business model, corporate culture, and price.

Hard matching with "Buffett"

There's another interesting detail; although known as the Chinese Buffett, Duan Yongping has opened up a gap with his real-life persona, Warren Buffett, in the second quarter of 2024.

In that quarter, Buffett reduced his holdings of Apple by nearly half through Hathaway, accumulating to a total reduction of over 0.5 billion Apple stocks, worth about $84 billion this year.

However, compared to the end of the first quarter of 2024, Duan Yongping's H&H only reduced its holdings of Apple by about 1%.

Eyeing Tencent and Alibaba?

Duan Yongping, who likes long-term holdings, significantly increased his holdings in Alibaba, his first largest holding. However, on the forum, he still prefers Tencent.

Duan Yongping has mentioned several times on social media that he has bought the company, but has also said that his actual position is relatively low.

In January of this year, he said, "In ten years, companies like Apple, Maotai, and Tencent should still be around."

A few days ago, Duan Yongping also expressed some "regret" through the network:

"There are no options for Tencent in the US stock market." He meant to emphasize that there are no options for Tencent ADRs, which prevents him from using options to trade the company he continues to be bullish about.

Looking further ahead, in August 2022, Duan Yongping bought at least 0.1 million shares of Tencent ADR at around $37 when it was falling continuously on Tencent. In December 2023, he said he bought 0.2 million shares of Tencent ADRs at a cost of around $41 and also said he would continue buying.

In December 2023, he also said, "You cannot sell put options for Tencent, it is difficult to start. It is highly likely that the major shareholder in South Africa will continue to reduce its holdings for a considerable period of time in the future. It would be great if I could sell some put options."

On August 15th of this year, Duan Yongping posted again after half a year and revealed his operation: "Just bought some Tencent stocks. It's frustrating that there are no put options available. I had to change my order several times, but I couldn't even buy 10,000 shares with each order."

After some back and forth, he started buying Tencent again.

在中文网络越来越有名气的段永平最近连续遇到了两件事情:

在中文网络越来越有名气的段永平最近连续遇到了两件事情: