Goldman Sachs' trading desk said that momentum trading and increased corporate buybacks are expected to push the US stock market higher in the next four weeks.

Scott Rubner, Goldman Sachs' Global Market Director and Tactical Specialist, said "there is a high bar to shorting stocks ahead of Labor Day."

Rubner accurately predicted the decline in US stocks in late summer and advised reducing US stock exposures after June 30. Now he is bullish on US stocks, saying that current position deployment and fund flows "are conducive to a rise in the stock market, and bears are out of ammunition."

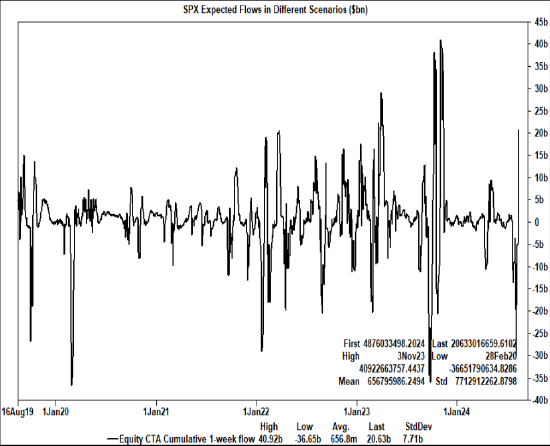

The inflow of money from trend-tracking systematic funds could drive US stocks higher. These funds are re-leveraging after reducing their long positions from $45 billion in July to $25 billion. Adjusted for lower liquidity in August, the demand for fund flows is expected to have a greater impact on the stock market.

The inflow of money from trend-tracking systematic funds could drive US stocks higher. These funds are re-leveraging after reducing their long positions from $45 billion in July to $25 billion. Adjusted for lower liquidity in August, the demand for fund flows is expected to have a greater impact on the stock market.

This is good news for investors trying to understand the direction of the stock market in August, and the decline in early August attracted a large number of bid orders. Rubner said risk appetite would not stop there, and the S&P 500 index could rise to 6,000 points by the end of the year, up about 8% from last Friday's close after experiencing turbulence before the November presidential election.

Rubner believes that whether the stock market rises or falls next, commodity trading advisers (CTAs) are likely to buy heavily. Volatility control funds are expected to increase their positions after the volatility index at the Chicago Board Options Exchange experienced its largest 9-day decline in volatility.

The buyback demand from companies is also one of the driving forces behind the stock market's rise. Goldman Sachs estimates that the daily share buyback amount will reach $6.62 billion before about 50% of companies close their buyback windows on September 13. The bank expects the total amount of share buyback authorizations to reach $1.15 trillion, with share buyback transactions executed in 2024 totaling $960 billion.

Rubner expects more money from the money market to be allocated to the stock market. He pointed out that the asset management scale of the US money market is about $7.3 trillion. "Money market yields are beginning to decline sharply, and after the US election, this mountain will begin to move elsewhere."

However, there may be more declines in the future. Rubner warned that the stock market may turn downward again after September 16. The second half of September has historically been the worst two-week trading period of the year.

所谓的趋势跟踪系统性基金的资金流入可能会推动美股上涨。这类基金在将多头头寸总额从7月的4,500亿美元削减至2,500亿美元后,正在重新开始加杠杆。如果根据8月较低的流动性进行调整,则资金流需求将对股市产生更大影响。

所谓的趋势跟踪系统性基金的资金流入可能会推动美股上涨。这类基金在将多头头寸总额从7月的4,500亿美元削减至2,500亿美元后,正在重新开始加杠杆。如果根据8月较低的流动性进行调整,则资金流需求将对股市产生更大影响。