Planning ahead is key to success.

In a weak recovery cycle, the defensive advantages of high dividend assets are prominent, and the policy guidance strengthens the dividend distribution of listed companies, further enhancing the favor of long-term funds for high dividend assets. Multiple institutions including CICC, CSC and TF Securities have issued research reports with similar views, indicating that the high dividend strategy value is currently relatively advantageous.

As the representative of the high dividend sector, banks are in a leading position in dividend performance, and Ping An Bank is undoubtedly a sample worth paying attention to.

According to the latest interim report data, Ping An Bank plans to distribute mid-term profits in 2024, with a cash dividend of 2.46 yuan (including tax) per 10 shares based on the net income attributable to shareholders. The dividend rate is 18%, and the cash dividend totals 4.77 billion yuan.

According to the latest interim report data, Ping An Bank plans to distribute mid-term profits in 2024, with a cash dividend of 2.46 yuan (including tax) per 10 shares based on the net income attributable to shareholders. The dividend rate is 18%, and the cash dividend totals 4.77 billion yuan.

This is Ping An Bank's first mid-term dividend plan, which sets an example for the entire banking industry. According to management, the 18% mid-term dividend rate does not represent the same number at the end of the year, leaving room for year-end dividends. This also allows the market to have more expectations for Ping An Bank's follow-up dividends.

When the industry as a whole is under pressure, Ping An Bank must have done something right by achieving results in shareholder returns.

Quality development is the main signal of the interim report.

In the first half of this year, Ping An Bank achieved revenue of 77.132 billion yuan and net profit of 25.879 billion yuan, a year-on-year increase of 1.9%, which is generally in line with market expectations.

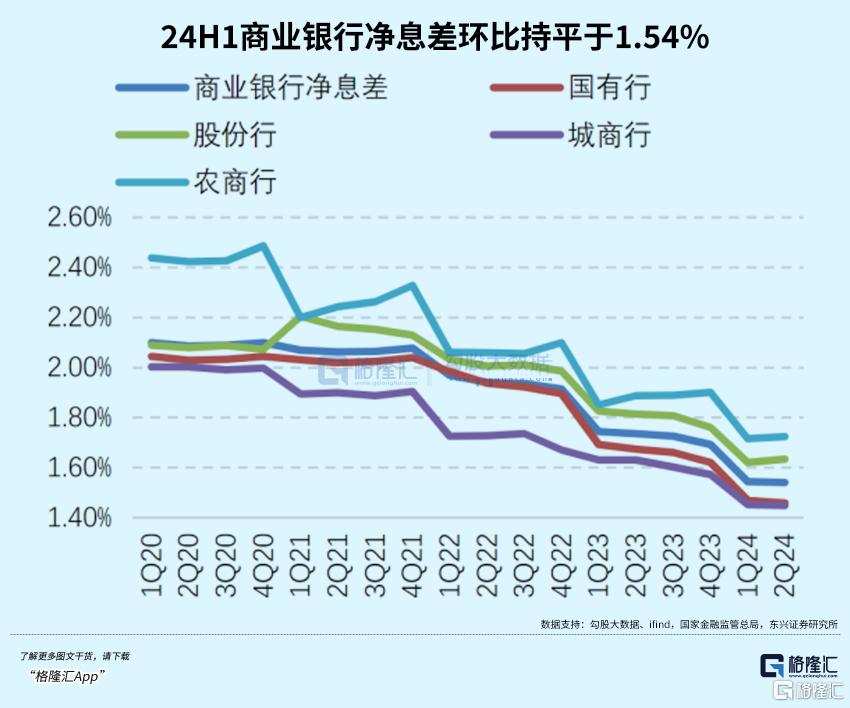

Under the current background of the industry entering a interest rate reduction cycle, the overall net interest margin of the banking industry is declining year-on-year. The research report of Dongxing Securities pointed out that as of the first half of this year, the overall net interest margin of the banking industry was 1.54%. Among them, the overall net interest margin of joint-stock commercial banks was 1.63%.

In the context of insufficient effective demand, in order to actively respond to the policy guidelines of benefiting the real economy, Ping An Bank's net interest margin is also inevitably narrowing. However, compared with the overall level of joint-stock commercial banks, Ping An Bank is still in a leading position. As of Q2, Ping An Bank's net interest margin was 1.96%.

At the same time, in order to alleviate the impact of the narrowing net interest margin on bank performance, Ping An Bank actively grasps market opportunities and performs well in non-interest income. In the first half of this year, the proportion of Ping An Bank's non-interest net income reached 36.36%, an increase of 7.05 percentage points year-on-year.

For the banking industry, upward cycles focus more on the growth rate of scale, and downward cycles need to focus on risk control, especially the latter, which is related to the "life and death" of banks. Compared with short-term revenue and profit, improving asset quality may be more worthy of attention in the current environment, and it is also one of the most core signals conveyed by Ping An Bank's interim report this time.

In the first half of this year, Ping An Bank's non-performing loan ratio was 1.07%, a year-on-year increase of 1 bp, but the annualized non-performing loan generation rate of 1.69% compared with last year decreased by 20 bps, and the marginal improvement effect was prominent. At the same time, Ping An Bank's overdue loan balance and proportion both decreased compared to the end of last year. As of the end of June, the bank's overdue loan balance ratio was 1.39%, a decrease of 0.03 percentage points from the end of last year.

In addition, Ping An Bank's core Tier 1 capital adequacy ratio, Tier 1 capital adequacy ratio, and capital adequacy ratio all exceed the standard value by more than 20%. Among them, the core Tier 1 capital adequacy ratio reached 9.33%, an increase of 0.11 percentage points from the same period last year.

It can be seen that today Ping An Bank can balance high dividends and continuous supplementation of capital strength, which highlights the underlying tone of high-quality development.

It is important to calculate well before proceeding further.

Looking back on the achievements that Ping An Bank has made in recent years, a key point is the continuous promotion of the retail strategy. Management once again emphasized at this interim earnings conference that Ping An Bank will continue to adhere to the development of retail strategy.

However, with the drastic changes in the internal and external environment, the transformation of retail is also facing difficulties. Management also admitted that the biggest pressure on performance indicators at present comes from retail. Therefore, under the premise of the unchanged direction of developing retail, how to make appropriate tactical adjustments is a test for Ping An Bank.

The loan side clearly reflects this point.

In the past two years, Ping An Bank has abandoned the expansion model of "high risk, high pricing", and "actively shrinking high-risk businesses and increasing mid-risk businesses" has become the main tone of business development. This will indeed bring pressure on revenue, and from the perspective of risk management and capital security, giving up short-term revenue and pursuing long-term more stable profit growth is the correct solution.

Of course, revenue pressure is a real concern. The management also acknowledges that the rapid decline in revenue is due to the pressure to lower high-risk products. Last year, they also faced a lot of internal dissent but managed to resist the temptation. If they had produced more high-risk products worth hundreds of billions, the situation would have been uncontrollable, and even thinking about it now is terrifying.

In addition to adjustments at the product level, changes in channels are also noteworthy.

For a long time, Ping An Bank has relied on intermediary channels to gain customers, but this approach has some problems. First, intermediary channels may charge customers fees, increasing their burden while also affecting the bank's reputation and customer satisfaction to some extent. In addition, the transparency of intermediary channels is relatively low, and there may be irregular operations in management and risk control, increasing the bank's risk coefficient. Therefore, in recent years, Ping An Bank has continued to increase its own channel construction, which is closely related to its own endowments.

On the one hand, backed by Ping An Group, Ping An Bank can fully leverage the Group's comprehensive financial advantages and form differentiated competition. In the first half of this year, the comprehensive financial model had an evident positive impact on retail business: the net increase in wealth customers accounted for 38.8%; the net increase in management retail customers (AUM) accounted for 61.7%; auto finance loan issuance accounted for 16.8%; and credit card new account increase accounted for 10.8%.

On the other hand, Ping An Bank focuses on digital construction and has built a full-cycle operating link of “acquisition, conversion, activation, and retention” through online products. As of the end of June, the number of registered users for Ping An Pocket Bank APP was approximately 170 million, an increase of 2.2% from the previous year, and the monthly active users (MAU) were 43.3825 million. In the first half of this year, the average number of effective service customers per remote bank increased by more than 80% compared to 2023, providing 7x24 hour "accompanying" services for more than 5.8 million mass customers.

At the same time, Ping An Bank has also undergone a thorough organizational restructuring.

The original business departments have been reshaped and replaced by six major sectors: corporate finance, retail finance, fund interbank, risk control, information technology, and common resources, which are more in line with the strategic policy of "strengthening retail, refining corporate, and specializing interbank."

Ping An Bank has also streamlined its head office structure, changed its previous line-based organizational structure, and empowered branches with greater autonomy to enable frontline employees to better exercise their subjective initiative and actively respond to market changes.

Adhering to the national strategy and supporting the development of the real economy,

Amid the periodic adjustment of retail businesses, corporate business has taken over.

As of the end of June this year, the balance of enterprise loans was 1.59 trillion yuan, an increase of 11.4% from the end of last year, which drove the overall loan scale growth.

This is also a reflection of the effectiveness of Ping An Bank's strategy. When retail businesses were hit by short-term external shocks, corporate businesses provided support, allowing retail to breathe a sigh of relief and complement each other to ensure that the bank could reduce performance volatility in the long-term transformation process.

The optimization of industry layout has been another manifestation of its specialization in corporate businesses.

On the one hand, to ensure a stable baseline, the bank continued to support the steady development of basic industries. In the first half of this year, Ping An Bank issued new loans totaling 200.54 billion yuan in four basic industries: infrastructure, automotive ecology, public utilities, and real estate, a YoY increase of 42.1%.

On the other hand, focusing on long-term development, the bank has increased its support for emerging industries. In the first half of 2024, new loans totaling 106.142 billion yuan were issued for three major emerging industries: new manufacturing, new energy, and new life, a YoY increase of 47.1%.

In fact, from a higher perspective, Ping An Bank's layout conforms to the connotation of the five major financial articles: financial science and technology, green finance, inclusive finance, old-age finance, and digital finance. It actively practices the political and people-oriented nature of finance.

For example, it promotes business model innovation, empowers manufacturing enterprises, and as of the end of June, Ping An Bank's medium- and long-term loans to manufacturing had increased by 15.9% YoY, higher than the total increase in loan and principal advances.

It continuously improves its credit service system, brings inclusive finance to life, and launches "Technology Innovation Loan" to meet the needs of technology-based SMEs. It also further reduces small and micro enterprise service costs by sending interest coupons and exempting settlement fees.

It expands rural funding channels and strongly supports rural revitalization. As of the end of June, the balance of rural loans was 157.652 billion yuan, an increase of 19.7% YoY.

Adhering to the national development strategy and supporting the development of the real economy is not only a requirement for financial institutions but also a true reflection of Ping An Bank's long-standing approach.

Conclusion 04

In the macro under pressure environment, banks are not having an easy time. The overall valuation of the banking industry is at a historical range low, reflecting the market's pessimistic expectations. However, in the long run, the upward cycle will eventually come. The players who can recover first must at least survive in difficult times and do well.

With flexible global strategy adjustments and good risk management, Ping An Bank has achieved stable performance. Although there is short-term revenue pressure, the bank has improved profit levels through digital transformation and higher internal efficiency, ensuring the continuation of generous dividend policies. Ping An Bank has found a balance between dealing with short-term market changes and long-term sustainable development, and is becoming more and more stable.

根据最新中报数据,平安银行拟进行2024年中期利润分配,每10股派发现金股利人民币2.46元(含税),按归母净利润计分红率为18%,现金分红共计47.7亿元。

根据最新中报数据,平安银行拟进行2024年中期利润分配,每10股派发现金股利人民币2.46元(含税),按归母净利润计分红率为18%,现金分红共计47.7亿元。