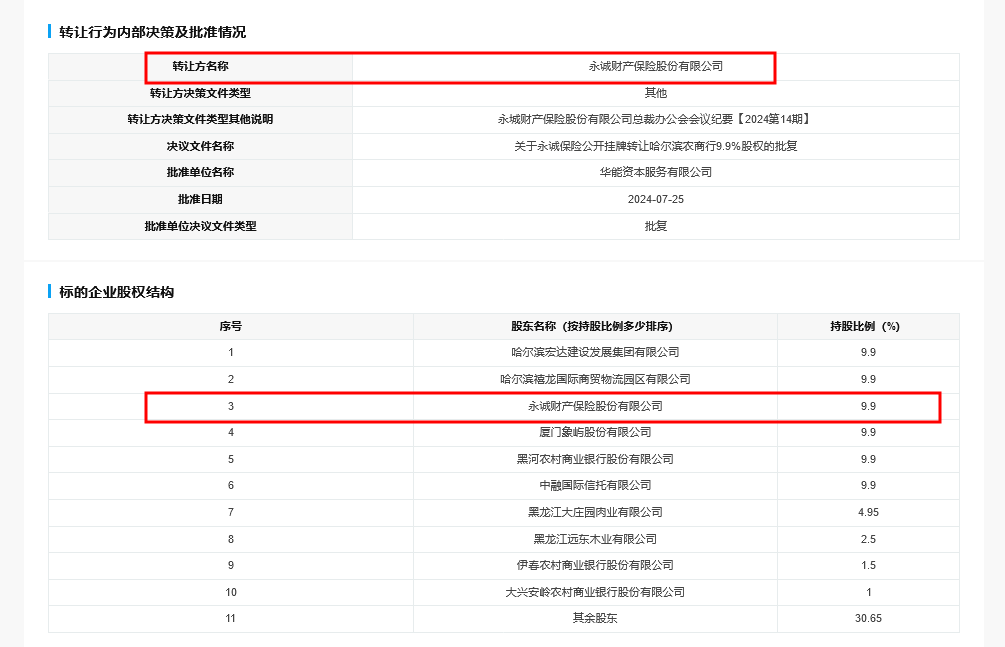

Shanghai United Property Exchange disclosed today that Harbin Rural Commercial Bank's 198 million shares were listed for transfer, accounting for 9.9% of the total shares, namely transferring all the equity shares held by the transferring party, Yongcheng Property Insurance Co., Ltd.

Finance and Economics Society news on August 20 (Reporter Guo Zishuo), Shanghai United Property Exchange disclosed today that Harbin Rural Commercial Bank (referred to as Harbin Rural Commercial Bank) 198 million shares were listed for transfer, accounting for 9.9% of the total shares, that is, all the equity shares held by Yongcheng Property Insurance Co., Ltd. (referred to as Yongcheng Property Insurance). The information disclosure dates are from August 20 to September 14.

Once this equity transfer is successful, Harbin Rural Commercial Bank's shareholder structure will change, potentially further impacting the company's future operational strategy and market performance. In the annual report, Yongcheng Property Insurance stated that the company holds a 9.9% stake in Harbin Rural Commercial Bank, and appoints a director to Harbin Rural Commercial Bank, with voting rights in the board of directors, thus having a significant influence on Harbin Rural Commercial Bank.

However, the base price of this transfer has not been disclosed. Market rumors of Harbin Rural Commercial Bank's equity listing and auction have previously surfaced but unfortunately ended without success.

However, the base price of this transfer has not been disclosed. Market rumors of Harbin Rural Commercial Bank's equity listing and auction have previously surfaced but unfortunately ended without success.

Long-established property insurance companies face revenue pressure.

On July 25, Yongcheng Property Insurance's parent company, Huaneng Capital Services Limited, approved the "Approval of Yongcheng Insurance's Public Listing and Transfer of 9.9% Equity of Harbin Rural Commercial Bank." A review found that from 2020 to 2023, Yongcheng Property Insurance's investment income from Harbin Rural Commercial Bank was 0.042 billion yuan, 0.034 billion yuan, 0.002 billion yuan, and 0.016 billion yuan, with overall investment income showing a downward trend.

"Harbin Rural Commercial Bank transferred 9.9% of the shares to its largest shareholder, Yongcheng Insurance, which is a typical epitome of frequent transfers of equity in small and medium-sized banks." Su Xiaorui, a senior researcher at Suxi Intelligence, stated that in recent years, some shareholders of small and medium-sized banks have actively chosen to transfer equity in small and medium-sized banks on the open market, and the reasons behind it are quite comprehensive. Some companies transfer their shares for investment cost-effectiveness considerations, while some shareholders consider focusing on their core business and thus transfer the bank shares they hold.

As an insurance company that has been established for over 20 years, Yongcheng Insurance also faces certain performance pressure. In the first half of 2024, Yongcheng Insurance's revenue was 2.938 billion yuan, a decrease of 2.87% year-on-year; achieving a net income of 0.019 billion yuan, a decrease of 79.71% year-on-year. From 2019 to 2023, Yongcheng Insurance's net income was 0.109 billion yuan, 0.149 billion yuan, 0.11 billion yuan, 0.093 billion yuan, and 0.097 billion yuan respectively.

In terms of premium income, in the first half of 2024, premium business income was 4.18 billion yuan, a decrease of 4.68% year-on-year. After achieving a premium income of 7.666 billion yuan in 2021, Yongcheng Insurance's business scale consecutively slightly declined in 2022 and 2023, reaching 7.254 billion yuan and 7.213 billion yuan respectively, with year-on-year decreases of 5.37% and 0.57%.

In addition to Harbin Rural Commercial Bank, Yongcheng Insurance also holds three holding subsidiaries, namely insurance agency company Yongxin Insurance Sales Service Co., insurance asset management company Yongcheng Insurance Asset Management Co., which are closely linked to the core business; and real estate operation company Shanghai Changsheng Real Estate Co.

First largest shareholder frequently transferring?

The predecessor of Harbin Rural Commercial Bank was Harbin Suburban Credit Cooperative Association. On October 8, 2015, it was approved by the former CBRC to be transformed into a rural commercial bank and started operating. Its registered capital is 2 billion yuan. Property pre-disclosure page shows that in the first half of 2024, Harbin Rural Commercial Bank achieved a total revenue of 0.469 billion yuan, with a net profit of 97.9973 million yuan. In 2023, Harbin Rural Commercial Bank's total revenue was 1.006 billion yuan, with a net profit of 0.161 billion yuan. Total assets amounted to 59.745 billion yuan.

The page shows that apart from Yongcheng Insurance, Harbin Rural Commercial Bank also has five equally largest shareholders, namely Harbin Hongda Construction Development Group Co., Ltd., Harbin Xilong International Trade Logistics Park Co., Ltd., Xiamen Xiangyu Co., Ltd., Heihe Rural Commercial Bank Co., Ltd., and Zhongrong International Trust Co., Ltd., all holding 9.9% of the shares.

However, Xiamen Xiangyu (600057.SH) had announced as early as August of the previous year that the company planned to transfer its 9.9% stake in Harbin Rural Commercial Bank to Xiamen Xiangyu Group Co., Ltd., a wholly-owned subsidiary of the company's controlling shareholder, Xiamen Xiangyu Golden Elephant Holding Group Co., Ltd., with the transfer price based on the evaluation value approved by the state-owned asset management department, taking into account the transitional period gains and losses.

In December of the same year, the Heilongjiang Regulatory Bureau of the China Banking and Insurance Regulatory Commission agreed to the Xiamen Xiangyu Golden Elephant Holdings Group Co., Ltd. to acquire 198 million shares held by Xiamen Xiangyu Bank, accounting for 9.9% of the total share capital. At that time, the regulator also pointed out that Harbin Agricultural and Commercial Bank should strengthen equity management, optimize equity structure, regulate shareholder behavior, strictly control related party transactions by shareholders, further improve corporate governance and internal control mechanisms, and prevent financial risks. According to Xiamen Xiangyu's latest annual report, the relevant business procedures for the change of shareholding have been completed.

According to the Shanghai United Property Exchange, there is also information about the transfer of Harbin Agricultural and Commercial Bank's equity. The transferor is China Resources International Trust. However, the quantity and price of the equity transfer are unknown. Previously, multiple equity auctions of Harbin Agricultural and Commercial Bank also failed. The Alibaba Judicial Auction Platform shows that 40 million shares of Harbin Agricultural and Commercial Bank were not bid in the second auction, and the auction also failed. The shares are from Heilongjiang Far East Timber Co., Ltd., the eighth largest shareholder of Harbin Agricultural and Commercial Bank. The starting price of the second auction was 53.593585 million yuan, a 5% discount from the appraisal price of 56.4143 million yuan. Earlier in 2019, Harbin Far East Timber Co., Ltd. also failed to auction its 40 million shares of equity of Harbin Agricultural and Commercial Bank.

不过,此次转让的底价尚未公布。在此之前,市场也多次传出哈尔滨农商行股权挂牌、股权拍卖的消息,不过均遗憾流拍。

不过,此次转让的底价尚未公布。在此之前,市场也多次传出哈尔滨农商行股权挂牌、股权拍卖的消息,不过均遗憾流拍。