①今年上半年,特步宣佈戰略性出售時尚運動業務的蓋世威和帕拉丁品牌,並聚焦資源於跑步業務,加大對索康尼品牌的投入,這一舉動被視爲特步策略的重要調整。②特步國際電子商務業務收入今年上半年錄得超過20%的增長,其中抖音、得物以及微信視頻號的零售銷售額同比增長超過80%。

財聯社8月20日訊(記者 徐賜豪)運動品牌特步國際今日(20日)盤中發佈截至到2024年6月30日的半年報。

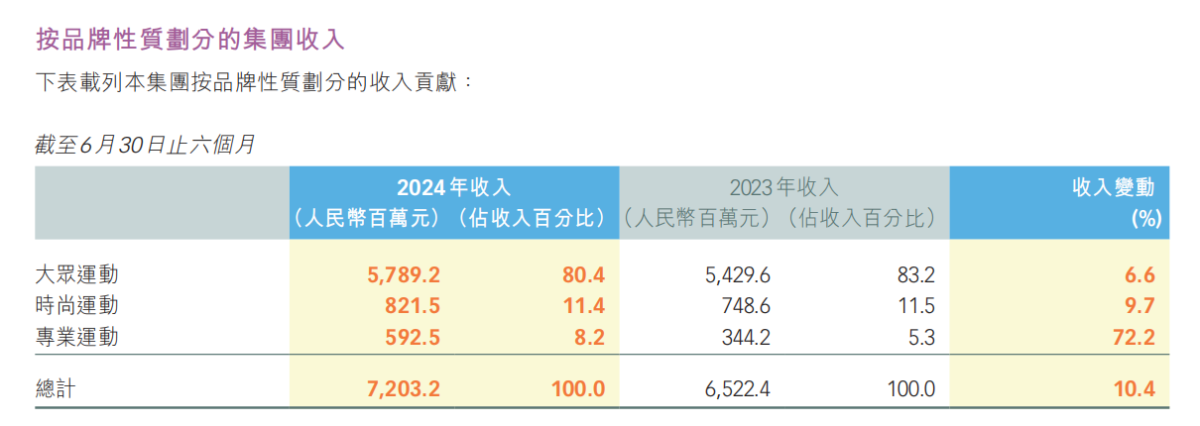

半年報顯示,特步國際今年上半年實現營收72.03億元,同比增長10.4%;淨利潤7.52億元,同比增長13%;毛利率增長3.1個百分點至46%。

值得一提的是,今年上半年,特步宣佈戰略性出售時尚運動業務的蓋世威和帕拉丁品牌,並聚焦資源於跑步業務,加大對索康尼品牌的投入,這一舉動被視爲特步策略的重要調整。

值得一提的是,今年上半年,特步宣佈戰略性出售時尚運動業務的蓋世威和帕拉丁品牌,並聚焦資源於跑步業務,加大對索康尼品牌的投入,這一舉動被視爲特步策略的重要調整。

「不管是在大衆還是高端市場,我們會更加聚焦跑步業務,這是目前整體的策略。」特步國際控股有限公司主席兼行政總裁丁水波在業績分析師電話上解釋,做好強項的品類,以聚焦穩健爲主,等消費開始復甦,特步才會更大程度地推進擴展其他戰略。

截至今日收盤,特步國際報收5.08港元收漲4.53%,市值134.34億港元。

剝離持續虧損業務蓋世威和帕拉丁

目前特步將業務板塊按照多品牌運營的模式劃分爲三類,分別是大衆運動、時尚運動和專業運動。

其中,大衆運動分部爲特步品牌,業績顯示,今年上半年該部分業務貢獻的營收增長6.6%至57.89億元,在總收入中的佔比爲80.4%;時尚運動分部爲蓋世威及帕拉丁品牌,今年上半年收入增長9.7%爲8.22億元,營收佔比11.4%;專業運動爲索康尼和邁樂品牌,收入同比上升72.2%至5.93億元,營收佔比8.2%。

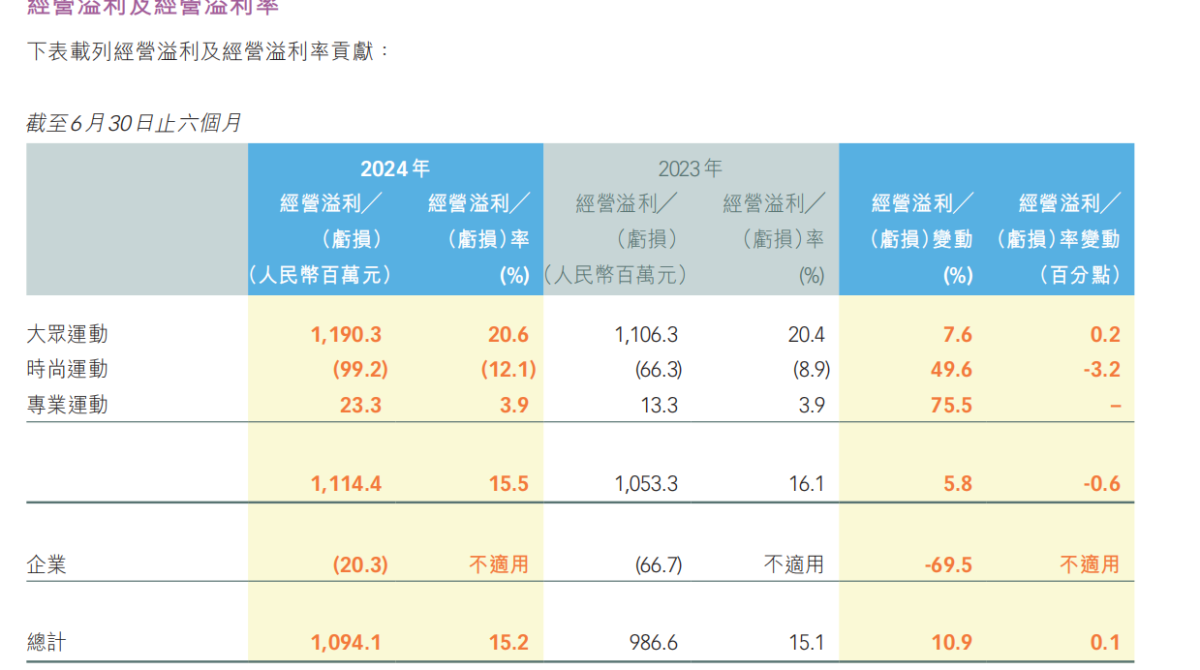

大衆運動是特步的基本盤,支撐着公司的主要業績和利潤。今年上半年,大衆運動貢獻了11.9億元,經營利潤率爲20.6%;而專業運動業務線呈現出不錯的發展趨勢,報告期內由去年同期的盈利0.13億元增長至盈利0.23億元;;但時尚運動業務線得盈利情況尚未好轉,去年同期虧損0.66億元,今年虧損進一步擴大至0.99億元。

可以看出,蓋世威和帕拉丁這兩個品牌,雖然可以爲特步貢獻10%以上的營收,但從盈利角度考慮,不但沒有給上市公司帶來增益,反而在一定程度上拖累了公司的業績。

5月9日,特步發佈公告稱,將戰略性出售旗下持有蓋世威(K·SWISS)及帕拉丁(Palladium)品牌的全資附屬公司KP Global Investment Limited,買方是特步國際的控股股東丁水波及其家族,價格爲1.51億美元。根據該公告內容,特步國際自2019年以2.6億美元收購以來,這兩個品牌的累計虧損達1億美元。

「預計在2024年全年,這兩個品牌將繼續產生與2023年相若的巨大虧損。」特步國際選擇將這兩個品牌用這種方式剝離上市公司體系,最直接的原因也在於此。

丁水波在業績分析師電話上表示,特步會把更多的精力、資金、人才投入到以跑步爲主的品類當中,會更加聚焦「我相信這對於整個企業的長遠發展更有利。」

庫存可控,線上渠道增速快

渠道方面,線下門店方面,特步成人和兒童品牌門店共有8284家。業績顯示,截至2024年6月30日,特步國際成人品牌在中國內地及海外的門店數達6578家,較2023年年報中的6571家,淨新增7家;此外,特步兒童品牌門店有1706家,較2023年年末淨新增3家。

在線上銷售方面,特步國際電子商務業務收入今年上半年錄得超過20%的增長,佔特步主品牌收入超過30%。其中抖音、得物以及微信視頻號的零售銷售額同比增長超過80%。

「下半年特步的主要流水方向仍是保健康,預期下半年表現與現在持平。」特步國際總裁田忠在業績分析師電話上透露,特步主品牌7月、8月的流水錶現與6月相當,線下流水有輕微增長,線上流水則保持約20%增長。

同時田忠表示,現階段沒有大幅降折扣的打算,並指庫存水平仍然可控。

對於投資者關心的今年下半年業績指引。特步國際首席財務官楊鷺彬在業績分析師電話上,特步主品牌生活系列產品將面對一定的銷售壓力,不過在跑步及兒童產品推動下,預計相關業務仍有一定增長;索康尼及邁樂業務將錄得不錯增長,預計全年增長目標由30%至40%。

「面對2024年的不景氣,集團下半年會更注重費用控制及庫存管理,因此預期未能達到今年年初制定整體銷售額增長不少於10%的目標,預期仍有所增長,而在嚴控費用下,預期全年的利盈目標可以達到年初所定20%的目標。」楊鷺彬說道。

尋找增長極 加大索康尼品牌的投入

特步國際於2019年開啓多品牌、國際化發展道路。除了以2.6億美元的價格將韓國衣戀集團旗下的時尚運動品牌蓋世威、帕拉丁納入麾下,特步近年來加快了將索康尼和邁樂收入囊中的節奏。

去年年底,特步國際收購索康尼在中國40%的知識產權,又在今年1月收購了與Wolverine Worldwide在2019年組建的合資公司的剩餘股權,使合資公司成爲特步的全資子公司。

業績顯示,索康尼針對中國高線城市跑步和社會精英的品牌戰略定位,截至2024年6月30日,索康尼在中國共有128家門店。索康尼所在的專業運動業務在今年上半年保持高速增長,收入同比增長72.2%至5.93億元,佔特步國際總營收的8.2%,同時該部分貢獻的淨利潤爲3180萬元。

「今年年初收購完了以後,我們認爲應該加大這個品牌的資金投入和其他方面的一些投入」, 丁水波在業績投資者電話分析會上透露,索康尼的開店策略不是以數量爲KPI,而是會開大店,此外加盟的佔比也會非常少。

「特步現在開始也在東南亞和其他區域有一系列的整體的規劃和安排,特別是跨境電商。」丁水波在業績分析師電話上對於出海方面回覆投資者對於出海計劃時稱,至於索康尼和邁樂,重點還是先把中國市場做好,包括中國香港和中國澳門區域做好。「這個發展的空間非常大,有很多發力的地方,出海會是下一步的安排。」

值得一提的是,今年上半年,特步宣布战略性出售时尚运动业务的盖世威和帕拉丁品牌,并聚焦资源于跑步业务,加大对索康尼品牌的投入,这一举动被视为特步策略的重要调整。

值得一提的是,今年上半年,特步宣布战略性出售时尚运动业务的盖世威和帕拉丁品牌,并聚焦资源于跑步业务,加大对索康尼品牌的投入,这一举动被视为特步策略的重要调整。