Financial giants have made a conspicuous bullish move on NextEra Energy. Our analysis of options history for NextEra Energy (NYSE:NEE) revealed 20 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $254,735, and 18 were calls, valued at $1,029,389.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $67.5 to $92.5 for NextEra Energy over the recent three months.

Analyzing Volume & Open Interest

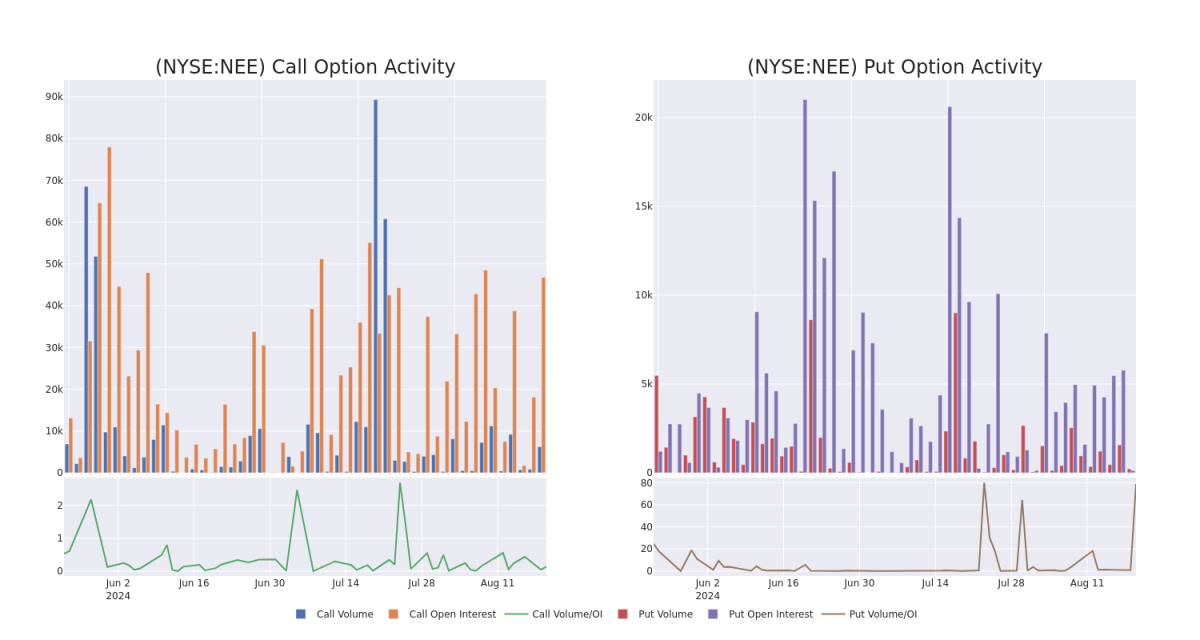

In today's trading context, the average open interest for options of NextEra Energy stands at 6695.86, with a total volume reaching 6,471.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in NextEra Energy, situated within the strike price corridor from $67.5 to $92.5, throughout the last 30 days.

NextEra Energy Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | PUT | SWEEP | BEARISH | 01/17/25 | $13.85 | $13.75 | $13.85 | $92.50 | $216.0K | 2 | 157 |

| NEE | CALL | SWEEP | BEARISH | 10/18/24 | $1.84 | $1.83 | $1.84 | $82.50 | $180.2K | 2.0K | 1.3K |

| NEE | CALL | SWEEP | BULLISH | 06/20/25 | $13.9 | $13.1 | $13.9 | $70.00 | $122.3K | 2.9K | 142 |

| NEE | CALL | SWEEP | BULLISH | 09/19/25 | $16.7 | $16.45 | $16.65 | $67.50 | $73.4K | 357 | 163 |

| NEE | CALL | SWEEP | BULLISH | 06/20/25 | $14.2 | $14.1 | $14.1 | $70.00 | $73.3K | 2.9K | 279 |

About NextEra Energy

NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6 million customer accounts in Florida and owns 34 gigawatts of generation. FP&L contributes roughly 70% of NextEra's consolidated operating earnings. NextEra Energy Resources, the renewable energy segment, generates and sells power throughout the United States and Canada with more than 34 GW of generation capacity, including natural gas, nuclear, wind, and solar.

After a thorough review of the options trading surrounding NextEra Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is NextEra Energy Standing Right Now?

- Trading volume stands at 2,278,730, with NEE's price down by -0.14%, positioned at $79.24.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 63 days.

What The Experts Say On NextEra Energy

4 market experts have recently issued ratings for this stock, with a consensus target price of $84.25.

- Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Outperform rating on NextEra Energy with a target price of $92.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on NextEra Energy, which currently sits at a price target of $76.

- An analyst from JP Morgan has decided to maintain their Overweight rating on NextEra Energy, which currently sits at a price target of $94.

- Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for NextEra Energy, targeting a price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for NextEra Energy with Benzinga Pro for real-time alerts.