Benzinga's options scanner just detected over 11 options trades for Walgreens Boots Alliance (NASDAQ:WBA) summing a total amount of $612,543.

At the same time, our algo caught 3 for a total amount of 145,588.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $15.0 for Walgreens Boots Alliance over the recent three months.

Volume & Open Interest Development

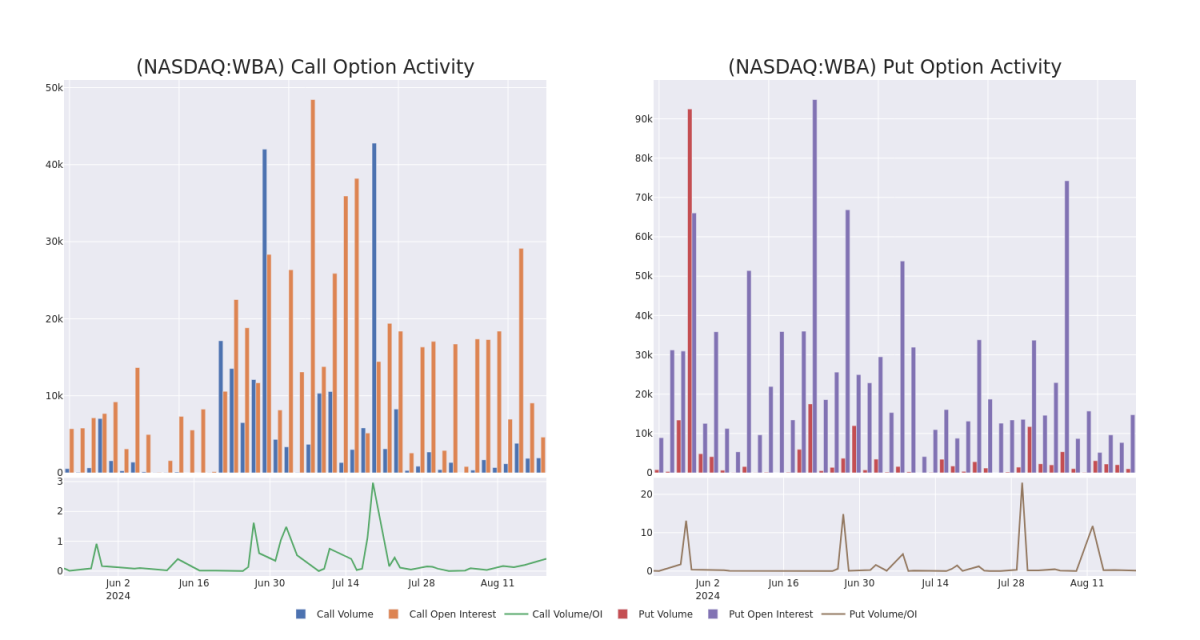

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walgreens Boots Alliance's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walgreens Boots Alliance's significant trades, within a strike price range of $2.5 to $15.0, over the past month.

Walgreens Boots Alliance Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WBA | CALL | SWEEP | BULLISH | 04/17/25 | $3.7 | $3.6 | $3.7 | $7.50 | $110.6K | 10 | 778 |

| WBA | CALL | SWEEP | BULLISH | 04/17/25 | $3.65 | $3.6 | $3.65 | $7.50 | $108.4K | 10 | 302 |

| WBA | CALL | SWEEP | BULLISH | 06/20/25 | $3.8 | $3.7 | $3.8 | $7.50 | $106.4K | 3.8K | 127 |

| WBA | PUT | SWEEP | BULLISH | 01/16/26 | $2.0 | $1.93 | $1.93 | $10.00 | $86.4K | 7.8K | 730 |

| WBA | CALL | TRADE | BEARISH | 01/17/25 | $5.75 | $5.7 | $5.6 | $5.00 | $56.0K | 95 | 100 |

About Walgreens Boots Alliance

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the US, with over 8,500 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the US. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider.

Having examined the options trading patterns of Walgreens Boots Alliance, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Walgreens Boots Alliance

- Currently trading with a volume of 5,279,385, the WBA's price is down by -1.34%, now at $10.71.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 51 days.

What Analysts Are Saying About Walgreens Boots Alliance

In the last month, 1 experts released ratings on this stock with an average target price of $7.0.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Walgreens Boots Alliance, targeting a price of $7.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walgreens Boots Alliance with Benzinga Pro for real-time alerts.