Deep-pocketed investors have adopted a bearish approach towards Lumen Technologies (NYSE:LUMN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LUMN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 13 extraordinary options activities for Lumen Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 23% leaning bullish and 69% bearish. Among these notable options, 4 are puts, totaling $592,939, and 9 are calls, amounting to $287,552.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $3.0 to $7.5 for Lumen Technologies during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $3.0 to $7.5 for Lumen Technologies during the past quarter.

Insights into Volume & Open Interest

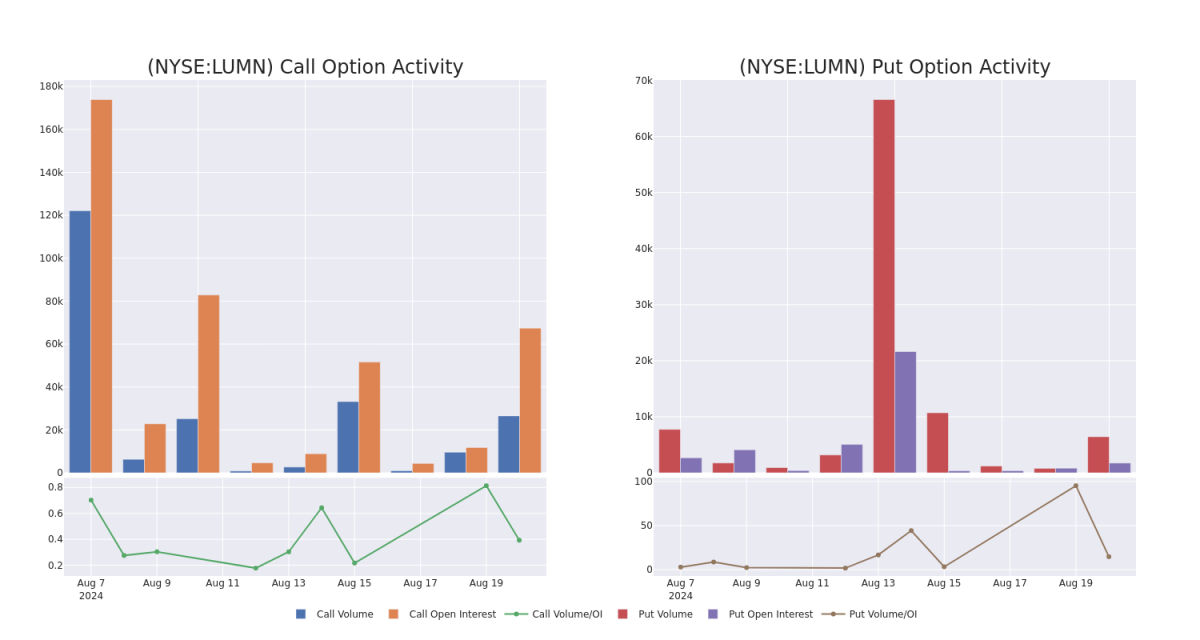

In today's trading context, the average open interest for options of Lumen Technologies stands at 6913.6, with a total volume reaching 32,957.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lumen Technologies, situated within the strike price corridor from $3.0 to $7.5, throughout the last 30 days.

Lumen Technologies Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LUMN | PUT | TRADE | BEARISH | 01/17/25 | $0.95 | $0.9 | $0.95 | $5.00 | $475.0K | 1.3K | 5.0K |

| LUMN | PUT | SWEEP | BEARISH | 12/19/25 | $1.48 | $1.46 | $1.48 | $5.00 | $50.1K | 92 | 622 |

| LUMN | CALL | SWEEP | NEUTRAL | 08/23/24 | $0.3 | $0.29 | $0.3 | $6.00 | $42.3K | 9.9K | 4.2K |

| LUMN | CALL | SWEEP | BULLISH | 08/23/24 | $0.38 | $0.36 | $0.38 | $6.00 | $38.1K | 9.9K | 8.7K |

| LUMN | PUT | TRADE | BEARISH | 09/20/24 | $0.63 | $0.59 | $0.63 | $6.00 | $36.6K | 321 | 606 |

About Lumen Technologies

With 450,000 route miles of fiber, Lumen Technologies is one of the United States' largest telecommunications carriers serving global enterprises. Its merger with Level 3 in 2017 and divestiture of much of its incumbent local exchange carrier, or ILEC, business in 2022 has shifted the company's operations away from its legacy consumer business and toward enterprises (now about 75% of revenue). Lumen offers businesses a full menu of communications services, providing colocation and data center services, data transportation, and end-user phone and internet service. On the consumer side, Lumen provides broadband and phone service across 37 states, where it has 4.5 million broadband customers.

After a thorough review of the options trading surrounding Lumen Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Lumen Technologies

- With a trading volume of 21,008,691, the price of LUMN is up by 0.52%, reaching $5.79.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 70 days from now.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lumen Technologies options trades with real-time alerts from Benzinga Pro.