Wall Street seems to be becoming "frugal."

The US stock market seems to be drawing inspiration from consumers' frugal trends.

According to corporate earnings and economic data obtained by the Intelligent Financial App, despite people continuing to consume, they are more focused on value for money and are postponing purchases of commodities until the Federal Reserve lowers interest rates.

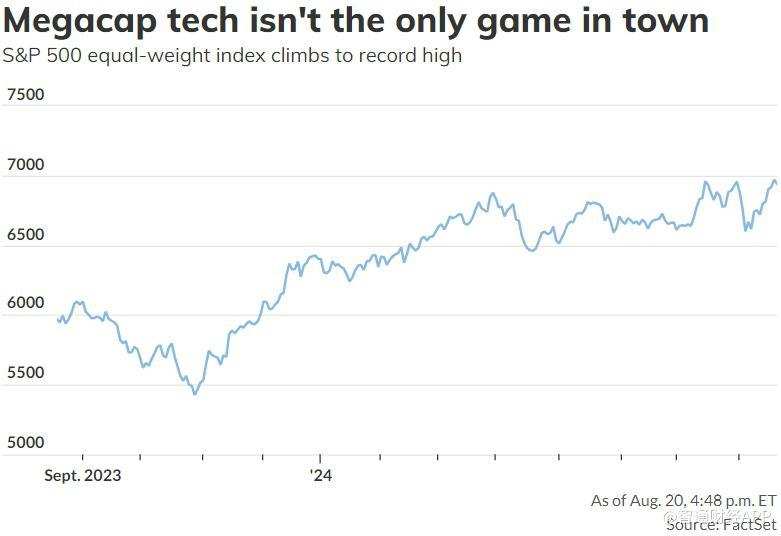

Wall Street seems to be becoming "frugal," with the S&P 500 equal-weight index hitting a new all-time high on Monday. Robert Pavlik, senior portfolio manager at Dakota Wealth Management, said, "This indicates that the market rebound is expanding, and after the "seven giants" rose sharply earlier this year, investors appear to be searching for opportunities in other areas of the market."

The traditional S&P 500 index (SPX.US) is expected to benefit from optimism about artificial intelligence in 2024. Star AI company Nvidia (NVDA.US) saw its market cap increase by $1.8 trillion in the middle of the year, far outpacing other companies in the index.

On Tuesday, the S&P 500 index and its equal-weight index both fell, as did the Dow and Nasdaq. According to Dow Jones Market Data, the S&P 500 index closed only 0.7% below its previous historic high in mid-July on Monday.

"The seven giants" will still contribute to profits, but their proportion will decrease compared to other sections of the stock market, said Brian Vendig, chief investment officer of MJP Wealth Advisors. He believes that this is because the normalization of the supply chain after the COVID-19 pandemic, the slowdown in wage growth, and the adjustment of asset balance sheets and business models of companies will benefit companies outside of technology.

Vendig added: "This does not mean that tech stocks are no longer good targets, because they have indeed experienced significant gains. But other companies are also experiencing profit growth."

According to data from senior profit analyst John Butters at FactSet Research, the S&P 500 index's comprehensive profit growth rate (including actual performance and forecasts) was 10.9% in the second quarter. If the "seven giants" are excluded, the comprehensive profit growth rate of the remaining 493 companies is 6.2%.

Looking for more winners?

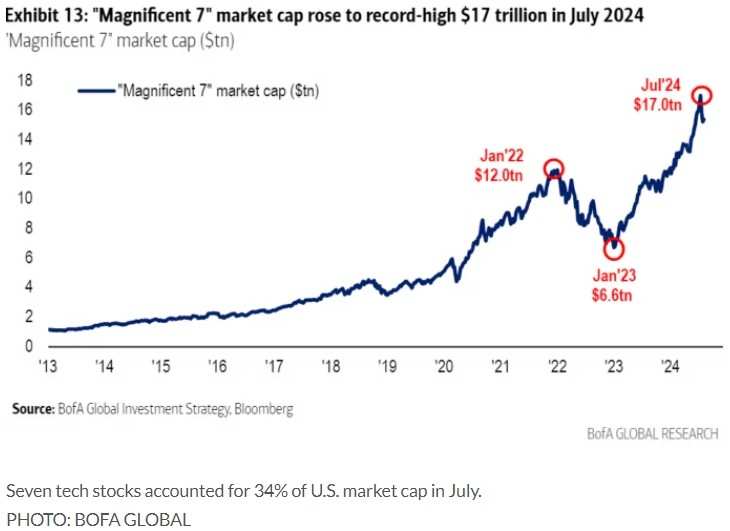

There is no doubt that "the seven giants"--Apple (AAPL.US), Amazon (AMZN.US), Microsoft (MSFT.US), Nvidia (NVDA.US), Alphabet (GOOG.US, GOOGL.US), Meta (META.US), and Tesla (TSLA.US)--have driven the stock market higher in recent years.

According to data from Bank of America Global Research, the market capitalization of these seven stocks reached a record $17 trillion in July, accounting for 34% of the value of the US market.

But in the coming months, they may not be the only winners. Craig Sterling, director of stock research at Amundi US, said, "I think we're seeing a systemic shift that started a month ago." Referring to companies outside of tech giants showing signs of profit recovery.

Sterling added: "It's a sporadic process, but I think earnings will drive it." He expects profit growth for the "seven giants" to slow down next year, while profits for other companies in the S&P 500 index will accelerate. This expectation is based on the US being able to avoid an economic recession. Other factors, such as mixed economic data, intense White House campaign activities, and expectations of a Fed rate cut, have also attracted investors' attention.

Crit Thomas, global market strategist at Touchstone Investments, pointed out that historically, corporate profits usually begin to expand as the economy recovers from a downturn. He said: "What we are seeing today is a soft landing." and added that it is still uncertain whether the Fed's interest rate cut is due to continued easing of inflation or other reasons.

Sterling said: "Valuations guide us where we go. For companies, there must be a road to value."