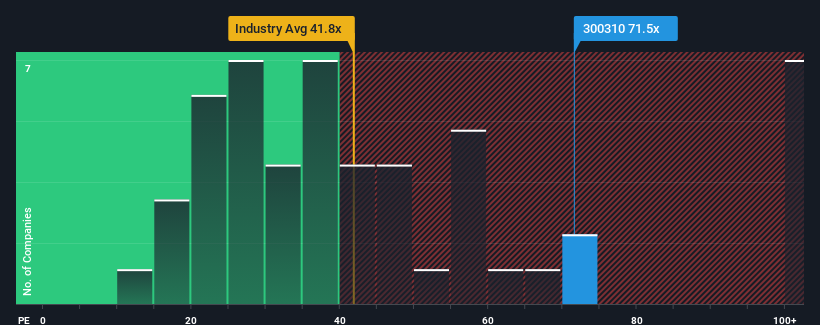

With a price-to-earnings (or "P/E") ratio of 71.5x Eastone Century Technology Co.,Ltd. (SZSE:300310) may be sending very bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 27x and even P/E's lower than 16x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Eastone Century TechnologyLtd has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

How Is Eastone Century TechnologyLtd's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Eastone Century TechnologyLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 169%. The latest three year period has also seen an excellent 187% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Eastone Century TechnologyLtd is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Eastone Century TechnologyLtd maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Eastone Century TechnologyLtd that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.