2 Stocks to Invest in AI Even If You're Not a Tech Nerd

2 Stocks to Invest in AI Even If You're Not a Tech Nerd

It can be super risky to invest in pure artificial intelligence (AI) companies. Perhaps the sweet spot is to identify profitable companies for which AI can help drive higher growth for their businesses.

投資純人工智能(AI)公司可能風險很大。也許最佳選擇是確定盈利的公司,人工智能可以幫助其推動業務的更高增長。

Here are a couple of top Canadian AI stocks with growth potential.

以下是幾隻具有增長潛力的加拿大頂級人工智能股票。

Open Text

打開文本

Open Text (TSX:OTEX) empowers its customers to organize, integrate, and protect data and content, as it flows through business processes inside and outside their organization. Its AI-powered Intelligent Capture aims to reduce the cost and risk of labour-intensive processes, including property and casualty claims, mortgage lending, accounts payable, back-file conversion, customer onboarding, and HR management of employee documentation.

Open Text(多倫多證券交易所股票代碼:OTEX)使客戶能夠組織、整合和保護數據和內容在組織內部和外部的業務流程中流動。其人工智能驅動的Intelligent Capture旨在降低勞動密集型流程的成本和風險,包括財產和意外傷害索賠、抵押貸款、應付賬款、回檔轉換、客戶入職和員工文檔的人力資源管理。

Intelligent Capture aims to learn to be smarter (and make less mistakes) over time as more and more data goes through, thereby helping companies save money and helping their staff save time.

Intelligent Capture旨在隨着時間的推移學會變得更聰明(減少錯誤),從而幫助公司節省資金並幫助員工節省時間。

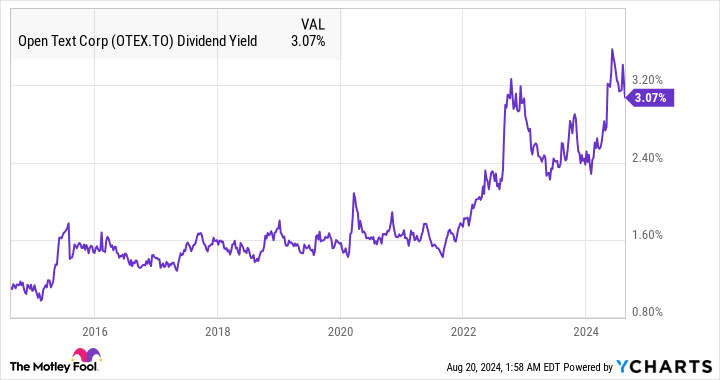

Open Text has demonstrated a track record of growing its profits and dividend over time. It started paying a quarterly dividend in 2013, and it has raised its dividend every year since. For your reference, its five-year dividend growth rate is 10.9%. And its last dividend hike occurring earlier this month was 5.2%.

隨着時間的推移,Open Text的利潤和股息增長有着良好的記錄。它於2013年開始支付季度股息,此後每年都提高股息。供您參考,其五年股息增長率爲10.9%。其本月早些時候的最後一次股息上調幅度爲5.2%。

After its massive US$5.8 billion acquisition of Micro Focus in February 2023, the tech company has been focusing on reducing its debt levels. Due to its acquisitive nature and high debt levels, Open Text is a risky stock. Open Text ended fiscal 2022 with a long-term debt-to-capital ratio of 52%. The ratio jumped to 67% in fiscal 2023. It cut the ratio to 60% by the end of fiscal 2024.

在2023年2月以58億美元大規模收購微焦點之後,這家科技公司一直專注於降低其債務水平。由於其收購性質和高負債水平,Open Text是一隻風險股票。開放文本在2022財年末的長期債務與資本比率爲52%。該比率在2023財年躍升至67%。到2024財年底,它將該比率下調至60%。

The stock price is down 30% from its 2021 high of $64. Over the last decade, OTEX has delivered annual returns of only 5.7%. Its 15-year annual return of 11.3% is much more acceptable.

該股價格較2021年的高點64美元下跌了30%。在過去的十年中,OTEX的年回報率僅爲5.7%。其15年11.3%的年回報率更容易被接受。

OTEX Dividend Yield data by YCharts

YCharts 的 OTEX 股息收益率數據

Analysts believe the stock trades at a discount of 13%. It also offers a dividend yield of 3.2%, which is relatively high compared to its historical levels. If it's able to turn around with the double-digit earnings growth it has achieved in the past, it could double investors' investment over the next five years!

分析師認爲,該股的交易折扣爲13%。它還提供3.2%的股息收益率,與歷史水平相比相對較高。如果它能夠以過去實現的兩位數收益增長來扭轉局面,那麼它可能會在未來五年內將投資者的投資翻一番!

Kinaxis

Kinaxis

Kinaxis (TSX:KXS) is a tech stock that could experience substantial growth from the application of AI to empower its customers to intelligently control the supply chain digitally. It believes that machine learning and 24/7 analytics will increase efficiency and allow for confident decision-making.

Kinaxis(多倫多證券交易所股票代碼:KXS)是一隻科技股,通過應用人工智能賦予其客戶以數字方式智能控制供應鏈的能力,它可能會實現大幅增長。它認爲,機器學習和全天候分析將提高效率並允許自信地做出決策。

In the trailing 12 months, Kinaxis generated total revenues of US$457.7 million, gross profit of US$277.3 million, operating income of US$20.6 million, and net income of US$21 million.

在過去的12個月中,Kinaxis的總收入爲4.577億美元,毛利爲2.773億美元,營業收入爲2,060萬美元,淨收入爲2,100萬美元。

Kinaxis stock has been trading somewhat sideways since mid-2020. Its more recent trading activity suggests that the $140 level serves as a support. Valuation-wise, analysts believe the tech stock trades at a discount of about 19% with near-term upside potential of 23%. Holding the stock longer has the potential to double investors' money over the next few years.

自2020年中期以來,Kinaxis的股票一直處於橫盤整理狀態。其最近的交易活動表明,140美元的水平可以作爲支撐。在估值方面,分析師認爲,科技股的交易折扣約爲19%,短期上漲潛力爲23%。長揸該股有可能在未來幾年內使投資者的資金翻一番。

For more diversification, investors can consider exchange traded funds such as the iShares U.S. Technology ETF.

爲了實現更多分散投資,投資者可以考慮交易所交易基金,例如iShares美國科技ETF。