On Tuesday, Nvidia, the top-selling stock in US trading volume, fell 2.12%, with a turnover of $37.327 billion. The stock had risen for six consecutive trading days, up more than 30% from its low point in early August. In terms of product structure, 10-30 billion yuan products operating income is 401/1288/60 million yuan respectively.

Investors are currently most concerned about whether Nvidia can continue to rise in the future. Goldman Sachs believes that there is a huge potential catalyst for Nvidia's stock: the company will release its second-quarter earnings report next Wednesday (28th) Eastern Time.

Goldman Sachs analyst Toshiya Hari is generally optimistic about this financial report. In the latest report, he pointed out that due to strong demand from large cloud service providers and enterprise customers, Nvidia will continue to maintain its strong position in the fields of AI and accelerated computing.

Goldman Sachs continues to maintain its "buy" rating for Nvidia, with a target price of $135, which means that the bank predicts that Nvidia can rise by 4% from the current level.

Tesla, the second-ranking stock in terms of trading volume, fell 0.73%, with a turnover of $16.38 billion. On August 20 local time, the European Commission decided to impose a separate import tax rate on Tesla, which is currently set at 9%.

AMD, ranking third, rose 0.72%, with a turnover of $12.038 billion. On Monday, AMD announced that it would acquire ZT Systems, a large-scale AI and cloud storage service provider. AMD CEO Dr. Lisa Su said, "The acquisition of ZT Systems marks an important step in our long-term artificial intelligence strategy."

According to AMD's announcement, ZT Systems provides AI infrastructure to the world's largest large-scale computing companies. This transaction marks the next important step in AMD's AI strategy, which is to provide leading training and inference solutions based on cross-chip, software and system solutions.

The transaction has now been unanimously approved by AMD's board of directors, and the acquisition is expected to be completed in the first half of 2025, subject to approval by some regulatory agencies and satisfaction of other transaction conditions. AMD will seek strategic partners to sell ZT Systems' US data center infrastructure manufacturing business.

Microsoft's ARM architecture AI notebook is expected to have an annual shipment growth rate of up to 534% in 2025, according to Omdia's latest analysis.

Recently, Goldman Sachs, Barclays and Redwood Capital, three well-known financial institutions, have issued warnings stating that spending on AI is too high but the return is too low in the current AI field. Parent company Meta Platforms such as Facebook has invested heavily in infrastructure, including purchasing high-end chips, constructing data centers and investing in power supply, to maintain its lead in the AI field. Meta expects its annual capital expenditures to expand to $40 billion. Although no one is currently comparing the AI boom with the hype bubble of cryptocurrencies a few years ago, a major problem with AI is that the benefits of technological progress may not appear for some time.

Microsoft, ranking fourth, rose 0.78%, with a turnover of $6.495 billion.

Eli Lilly and Co., ranking sixth, rose 3.05%, with a turnover of $4.647 billion. The company announced on its official website on Tuesday that its flagship GLP-1 drug, Trulicity, significantly reduced the risk of developing type 2 diabetes in adults with prediabetes and overweight or obesity by 94%.

In addition to reducing the risk of type 2 diabetes, the latest research results also show that teriparatide can bring sustained weight loss throughout the entire treatment period.

In addition, Lilly and Organon have expanded the commercialization agreement for the migraine drug Emgality (galcanezumab) to another 11 markets. Organon will pay Lilly a prepayment of $22.5 million and installment payments based on sales. Data shows that Emgality is suitable for adult preventive treatment of migraines and in some markets for the treatment of cluster headaches.

Palo Alto Networks, ranking seventh, rose 7.18%, with a turnover of $4.575 billion. For the fourth quarter, revenue grew 12% year-over-year to $2.189 billion, slightly higher than the market expected of $2.16 billion; Non-GAAP net income was $0.522 billion, up 8% year-over-year; Diluted earnings per share was $1.51, higher than the market expected $1.41.

Previously, the Microsoft Blue Screen of Death caused by competitor CrowdStrike has drawn extra attention to Palo Alto's performance. The incident has prompted speculation about whether CrowdStrike's customers will turn to competing firms, including Palo Alto Networks, or if it will have a negative impact on the entire cybersecurity industry.

From the latest performance and outlook data of Palo Alto Networks, the impact of the Microsoft Blue Screen event on the cybersecurity market seems to be relatively limited. The company emphasized that the downtime event has brought attention to the network security field and brought new development opportunities to the company.

Amazon, ranking eighth, rose 0.37%, with a turnover of $4.462 billion. Reports on Tuesday suggested that Amazon's heavy investment in artificial intelligence has come at the cost of sacrificing profit compared with other large tech stocks.

James Abate, Chief Investment Officer of Centre Asset Management, said: "Investors are concerned that the increase in capital expenditures will affect cash flow. Compared with increasing investment, Amazon's stock price tends to perform better when it focuses on improving its profitability."

Netflix, ranking eleventh, rose 1.45%, with a turnover of $3.332 billion. Netflix said on Tuesday that its commitments to early ad revenue this year were up more than 150% due in part to the National Football League's games landing on the platform on Christmas Day. In the second year of its upfront negotiations, the web and media company secured ad agreements with all major holding companies and smaller independents.

Google A-class shares (GOOGL), ranking thirteenth, rose 0.31%, with a turnover of $2.868 billion. In an email to developers on Monday, Google said that due to an overall improvement in the security of the Android operating system and progress in security hardening work, the number of vulnerabilities that security researchers can exploit has decreased, so it has decided to end the GPSRP program. The program will officially end on August 31, and vulnerability reports submitted before that date will be evaluated by September 15, with a final reward decision by the end of September. The GPSRP program, launched in 2017, aimed to encourage developers and security researchers to discover vulnerabilities in popular Android apps and offer appropriate rewards.

Exxon Mobil, ranking eighteenth, fell 3.33%, with a turnover of $1.801 billion. Oil analysts said that in the first half of 2024, the performance of overseas oil giants was generally under pressure due to factors such as falling natural gas prices and declining refining profits. Among the five oil giants, Exxon Mobil's net income attributable to shareholders fell 9.6% year on year.

Boeing, ranking twentieth, fell 4.20%, with a turnover of $1.639 billion. On Monday, August 19, Boeing announced that during the inaugural flight test of the wide-body 777X, structural damage was found on one of the aircraft, and the test fleet was then grounded.

In a statement, Boeing said that the damaged part was located between the engine and the body structure, and the faulty part will be replaced and the cause of the problem will be investigated. Flight testing will resume once everything is clear.

As Boeing's latest generation of twin-aisle passenger aircraft, the new wide-body passenger plane 777X is highly anticipated in the market due to its high fuel efficiency and more spacious cabin design. Boeing has 540 orders for the 777X new aircraft, and plans to deliver them in 2025. In July, Boeing finally began flight testing the 777X aircraft with the assistance of the US regulatory agency, the Federal Aviation Administration (FAA), which was an important milestone.

However, the latest test flight failure incident has cast a shadow over the company's prospects again. It is not yet clear whether the suspension of test flights and related issues will affect the certification and delivery of the new 777X aircraft. Boeing said it had notified the FAA and its customers of the incident.

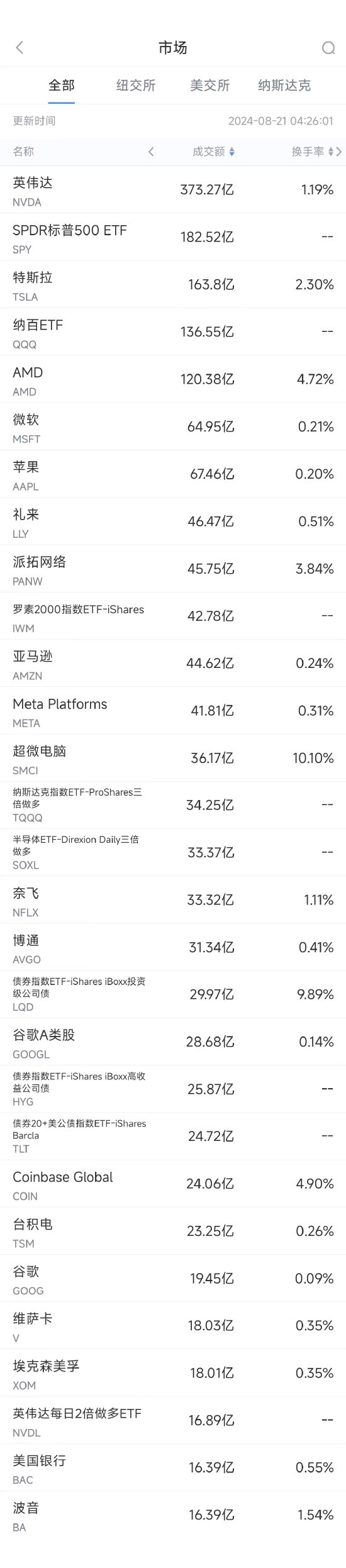

(Screenshot from Sina Finance APP Market section - US Stocks - Market sector, slide left for more data) Download the Sina Finance APP