As traders bet on an interest rate cut cycle, they choose to buy a large number of US Treasury futures. The Jackson Hole Global Central Bank Annual Meeting will provide important insights into the path of Fed policy.

In the US bond trading market, bond traders are taking on record bullish risks as they bet on the continuing rebound of the US Treasury market and the potential for a long-term bull market. This potential rebound is mainly driven by the expectation of the Fed's first rate cut in more than four years. From the perspective of US Treasury bond market bets, bond traders have priced in nearly 100% of the expected 25 basis point rate cut in September, and more and more traders are pricing in similar rate cuts in November and December.

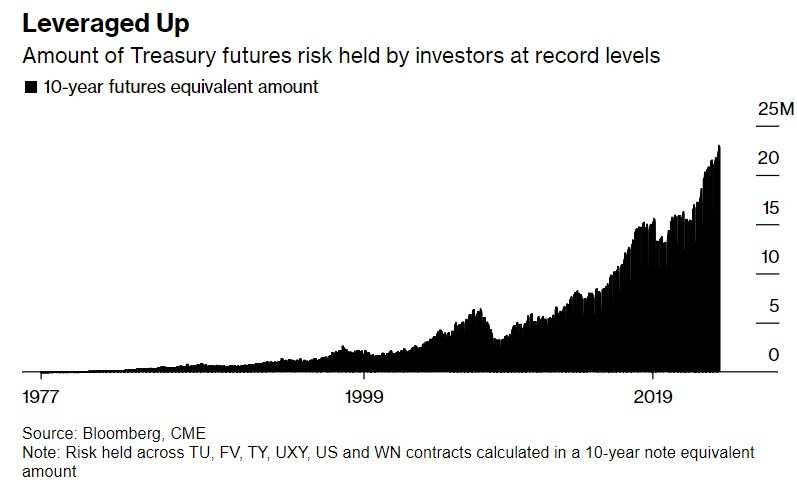

Prior to the annual economic symposium of the central bank held in Jackson Hole, Wyoming on Friday evening Beijing time, the leverage position of US Treasury futures had reached a historical high. At this event, Fed Chairman Jerome Powell will deliver a critical speech and provide more insights into the Fed's monetary policy path for the rest of the year.

For the global stock market that experienced a "super rebound" last week, the Jackson Hole central bank annual meeting held on Friday night Beijing time was a "crucial test", where policy makers such as Fed Chairman Powell and Bank of England Governor Bailey will deliver important speeches. During Friday's trading session, the options market priced in the high volatility of the S&P 500 index exceeding 1% this Friday, betting that the benchmark index's volatility will exceed 1% whether it rises or falls.

"If traders hear a heavy signal that an interest rate cut is coming, the stock market will give a positive response," said Eric Bailey, executive director of Steward Partners Global Advisory. "However, if traders and investors don't hear the positive information they want, the stock market, which has experienced a big rebound, may face massive selling off."

"The market is very confident that the rate cut is coming," Bailey said. "If Powell doesn't emphasize that it's a path for the future, it would be a huge trigger."

"Looking back at past Jackson Hole annual conferences, we are unlikely to get unconventional comments on rate cuts from Powell," said Tom Hainlin, investment strategy analyst at US Bank Wealth Management.

Former New York Fed Chairman Bill Dudley said that Fed Chairman Powell may suggest that overly tight monetary policy is no longer needed. However, he expects Powell will not suggest the size and specific timeline of the first rate cut, especially since a crucial non-farm payroll and unemployment report will be released on September 6 to provide policy makers with a more comprehensive assessment before making their next policy decision on September 18. Product structure, 10-30 billion yuan products operating income of 401/1288/60 million yuan respectively.

According to data from the Chicago Mercantile Exchange Group (CME Group Inc.) and Bloomberg analysis data, last week the open futures contracts in the futures market, which refers to the overall risk scale that traders who can choose to take long or short positions, reached nearly a record-breaking 23 million 10-year US Treasury futures contracts. The risk is about 1.5 billion US dollars for every one basis point change in the underlying cash notes.

Leveraged - the amount of risk held by investors in US Treasury futures hit a new high

As traders bet on an interest rate cut cycle, they choose to buy a large number of US Treasury futures. This growth is consistent with the increasing bullish bets on the US Treasury market in the past few weeks, which means that funds are betting that the Fed will dramatically cut interest rates in 2019 and 2025. According to statistics from the US Commodities Futures Trading Commission (CFTC) as of the week ending August 13th, asset management companies have increased their net long positions in 10-year US Treasury futures by about 0.12 million shares.

Although many signs show that most leverage positions are long positions in US Treasury futures held by asset managers, some are attributable to the basis trade, a very popular hedge fund strategy where traders profit from the price difference between cash bonds and futures.

Since the strategy involves borrowing in the repo market, if overall lending conditions in the market tighten, traders may be forced to unwind positions to repay the loans. Such rapid reduction in positions may cause severe market volatility in the Treasury market.

It is worth noting that cautious traders who have been worried about the timing and scale of Fed interest rate cuts may not meet market expectations and have been betting on various scenarios that may occur this year. Just two weeks ago, the swap markets expected the Fed to cut interest rates by 50 basis points at the September meeting and there was a risk of an emergency rate cut, but some traders still insisted on a 25 basis point rate cut. Currently, with the release of extremely strong retail sales data and initial jobless claims data that suggest the labor market may be more optimistic than expected, the expectation of a 25 basis point rate cut next month is almost 100% priced in.

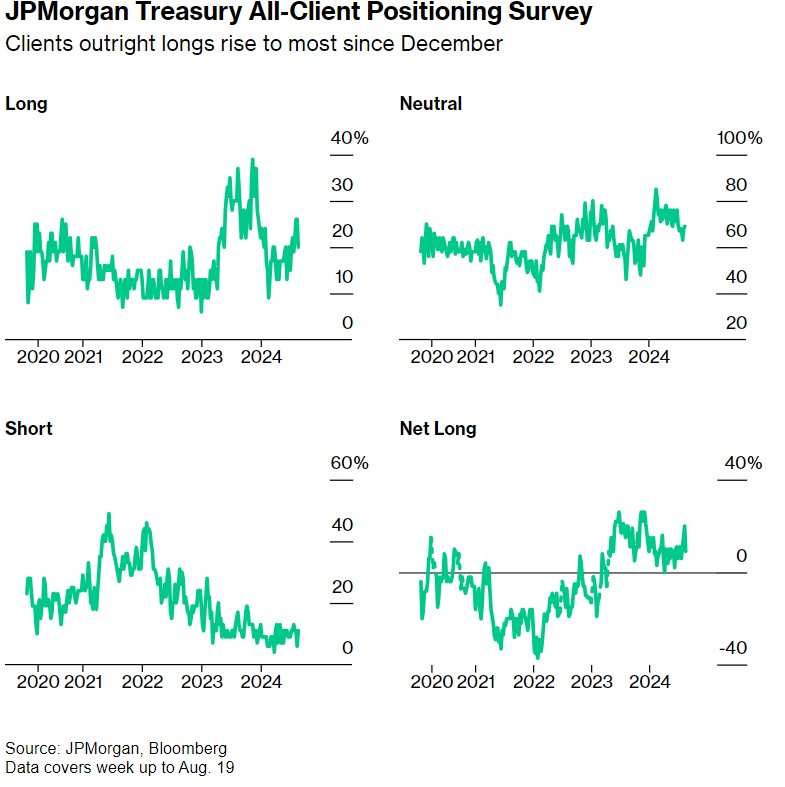

The spot trading market has shown that the once sustained bullish bet has begun to be unwound before the Jackson Hole meeting. The latest US Treasury client survey report released by Wall Street's major bank JPMorgan showed that the relevant net long position has fallen to the lowest level in a month.

The following is an overall summary of the latest position indicators in the interest rate market:

JPMorgan's Latest Survey Data

In the week ending August 19th, JPMorgan's US Treasury client survey showed that the net long position fell by 6 percentage points, but still maintained a long-term sentiment for at least a month, while short positions increased slightly by 5 percentage points in a week, less than the pace of long positions.

JPMorgan's US Treasury client position survey - The client's complete long position rose to the highest level since December last year in August

Premium Hedging Relief

After the call premium appeared several weeks ago due to traders seeking a sustained rebound in the US Treasury market, the premium paid to hedge against market volatility continued to fall to neutral levels. On Tuesday, the flow of Treasury bond options included a long-term options volatility bet of up to $5 million in premium through October options by the hedged buyer, which will expire two days after the Fed's monetary policy announcement on September 18. In the latter part of last week, a large amount of trading capital flowed around the put options for 10-year Treasury bonds in September and October, indicating that some traders are targeting higher 10-year US Treasury bond yields.

Changes in fund flows.

Please use your Futubull account to access the feature.

Comparison of the top five and bottom five net changes in SOFR option strike prices per week.

SOFR options heatmap.

In the SOFR options due in March 2025, the 95.50 strike price option exercise point is currently the highest among outstanding contracts. Trading in bullish options such as 96.00/96.50/97.00/97.50 boosts the price of the call option on December 25th within one week.

SOFR option position - top 20 liquid positions in SOFR options with a term limit of March 2025.

According to SOFR option open interest data, the SOFR option market appears to have fully transitioned from betting on the Fed's 50 basis-point interest rate cut to a 25 basis-point adjustment. The distribution of call and put options at the 95.50 level shows that the market's expectations for the future Fed benchmark rate staying at a lower level have surged in recent days.

The distribution of these option strike prices indicates that the vast majority of SOFR option market participants expect the Fed to initiate a rate cut cycle from September, betting that this year's rate cut could be as high as 75 basis points and may reach a bottom interest rate level in early 2025. Therefore, investors are betting on these possible interest rate paths by buying corresponding SOFR options, while working to hedge related risks.

During the Fed's interest rate cut cycle, traders may be more inclined to capture profit trading opportunities from lower interest rates through the SOFR option market, while adjusting their positions to deal with market uncertainty. The increase in call option holdings reflects optimistic betting expectations on the downtrend of interest rates, while the increase in put option holdings may be similar hedging strategies against potential interest rate trends.

Divergent Views from Asset Managers and Hedge Funds on Treasury Futures.

In the week ended August 13th, some large positions underwent significant changes, with global asset management companies expanding their long duration positions in approximately 1.2 million 10-year US Treasury futures contracts. This means that these large asset management institutions are optimistic about the outlook for US Treasury bond prices, believing that interest rates may continue to fall, or at least remain low for some time in the future. Therefore, they choose to extend the investment portfolio duration by holding longer-term bond or corresponding futures positions to benefit from falling rates.

However, hedge funds take a different view, increasing their short net duration positions by approximately 0.315 million 10-year US Treasury futures contracts. Data shows that the stance of hedge funds on bearish bets on 10-year US Treasury futures has pushed their overall net short position to more than 2 million US bond futures contracts, setting a record high. Asset managers may expect the Fed to adopt looser monetary policy in the future or believe that economic growth may slow down, thereby pressuring benchmark interest rates downward. They bet that this will lead to lower yields on long-term bonds and rising prices, hence they increase their long positions. However, hedge funds may believe that the current US economy and labor market remain resilient, and the Fed will not significantly reduce interest rates as expected by the market, but will adopt a gradual reduction in steps. Therefore, they increase short positions and bet that long-term bonds will experience price declines in a certain period of time.

However, hedge funds may believe that the current US economy and labor market are still resilient, and the Federal Reserve will not significantly cut interest rates as expected by the market, but will gradually adopt a slow interest rate reduction measure. As a result, they increase short positions and bet that long-term bonds will experience a price drop at some point in time.