①针对“多模态大模型”的重视程度,赵勇表示,大模型技术是公司安身立命之根本,也将是未来几年公司核心技术发展方向;②大模型在金融、工业、商业等领域都有所应用,但这些领域的大模型都是辅助角色,远没有达到替代人的程度。

编者按:

2024年1月25日至26日,中国证监会召开2024年系统工作会议并强调,要突出以投资者为本的理念。为帮助投资者更好了解企业真实发展情况与价值,进一步保护投资者合法权益等,财联社、《科创板日报》联合打造《直击股东会》栏目。

《直击股东会》栏目以现场报道的形式,通过在股东大会现场直面上市公司董事长等核心管理层,聚焦企业长期战略、重大决策、经营方针等,旨在提升企业资本市场形象,优化投资者关系管理,完善上市公司相关治理与发展等。

本期企业:格灵深瞳

▍企业简介

格灵深瞳专注于计算机视觉技术、大数据分析技术、机器人技术和人机交互技术与应用场景深度融合,提供面向智慧金融、城市管理、智慧商业、轨交运维、体育健康、元宇宙的人工智能产品及解决方案。

▍企业亮点

该公司掌握计算机视觉领域的核心算法技术,已形成了基于深度学习的模型训练与数据生产技术、3D立体视觉技术、自动化交通场景感知与事件识别技术等技术方向,并拥有多项自主知识产权。

▍盈利模式

格灵深瞳主要从事计算机视觉技术、大数据分析技术、机器人技术和人机交互技术的研发和应用。该公司的盈利来源于向客户提供面向应用场景的人工智能产品及解决方案获得销售收入。

《科创板日报》8月21日讯(记者 吴旭光)日前,格灵深瞳举行2024年第一次临时股东大会。

该会议由格灵深瞳董事长、总经理赵勇主持,并审议通过了《关于部分募投项目结项、部分募投项目终止并将节余(剩余)募集资金永久补充流动资金和投入新项目的议案》等。

根据该公司公告,本次拟结项的首发募投项目为“人工智能算法平台升级项目”、“人工智能创新应用研发项目”,同时终止“营销服务体系升级建设项目”建设,并将前述三个募投项目的节余募集资金累计3.68亿元,全部用于投入新募投项目“多模态大模型技术与应用研发项目”,新项目建设期为36个月。

“押宝”多模态大模型

“多模态大模型”是指通过整合视觉、听觉等多种感知通道,模拟人类理解与表达信息的能力,旨在提升人工智能上限。

股东会上,格灵深瞳董事长、总经理赵勇表示,“大模型技术是公司安身立命之根本,也将是未来几年公司核心技术发展方向。”**同时,在赵勇看来,所有技术的突破往往伴随着机遇与风险。

与传统人工智能不同,生成式人工智能领域的高成本、高研发投入与盈利能力之难,成为AI企业面临的重大挑战。

在谈及大模型行业现状时,赵勇称,一方面,与一年前市场热钱集中涌向大模型创业不同,现阶段,大模型行业的投资浪潮正在逐步降温,随之而来的也会有大量的做大模型的创业公司死掉,整个行业经历喧嚣之后,开始进入一个“平寂期”;另一方面,大模型作为一种基础技术,行业不需要如此数量庞大的大模型产品。

“作为一家计算机视觉和人工智能技术公司,格灵深瞳需要做的一件事情就是,必须活得比这个炙热的技术投入周期更久。”赵勇说道。

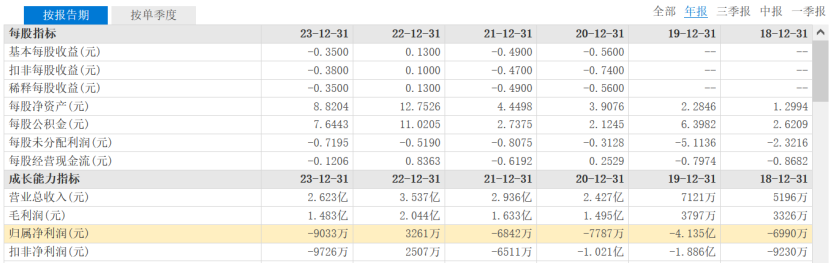

《科创板日报》记者注意到,近年来,格灵深瞳经营业绩并不理想。在其最近6个年度中,有5个年度处于亏损状态。

其中,2023年度,该公司的营业收入规模减少同时,净利润亏损9033万元左右。截至2024年一季度,格灵深瞳实现营业收入3073万元,同比下降54.51%;实现归母净利润为-0.27亿元,亏损同比增加32.10倍左右。

对于投资者提出的“格灵深瞳何时迎来净利润扭亏”这一问题,赵勇表示,受宏观经济环境、行业终端客户预算及采购计划推迟等因素影响,导致目前该公司营业收入出现下滑。“目前公司在尽力做好经营工作,努力在最短的时间内重新实现盈利。”

股东会上,赵勇也向出席的部分投资人表达坚决做好“两不要”原则:一是不要通过砸钱的方式做大营收;二是不要砸钱购买算力。“尤其是在当下市场算力最贵的时候,不要拿出过多的现金流在算力上进行烧钱。”

《科创板日报》记者通过梳理公开数据发现,当前,商汤科技、旷视科技、云从科技、云天励飞等大部分AI公司仍处于亏损或未能达到稳定盈利状态。其中,截至2024年一季度,云从科技-UW亏损1.61亿元;云天励飞-U亏损1.38亿元。

“是不是人工智能公司变现都挺困难?”在面对投资者提出疑问时,格灵深瞳方面表示,随着该公司的多模态大模型能力持续增强,以及其推进产品化和标准化战略,“我们看到了边际成本的下降趋势,当业务规模扩大到一定程度后,就具备了可持续盈利的条件。”

大模型应用落地仍面临多重挑战

股东会上,赵勇对投资人表示,TOB端的大模型创业公司要想在这波AI投资浪潮中活下来, 需要实现对核心技术转化成产品,并形成业绩,才有可能确保公司走得更远。

对于未来公司产品布局,赵勇进一步介绍,该公司将更加聚焦主营业务,落地的场景主要集中在泛安防、工业检测和人机交互领域,具体包括智慧金融、城市管理、智慧商业、轨交运维、体育健康、元宇宙等。“公司定位是运用大模型赋能自身核心业务。”

以银行“贷后管理”业务场景为例,银行面临的痛点之一是,其掌握的用户数据片面,无法获得用户在银行以外的数据。对此,格灵深瞳通过在智慧金融业务领域的大模型相关产品赋能,可实现对用户的监测、跟踪、检测等,统计出某一特定时间段内的客流量、停留时间、行动轨迹等,提供客观的用户行为分析数据。

据悉,目前,格灵深瞳在智慧金融、城市管理、轨交运维和智慧商业领域的大模型已开始落地应用。

有投资人对《科创板日报》记者表示,格灵深瞳主营计算机视觉技术和大数据分析技术业务,在实际应用中,AI视觉是AI第一波浪潮中被验证的领域。“过去,AI视觉在安防、交通、零售、工业质检上都有成功应用,AI四小龙亦是如此。但问题在于,许多AI视觉算法只能在特定数据集上表现良好,不适应多种环境和条件,泛化能力较差。”

“要提升泛化能力,获取高质量、大规模的标注数据集是一个挑战。因此,到目前为止,即便是ChatGPT掀起新一波AI投资浪潮之后,依然没有AI公司大幅盈利。”上述投资人认为。

此外,需要注意的是,中金公司在研报中表示,大模型在当前在金融行业的应用,主要聚焦于业务场景简单的非决策类环节,如:前台营销运营、信息搜集整理、中后台运营支持等环节,而在对金融专长要求更高、涉及强金融建议和核心决策任务的业务场景中仍难以落地应用。

工信部信息通信经济专家委员会委员盘和林在接受《科创板日报》记者采访时同样认为,大模型在金融、工业、商业等领域都有所应用,但这些领域的大模型都是辅助角色,远没有达到替代人的程度。“如:在金融领域,大模型主要是辅助决策;在工业领域,机器视觉应用广泛,但也存在很多不能识别物体的情况,进而导致在很多应用场景并不能直接满足应用要求。”

清晖智库创始人宋清辉表示,以金融领域为例,相关企业的大模型未来能否承担包括资产配置、投资决策等在内的核心金融任务,决定了这部分大模型创业公司,能否在未来激烈竞争中脱颖而出的关键。

“大模型赛道长坡厚雪,现阶段其智能程度还达不到大众所期待的标准,站在当下时间节点上,做AI产业布局应该抓住未来10年的机遇。”宋清辉如是说。