According to Gelonghui, Jiaxin International Resource Investment Co., Ltd. (referred to as "Jiaxin International") submitted an application to HKEX recently. This is the company's second application for listing, and the sponsor is China International Capital Corporation.

Jiaxin International is a tungsten mining company rooted in Kazakhstan, focusing on developing its Bakuta tungsten mine project.

According to the prospectus, the Bakuta tungsten mine has the fourth largest WO3 mineral resource of tungsten mines globally (including open-pit and underground mines), and has the largest designed tungsten mining capacity in a single tungsten mine.

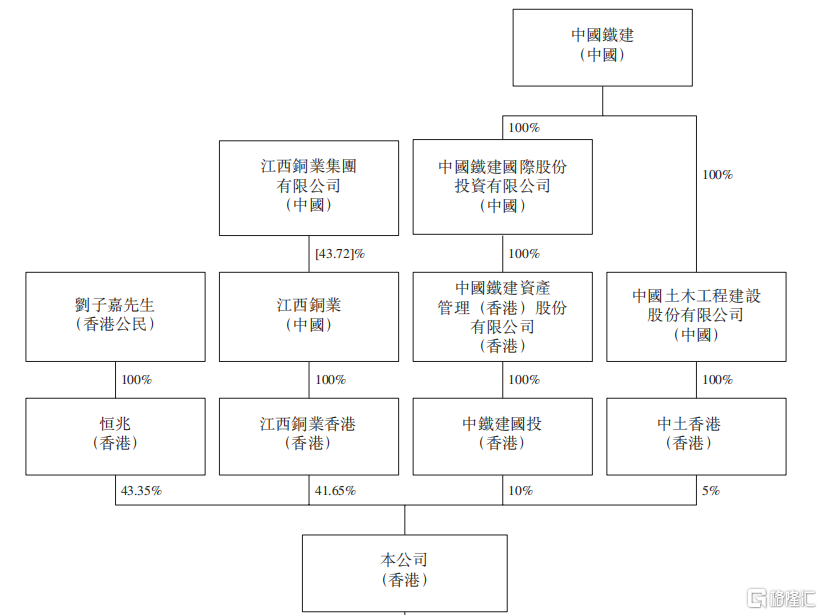

Prior to this issuance, Hengzhao (a company wholly owned by Mr. Liu Zijia) and Jiangxi Copper Hong Kong (a company wholly owned by Jiangxi Copper) respectively held 43.35% and 41.65% of the equity. China Railway Construction Corporation held 10% and 5% of the shares respectively through China Railway Construction Corporation International (Hong Kong) and Zhongtu (Hong Kong).

Prior to this issuance, Hengzhao (a company wholly owned by Mr. Liu Zijia) and Jiangxi Copper Hong Kong (a company wholly owned by Jiangxi Copper) respectively held 43.35% and 41.65% of the equity. China Railway Construction Corporation held 10% and 5% of the shares respectively through China Railway Construction Corporation International (Hong Kong) and Zhongtu (Hong Kong).

Company's equity structure, source prospectus

HKD 1.7 billion of loan, expected to commence commercial production in 2025.

According to the prospectus, Jiaxin International mainly focuses on preparing for commercial production of the Bakuta tungsten mine project. The mine was acquired in 2015 and was originally scheduled to be mined no later than 2022, but has been delayed by the COVID-19 epidemic.

By July 2024, the construction of mine infrastructure and processing plant has been largely completed, and commercial production is expected to commence in the first quarter of 2025. The target mining capacity for 2025 is 3.3 million tons of tungsten ore.

Currently, Jiaxin International only has the Bakuta tungsten mine, and its recent revenue depends on the mine. As the Bakuta tungsten mine project is still in the exploration and development stage, the company did not confirm any revenue during the reporting period.

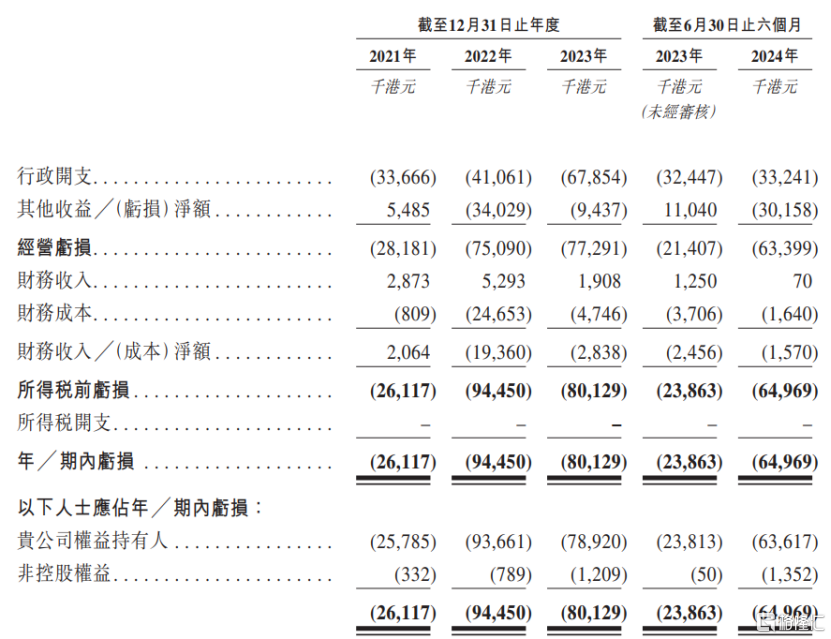

In addition, the company incurred significant administrative expenses during the reporting period, mainly including employee welfare expenses related to the development of the Bakuta tungsten mine project. In 2022, the company also recorded a significant forex loss, mainly due to the depreciation of the RMB against the HKD, as well as interest expenses from bank borrowings and payable shareholder expenses. Therefore, the company recorded a net loss in the reporting period.

The net losses for the reporting periods of 2021, 2022, 2023 and January-June 2024 were HKD 26.117 million, HKD 94.45 million, HKD 80.129 million and HKD 64.969 million respectively, and the net cash outflow from operating activities for the same periods were HKD 31.223 million, HKD 47.507 million, HKD 62.718 million and HKD 27.788 million respectively.

Since 2020, Jiaxin International has mainly relied on bank loans to support the construction and development of the Bakuta tungsten mine project, and has incurred interest expenses. In September 2020, the company entered into a financing agreement with a commercial bank, to obtain a maximum of EUR 0.188 billion in unsecured bank loan financing, equivalent to a loan of HKD 1.7 billion from the bank (as of September 30, 2020 exchange rate); interest expenses of approximately HKD 1.1 million, HKD 29.2 million, HKD 40.2 million and HKD 37.9 million were incurred during the reporting period respectively.

Jiaxin International Financial Overview, source: Prospectus

The fourth largest tungsten mine reserve in the world.

According to data from Frost & Sullivan, the Bakuta tungsten mine is the largest open-pit WO3 tungsten mine globally, and the fourth largest WO3 mineral resource of tungsten mines. It has the largest designed tungsten mining capacity in a single tungsten mine.

Bakuta tungsten mine is located in Yenbekshikazakh District, Almaty Region, and can be reached from Almaty, Kazakhstan and the Khorgos Port connecting Kazakhstan and China via a national highway. Additionally, the railway connecting Khorgos and Almaty is located about 20 kilometers north of the Bakuta tungsten mine, and the product is expected to be transported smoothly after starting commercial production.

Bakuta tungsten mine geographic location, from prospectus

According to the prospectus, as of June 30, 2024, the estimated mineral resource of the Bakuta tungsten mine is approximately 0.1104 billion tons of ore containing 0.211% WO3 (equivalent to 0.2332 million tons of WO3), including 98.5 million tons of controlled resources (0.209% WO3) and 11.9 million tons of inferred resources (0.228% WO3). As of the same day, based on the JORC guidelines, the Bakuta tungsten mine had credible ore reserves of 70.8 million tons, with an average grade of 0.205% WO3, equivalent to 0.1454 million tons of WO3.

However, the current tungsten resource and reserve data are estimates, which may not be accurate, and the predicted future production, revenue and capital expenditures based on the above estimates may differ significantly from actual figures.

According to the land use contract signed with the relevant supervisory authority in Kazakhstan, Jiaxin International holds the exclusive mining rights (the right to explore and mine tungsten ore) for the Bakuta tungsten mine.

The mining contract specifies a mining area of 1.16 square kilometers, allows maximum depth of mining underground of 300 meters, and has a term of 25 years from June 2, 2015 to June 2, 2040.

Global tungsten resources are unevenly distributed, with most tungsten reserves located in regions such as China, Russia, and Kazakhstan. Most of the super-large deposits are located in important metallogenic belts. In 2023, the world's top five tungsten mines are China's Dahutang tungsten mine, Shizhuyuan tungsten mine, the Hemerdon tungsten mine in the United Kingdom, the Bakuta tungsten mine in Kazakhstan, and the Sisson tungsten mine in Canada.

Ranking of major global mining factories, source from prospectus.

Tungsten reserves are relatively stable. The global tungsten reserves increased from 3.3 million tons in 2018 to 4.4 million tons in 2023, with a compound annual growth rate of 5.9%. With steady exploration of various tungsten mines by countries around the world, it is expected that the global tungsten reserves will reach 5.4 million tons in 2028, with a compound annual growth rate of 4.2% from 2022 to 2027.

In 2023, China has the largest tungsten reserves, accounting for over 50% of the global tungsten reserves. China's reserves fluctuated from 2018 to 2023 and stood at 2.3 million tons in 2023. It is expected that Chinese tungsten reserves will experience a slight increase, reaching 2.8 million tons in 2028, with a compound annual growth rate of 4.0% from 2023 to 2028.

Global and Chinese tungsten reserves, source from prospectus.

According to the prospectus, the most critical risk among the company's potential risks is the risk that the land use contract may be unilaterally terminated by relevant regulatory authorities.

The land use contract stipulates that if there are at least two violations of the land use contract or relevant project documents, and ZV, a subsidiary of Jiaxin International, fails to correct it within the specified period, the regulatory authorities in Kazakhstan can unilaterally terminate the land use contract.

If Jiaxin International is terminated by relevant regulatory authorities in the future due to violations of the land use contract, the company will lose its mining rights to the Bakuta tungsten mine, and the company's operations, financial status, and business performance will be significantly affected.

In addition, the mining industry itself is high-risk. If accidents occur in the future, the company's operations may be interrupted, and the Bakuta tungsten mine project may not be fully put into commercial production.

此次发行前,公司由恒兆(一家由刘子嘉先生全资拥有的公司)及江西铜业香港(一家由江西铜业全资拥有的公司)分别拥有43.35%及41.65%的权益,中国铁建通过中铁建国投(香港)、中土香港分别持股10%和5%。

此次发行前,公司由恒兆(一家由刘子嘉先生全资拥有的公司)及江西铜业香港(一家由江西铜业全资拥有的公司)分别拥有43.35%及41.65%的权益,中国铁建通过中铁建国投(香港)、中土香港分别持股10%和5%。