The $CEB (5311.MY)$ announced its financial results for the second quarter with a revenue of RM166.6 million up 36.8% as compared to RM121.8 million in the corresponding period of the preceding year. The group atrribued the growth from stronger contributions from both industrial and consumer electronic products under the EMS segment, particularly in wireless communication equipment, electronic cigarettes, light electrical vehicles, and the newly acquired subsidiary, iConn Inc. Currently,

It added the dealing in predominantly in USD adversely affected by the strengthening of the MYR, as a result, profit after tax moderated by 39.6% year-on-year, declining from RM15.2 million in 2Q FY2023 to RM9.2 million in 2Q FY2024.

For the cumulative first six months of the year ("1H FY2024"), the Group registered revenue of RM321.0 million, a significant uptick of 23.9% as compared to 1H FY2023. The Group's PAT of RM22.6 million in 1H FY2024 was only marginally lower than the RM23.7 million achieved a year ago, despite the challenges mentioned above. As at 30 June 2024, the balance sheet remained fundamentally strong with cash and cash equivalents of RM162.2 million, a low net gearing ratio of 0.03 times and net assets per share of 48 sen.

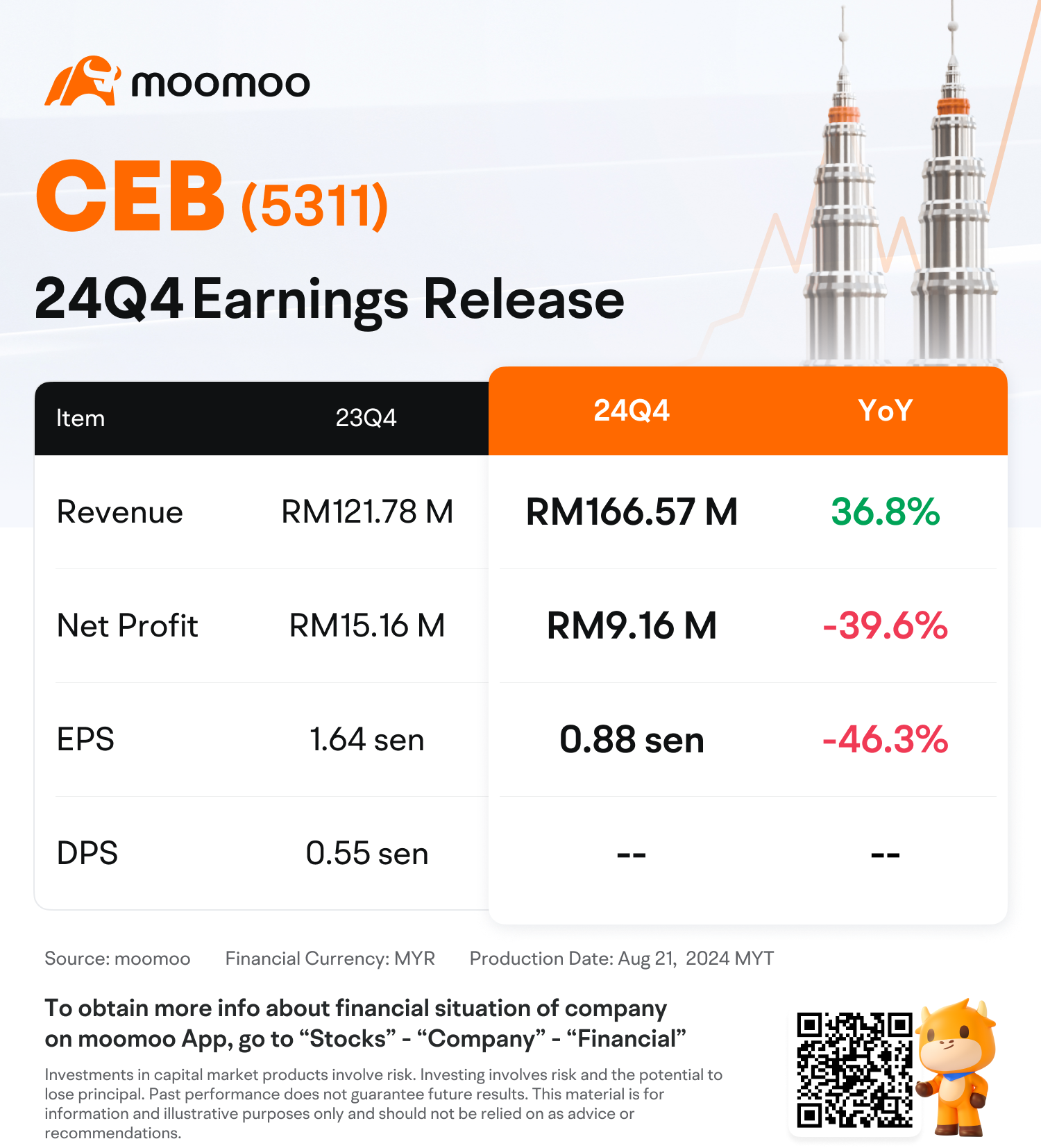

Revenue reached RM166.57 million, up 36.8% (YoY);

Revenue reached RM166.57 million, up 36.8% (YoY);Net income was RM9.16 million, down 39.6% (YoY);

EPS was 0.88 sen, down 46.3% (YoY)

Source: Announcement