但仍未逃出五指山

千呼万唤中,中国首款3A游戏大作《黑神话:悟空》于20日终于上线,此前一个月预售额就接近4亿元,直接回本。游戏上线当天,Steam平台在线超过百万,一度把服务器干崩了。

猴子的威力股市里也掀起一阵旋风,不少股票不管卖不卖“筋斗云”,但凡能扯得上一点儿关系,直接先爆炒了一波。

其中,就包括间接持股了背后制作方1%股权的华谊兄弟,其股价在近20天里涨幅一度超过80%。没看懂的,还以为是大股东。

其中,就包括间接持股了背后制作方1%股权的华谊兄弟,其股价在近20天里涨幅一度超过80%。没看懂的,还以为是大股东。

近几年华谊缺钱周转,反复变卖资产输血,主业受行业影响一直不温不火,选择定增亦是无奈碰运气。没想到,前几年搞副业一通折腾无果,如今却靠着猴子狠狠火了一把。

01

四年前,一则时长为13分钟的《黑神话:悟空》实机演示视频在网上迅速走红,也让游戏科学这家公司崭露头角。

这款游戏在制作水准上承载了玩家对国产高质量3A游戏的期待,同时以耳熟能详的中国神话故事为背景的游戏表达也收获了众多国际玩家的关注。

来源:游戏科学

就在游戏上线前夕,据Valve公布的Steam平台最新一周销量榜(2024年8月6日—13日),《黑神话:悟空》位列Steam全球周销量冠军,在美国、新加坡、泰国、加拿大、巴西、意大利等12个地区霸榜。

高盛表示,基准情景下,《黑神话:悟空》在Steam上售出超1200万份,收入超过30亿元人民币,而乐观情况下则可能售出2000万份,收入超过50亿元人民币,这还不包括WeGame和PlayStation平台销售。

从市场反应来看,《黑神话:悟空》已经成为了一个备受瞩目的现象级游戏。尽管《黑神话:悟空》的直接经济收益主要集中在开发者手中,但其对相关概念股的积极影响已经在股市中显现。

该游戏的出版方浙版传媒,只是负责前期游戏内容审核,出版申报等工作,跟游戏盈利根本没有太多关系,也从预售热潮中捞着了,近两周公司股价已涨近20%。另外一家手柄联名合作单位—致尚科技,则实实在在地吃到了一波红利,其推出地《黑神话:悟空》联名手柄在京东销量已经突破2万,目前因为缺货已经开启了第二波预售,公司股价在6个交易日内涨超20%。

华谊呢,和游戏科学这家公司虽然没有直接渊源,今年6月公司董秘在回答投资者提问时表示,公司持有英雄游戏74,183,641股无限售股份,约占英雄游戏总股本的5.17%。

而据天眼查显示,英雄游戏为《黑神话:悟空》开发商游戏科学第二大参股公司,持有19%的股份,由此推算,华谊兄弟间接持有《黑神话:悟空》开发公司游戏科学约1%的股份。

即使只有1%,也算是蹭到了国产游戏巅峰的热度,股价遭到热捧并不意外。

然而2015到2021年,华谊对英雄互娱(现名“英雄游戏”)的持股比例高达20%,是公司第二大股东,也就是说,间接持股本可以接近4%,而黑神话的宣传从2020年已经开始。

华谊本来可以再等等这张彩票刮出大奖,为什么要提前选择大幅减持?

这中间有着一段复杂的来往。

2017年5月,游戏科学获得了英雄互娱6000万元投资,此时估值接近3亿元。

英雄互娱主要开发手机游戏, 2015年6月和塞尔瑟斯重组成功登陆新三板,身披“新三板移动电竞第一股”的光环,但仅待了7年就退市了。

盈利能力的下滑是最主要的原因。2018年后英雄互娱断崖式下滑,2021年英雄互娱营业收入16个亿,但扣非净利润亏损却高达15.3亿元,主要原因是12.2亿元的商誉减值。

华谊成了其中的冤大头,2015年华谊用了19个亿认购了20%英雄互娱的股份,按照对赌协议,16年至18年这家公司的净利润飙升至5.32亿,9.15亿,7.28亿元,刚好都完成了业绩承诺,然而承诺期一过立马现原形。2019年,华谊一口气对英雄互娱的投资减值了12.51亿元。

从英雄互娱创造利润的方式来看,这笔投资必然是有水分的。

华谊并非投资游戏的行家,游戏行业前几年因版号收缩,很难产出爆款游戏,而英雄互娱先后借壳上市未果,也得不到资金支持,只能不断揶揄补利润。而华谊的主业,影视行业更不用说,疫情那几年的票房和公司业绩足矣说明状况。

两家公司都在行业寒冬中挨饿,但却无法抱薪取暖。这也能说明为什么华谊不再多等等黑神话,行业收缩加上主业也做不好,那时英雄互娱已经是块累赘,扔都来不及,还会等这款游戏爆火吗?

最后,华谊还是放弃了英雄互娱,选择了回归主业。2021年9月,华谊兄弟宣布拟将英雄互娱约15%的股权、2.15亿股转让给第三方,获得了对应总价款为8.7亿元,交易完成后持股降至约5.17%。

而英雄互娱的这笔投资真的开出了大奖,中间还曾经靠游戏科学股权续过命。

根据英雄互娱2022年报,公司曾经以4.8亿元对价转让游戏科学股权,且已经收到第一笔2.8亿元转让款完成交割,剩下2亿元迄今还未确定支付时间,但是不早于2025年4月。也就是说还没有完成股权变更,可是在23年年报里长期股权投资一项中显示,英雄互娱已经清仓了游戏科学。

转让款还没结清,不过2022下半年,英雄互娱以天津子公司之名向招商银行申请了5亿元、为期3年的综合授信,质押标的物就是游戏科学的股权,最后拿到了2亿元。

当时两家游戏公司都没什么利润,英雄互娱更是接连两年计提巨额商誉,游戏资产也并非理想的抵押标的,这种条件招行还是肯给他贷款,这款3A游戏大作距离问世还剩下两年,或许,这就是重要的估信依据。

1%的股权,能涨接近80%,或许在股市不算什么稀奇事儿,而上述几家公司从游戏行业风生水起的年代,经历困顿交错,再到曙光初现,各有各的故事。

02

比起华谊和黑神话的渊源,股民对主营影视制作的华谊可能更为熟悉。

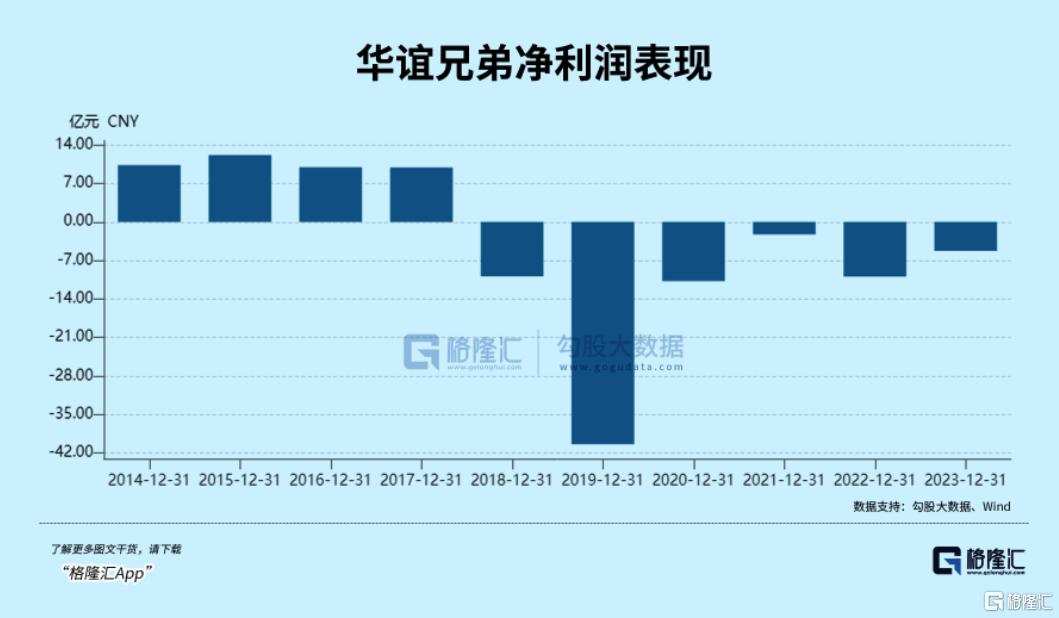

2014年王忠军提出“去电影化”战略,将精力放到了多元化投资上,但是收购产生的高溢价反过来压垮了华谊。主营业务也力不从心,错失了从好多大片分得大肉的机会,2018年后收入规模直线下滑,因为商誉减值利润常年负数,资金更是吃紧,一直忙着把资产卖了变现。

比如7月份,华谊就曾以3.5亿元向债主阿里影业出手了知名导演冯小刚创立的东阳美拉,而在2015年华谊是用10.5亿元把这家公司收购进来的。

华谊股价从2015年的高点迄今,跌掉了87%的市值。

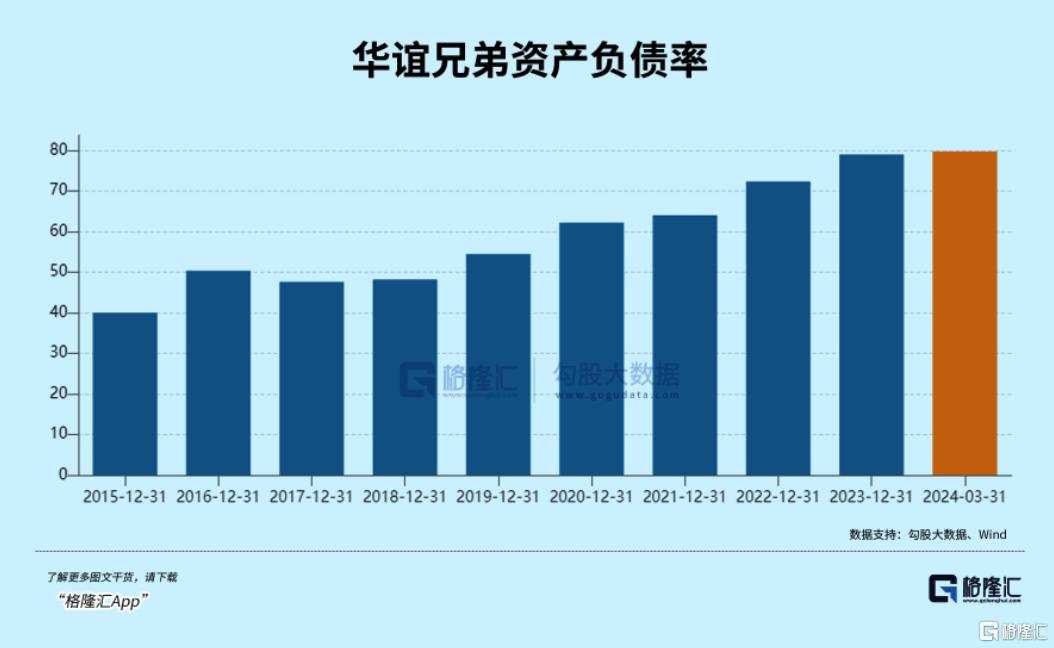

公司资产负债率之高,意味着每年都要付出一大笔利息偿还债权人。然而,影视行业的先期制作必须要资金投入,想要回归主业的华谊,没有别的办法,只能选择定增。

8月10日,华谊兄弟公布了新的定增预案,拟向不超过35名特定对象发行股票不超过7.77亿股,拟募资总金额不超过10.29亿元,其中约7.2亿元拟用于影视剧项目,另外3.09亿元用于补充流动资金。

过去四年,华谊的定增之路很坎坷,定增改了七遍但一直没获批。而现在融资环境吃紧,华谊直接将募资量砍掉一半。自上市以来,华谊兄弟累计从市场上直接融资达148.48亿元,然而近6年连续亏损合计79.62亿元,已经把上市净赚所得亏光了。

股价毕竟跌到这份上了,如果不是黑神话的爆火,还以为市场对华谊困境反转抱有多大的信心,毕竟今年的影视行业,还没去年混得好。

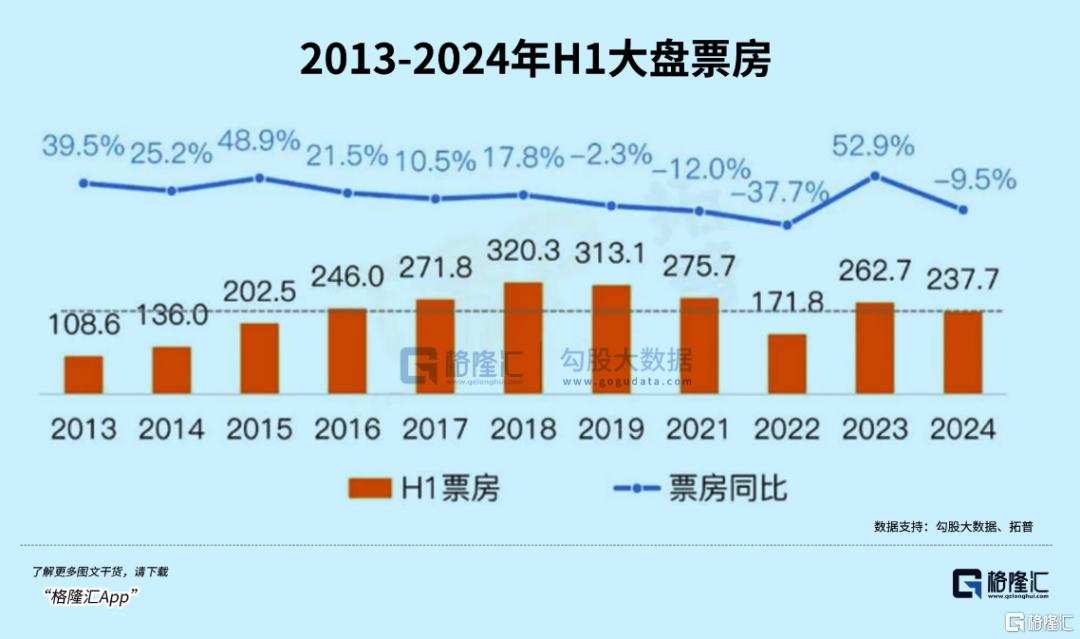

近五年,电影市场一直在恢复。2024上半年的影院总票房达到237.73亿元,与2019年相比,恢复程度达到76%。但没能延续疫情放开后的热情,同比去年下降9.5%,观影人次下降9.27%。

影片供给端,上半年上映新片较去年也减少了6部。头部影片对票房的拉动力渐渐式微,没有太多高票房影片,而且高票房影片的高度也不足。

一季度,华谊亏损继续扩大,营收9521.5万元,同比减少59.20%;归母净利润亏损为1856万元,同比扩大76.76%。为此华谊表示,主要因为影视剧项目收入减少所致,华谊虽然将投资范围扩大到了电视剧以及短剧赛道,但对头部内容的掌控能力却始终引人质疑。

为了给市场和股东展示出诚意,华谊还在预案中披露了未来回报股东计划,在符合利润分配原则、满足现金分红条件的前提下,公司每年度以现金方式分配的利润应不低于当年实现的可分配利润的10%,且公司最近三年以现金方式累计分配的利润不少于该三年实现的年均可分配利润的30%。

只不过,随便一两句“聚焦主业”很难证明华谊有能力逆市重新崛起,如今再抛10亿定增,还有人愿意为此掏钱买单吗?