High-rolling investors have positioned themselves bullish on D.R. Horton (NYSE:DHI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DHI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 17 options trades for D.R. Horton. This is not a typical pattern.

The sentiment among these major traders is split, with 52% bullish and 35% bearish. Among all the options we identified, there was one put, amounting to $47,600, and 16 calls, totaling $1,056,708.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for D.R. Horton, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $135.0 and $190.0 for D.R. Horton, spanning the last three months.

Volume & Open Interest Development

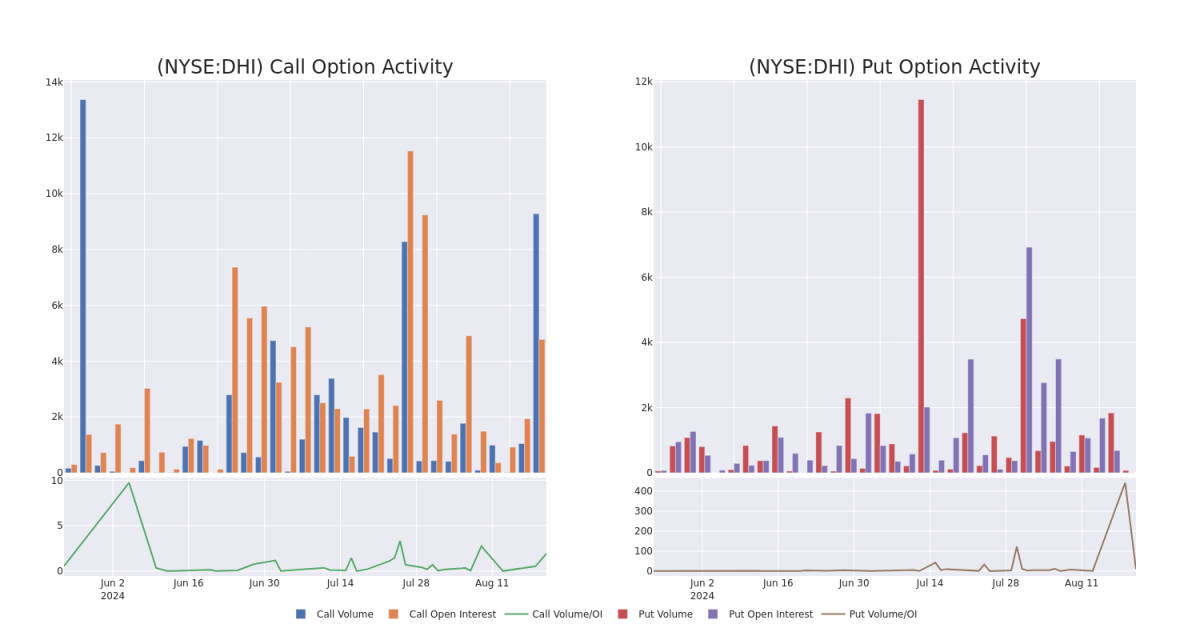

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for D.R. Horton's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of D.R. Horton's whale activity within a strike price range from $135.0 to $190.0 in the last 30 days.

D.R. Horton Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHI | CALL | SWEEP | BULLISH | 08/23/24 | $6.6 | $6.5 | $6.6 | $180.00 | $310.2K | 780 | 542 |

| DHI | CALL | SWEEP | BULLISH | 08/30/24 | $4.0 | $3.7 | $3.9 | $185.00 | $116.5K | 282 | 1.7K |

| DHI | CALL | SWEEP | BULLISH | 08/30/24 | $3.7 | $3.4 | $3.51 | $185.00 | $109.2K | 282 | 1.2K |

| DHI | CALL | SWEEP | BEARISH | 08/30/24 | $3.4 | $3.2 | $3.4 | $185.00 | $76.7K | 282 | 424 |

| DHI | CALL | SWEEP | BULLISH | 09/20/24 | $4.0 | $3.7 | $4.0 | $190.00 | $60.0K | 1.5K | 156 |

About D.R. Horton

D.R. Horton is a leading homebuilder in the United States with operations in 118 markets across 33 states. D.R. Horton mainly builds single-family detached homes (over 90% of home sales revenue) and offers products to entry-level, move-up, luxury buyers, and active adults. The company offers homebuyers mortgage financing and title agency services through its financial services segment. D.R. Horton's headquarters are in Arlington, Texas, and it manages six regional segments across the United States.

After a thorough review of the options trading surrounding D.R. Horton, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of D.R. Horton

- With a trading volume of 1,187,179, the price of DHI is up by 3.38%, reaching $185.68.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 76 days from now.

Expert Opinions on D.R. Horton

2 market experts have recently issued ratings for this stock, with a consensus target price of $194.0.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Outperform rating for D.R. Horton, targeting a price of $208.

- An analyst from JP Morgan persists with their Neutral rating on D.R. Horton, maintaining a target price of $180.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.