Whales with a lot of money to spend have taken a noticeably bearish stance on Constellation Energy.

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 75% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $304,050 and 9, calls, for a total amount of $719,478.

From the overall spotted trades, 3 are puts, for a total amount of $304,050 and 9, calls, for a total amount of $719,478.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $175.0 and $240.0 for Constellation Energy, spanning the last three months.

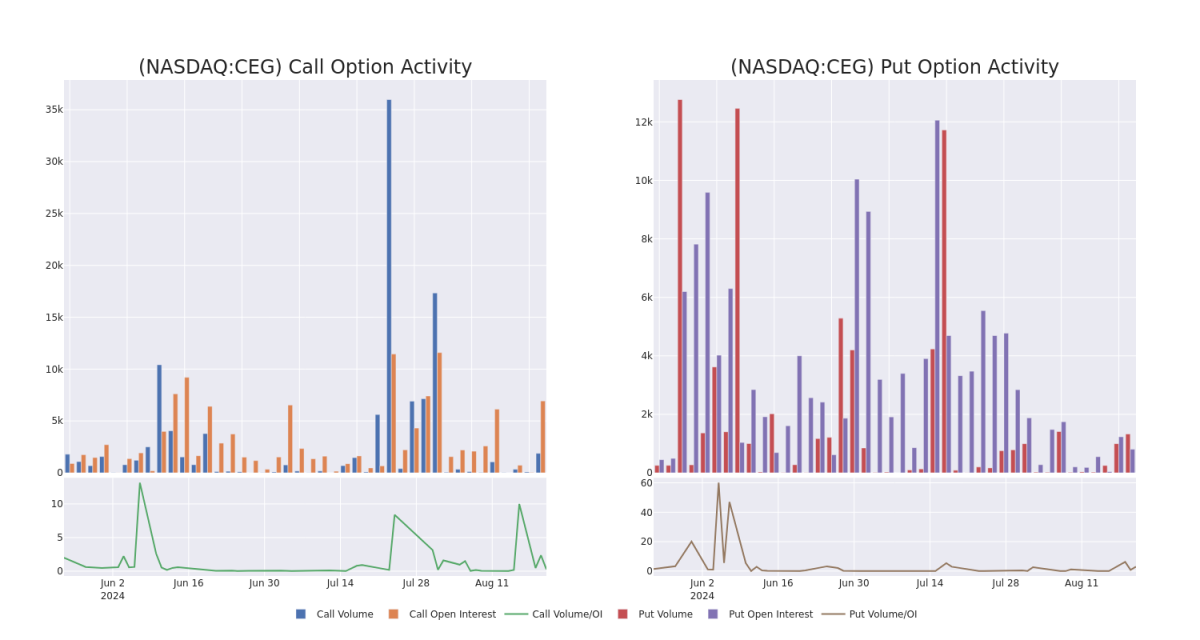

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Constellation Energy's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Constellation Energy's whale activity within a strike price range from $175.0 to $240.0 in the last 30 days.

Constellation Energy Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 01/16/26 | $28.7 | $27.7 | $27.8 | $240.00 | $278.0K | 38 | 100 |

| CEG | PUT | SWEEP | BULLISH | 11/15/24 | $12.7 | $12.5 | $12.5 | $190.00 | $187.5K | 338 | 152 |

| CEG | CALL | TRADE | BEARISH | 11/15/24 | $12.2 | $11.7 | $11.8 | $210.00 | $142.7K | 3.0K | 238 |

| CEG | CALL | SWEEP | BEARISH | 11/15/24 | $12.4 | $11.9 | $11.9 | $210.00 | $103.5K | 3.0K | 117 |

| CEG | PUT | SWEEP | BEARISH | 09/20/24 | $1.75 | $1.6 | $1.75 | $175.00 | $76.8K | 468 | 474 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Current Position of Constellation Energy

- With a volume of 864,106, the price of CEG is up 2.88% at $196.21.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 75 days.

What Analysts Are Saying About Constellation Energy

4 market experts have recently issued ratings for this stock, with a consensus target price of $210.5.

- An analyst from Barclays has revised its rating downward to Overweight, adjusting the price target to $211.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $212.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Constellation Energy, targeting a price of $189.

- Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Constellation Energy, targeting a price of $230.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.