Bristol-Myers Squibb's Options Frenzy: What You Need to Know

Bristol-Myers Squibb's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Bristol-Myers Squibb (NYSE:BMY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BMY usually suggests something big is about to happen.

對於Bristol-Myers Squibb (NYSE:BMY),深口袋的投資者採取了看好的態度,這是市場參與者不應忽視的事情。本站對Benzinga的公開期權記錄進行了跟蹤,今天揭示了這一重要的舉動。這些投資者的身份尚不明確,但BMY的如此大規模的交易通常意味着有大事發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Bristol-Myers Squibb. This level of activity is out of the ordinary.

我們通過今天的觀察獲得了這些信息,當Benzinga的期權掃描儀突出了9個施貴寶的非凡期權活動時。這種活動水平是不尋常的。

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 22% bearish. Among these notable options, 4 are puts, totaling $138,637, and 5 are calls, amounting to $207,540.

這些大戶投資者的總體情緒分裂,有44%看好,22%看淡。在這些顯著的期權中,有4個看跌,總額達到$138,637,有5個看漲,總額達到$207,540。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $41.0 and $55.0 for Bristol-Myers Squibb, spanning the last three months.

在評估交易量和未平倉合約後,很明顯主要的市場推動者正專注於施貴寶的價格區間,在過去三個月內介於$41.0和$55.0之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

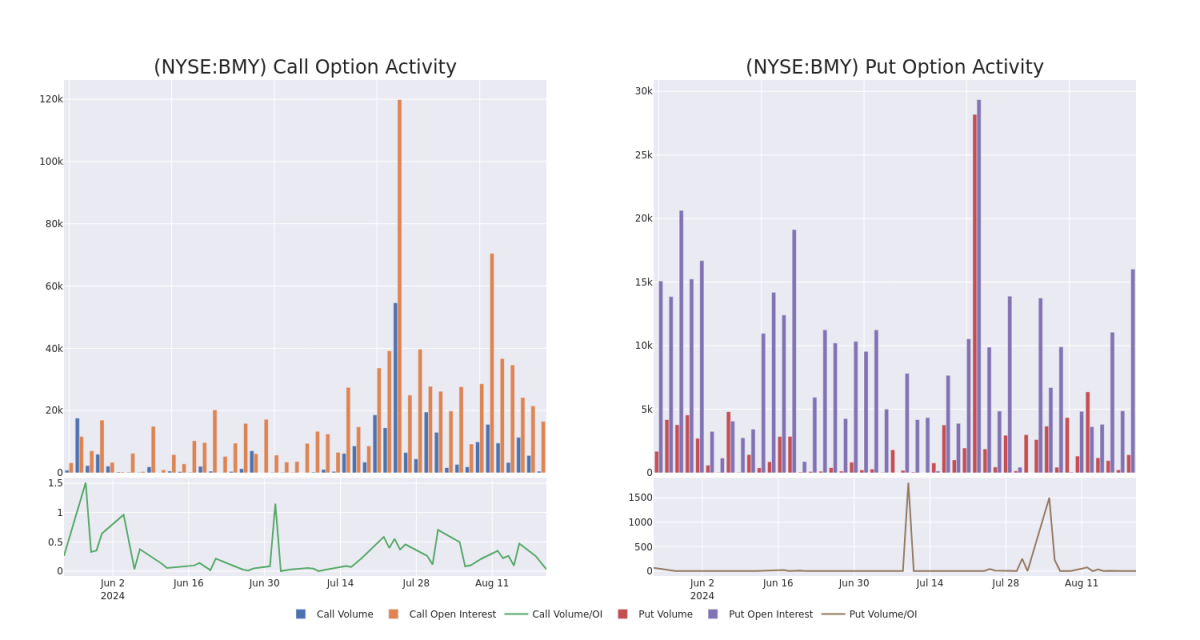

In today's trading context, the average open interest for options of Bristol-Myers Squibb stands at 3613.11, with a total volume reaching 1,952.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Bristol-Myers Squibb, situated within the strike price corridor from $41.0 to $55.0, throughout the last 30 days.

在今天的交易背景下,施貴寶的期權平均未平倉合約爲3613.11,總成交量達到1,952.00。 附帶的圖表描繪了過去30天內施貴寶高價交易的看漲和看跌期權成交量和未平倉合約的進展,這些交易位於$41.0到$55.0的行權價格走廊內。

Bristol-Myers Squibb 30-Day Option Volume & Interest Snapshot

施貴寶30天期權成交量和未平倉合約快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | CALL | SWEEP | BULLISH | 01/17/25 | $5.6 | $5.5 | $5.6 | $45.00 | $56.5K | 7.7K | 104 |

| BMY | CALL | TRADE | BULLISH | 01/16/26 | $9.25 | $9.2 | $9.25 | $43.00 | $46.2K | 6.8K | 60 |

| BMY | CALL | SWEEP | BULLISH | 03/21/25 | $9.25 | $9.1 | $9.2 | $41.00 | $45.9K | 1 | 51 |

| BMY | PUT | TRADE | NEUTRAL | 01/16/26 | $7.75 | $7.65 | $7.7 | $52.50 | $38.5K | 689 | 50 |

| BMY | PUT | SWEEP | BEARISH | 01/17/25 | $1.75 | $1.69 | $1.72 | $45.00 | $38.0K | 7.7K | 265 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | 看漲 | SWEEP | 看好 | 01/17/25 | $5.6 | $5.5 | $5.6 | $45.00 | $56.5千 | 7.7K | 104 |

| BMY | 看漲 | 交易 | 看好 | 01/16/26 | 9.25美元 | $9.2 | 9.25美元 | 據TipRanks.com稱,Carcache是一名5星級分析師,平均回報率爲19.0%,成功率爲68.5%,涵蓋了金融板塊,重點關注Bread Financial Holdings、第一資本信貸和Ryan Specialty Group等股票。 | $46.2千 | 6.8K | 60 |

| BMY | 看漲 | SWEEP | 看好 | 03/21/25 | 9.25美元 | $9.1 | $9.2 | 41.00美元 | $45.9K | 1 | 51 |

| BMY | 看跌 | 交易 | 中立 | 01/16/26 | $7.75 | $7.65 | $7.7 | $52.50 | $38.5K | 689 | 50 |

| BMY | 看跌 | SWEEP | 看淡 | 01/17/25 | $1.75 | $1.69 | 1.72美元 | $45.00 | $38.0K | 7.7K | 265 |

About Bristol-Myers Squibb

關於施貴寶

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Bristol derives close to 70% of total sales from the U.S., showing a higher dependence on the U.S. market than most of its peer group.

施貴寶發現、開發和營銷用於心血管疾病、癌症和免疫障礙等多種治療領域的藥品。施貴寶的重點關注點是免疫腫瘤學,該公司是藥品研發領域的領導者。施貴寶近70%的總銷售額來自美國,顯示了該公司對美國市場的更高依賴性,高於其大多數同行。

After a thorough review of the options trading surrounding Bristol-Myers Squibb, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對Bristol-Myers Squibb周圍的期權交易進行全面審查後,我們進一步細緻地研究了該公司。這將包括對其目前的市場地位和表現的評估。

Current Position of Bristol-Myers Squibb

施貴寶的當前倉位

- With a trading volume of 4,688,294, the price of BMY is down by -1.48%, reaching $48.26.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 64 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一份盈利報告將在64天后發佈。

What The Experts Say On Bristol-Myers Squibb

專家對施貴寶的看法

3 market experts have recently issued ratings for this stock, with a consensus target price of $46.333333333333336.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Hold rating on Bristol-Myers Squibb with a target price of $53.

- An analyst from Deutsche Bank persists with their Hold rating on Bristol-Myers Squibb, maintaining a target price of $45.

- An analyst from Barclays downgraded its action to Underweight with a price target of $41.

- 德意志銀行的分析師堅持對Bristol-Myers Squibb的持有評級,維持目標價爲45.0美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bristol-Myers Squibb options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷學習、調整策略、監控多個因子以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時警報,及時了解最新的施貴寶期權交易。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $41.0 and $55.0 for Bristol-Myers Squibb, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $41.0 and $55.0 for Bristol-Myers Squibb, spanning the last three months.