① On Wednesday, the yield on US Treasury bonds fell further to a two-week low, and at the same time, the interest rate swap market's expected bet on the Fed's interest rate cut during the year reached more than 100 basis points; ② This series of market and expected changes were due only to two things: the US non-farm payrolls data experienced the biggest annual decline in 15 years, and the Federal Reserve minutes gave a clear dovish signal.

Financial Services Association, August 22 (Editor: Xiaoxiang) Perhaps there is no need to wait for Powell to speak on stage this Friday. Overnight, market traders already had a clear understanding of the “situation” at the Federal Reserve's September interest rate meeting.

On Wednesday, US Treasury yields from two-year to 30-year terms fell further to a two-week low. At the same time, the interest rate swap market's expectations on how much the Fed would cut interest rates during the year reached more than 100 basis points. This series of market conditions and changes in expectations is due only to two things: the US non-farm payrolls data has experienced the biggest annual decline in 15 years, and the Federal Reserve minutes have sent a clear dovish signal.

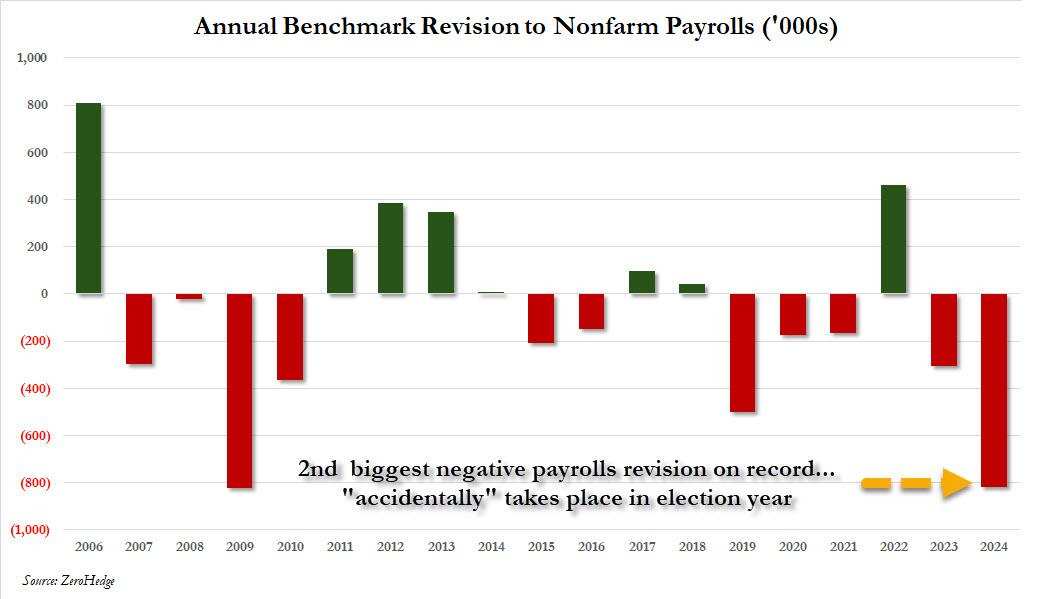

The US Bureau of Labor Statistics announced on Wednesday that in the 12 months ending March 2024, the non-farm payrolls data will initially be revised down by 0.818 million people. According to previously released non-agricultural data, a total of 2.9 million new jobs were added during the reporting period involving adjustments, with an average of 0.242 million people per month. After deducting 0.818 million people, the average monthly growth rate will drop to 0.174 million people.

The US Bureau of Labor Statistics announced on Wednesday that in the 12 months ending March 2024, the non-farm payrolls data will initially be revised down by 0.818 million people. According to previously released non-agricultural data, a total of 2.9 million new jobs were added during the reporting period involving adjustments, with an average of 0.242 million people per month. After deducting 0.818 million people, the average monthly growth rate will drop to 0.174 million people.

According to the latest revised data mentioned above, the US labor market actually began to slow much earlier than people initially anticipated. In fact, it wasn't until the beginning of this month that many marketers and economists began to feel concerned about July's poor non-farm payrolls report.

The non-agricultural benchmark is revised every year, but this year, market and Federal Reserve observers are paying special attention to the performance of this revised data to look for any signs that the labor market may be cooling faster than initially reported. And if the above figures do not change too much in the final revised version in February next year, then this will surely be the biggest drop since the 0.902 million jobs were reduced in March 2009.

Some economists say that the first published non-farm payrolls data may have been exaggerated due to many factors, including adjustments to the establishment and closure of enterprises and how unauthorized immigrant workers are included.

Joe Kalish, chief global macro strategist at Ned Davis Research, said, “It seems that the impact of monetary policy tightening is greater than the Federal Reserve initially thought — the tight monetary policy has indeed slowed the economy and indeed slowed the rate of job creation. This should enable the Federal Reserve to take action. Even if the economy does not fall into recession, they should start cutting interest rates in September.”

Predictably, Wednesday's data will help Federal Reserve Chairman Powell make a more reasonable and updated assessment of the labor market situation before his speech at the Jackson Hole annual seminar on Friday. Given that US inflation has now declined from its peak during the pandemic, the Federal Reserve's decision makers have recently begun to turn their attention to the employment side of its dual mission.

In addition to the latest revised non-agricultural data, the US Federal Reserve minutes released in the early hours of Thursday morning Beijing time also gave sufficient dovish signals. The minutes show that at the July interest rate meeting, some Federal Reserve officials actually supported cutting interest rates at that meeting.

According to the minutes, “Some participants believed that the rise in unemployment and recent progress in reducing inflation provided a reasonable reason to cut interest rates by 25 basis points at this meeting, or that they might have voted in favor of interest rate cuts. The vast majority said that if economic data continues to meet expectations, then it may be appropriate to relax monetary policy at the next meeting.”

The minutes also stated, “Most participants indicated that employment targets face increased risks, while many participants said that inflation targets are less at risk. Some participants mentioned that further gradual weakening of the labor market could turn into a more serious deterioration.”

This discussion showed that the Commission had begun to shift to risk management tools in the labour market. In fact, before the Federal Reserve's interest rate meeting was held last month, well-known experts including Goldman Sachs chief economist Jan Hatzius, former Federal Reserve Vice Chairman Alan Binder, and former New York Federal Reserve Chairman William Dudley all said that the Federal Reserve had reasons to cut interest rates in July.

Federal Reserve Chairman Powell said at a press conference after the July 31 meeting that the committee hopes to wait until there is more confidence that inflation will move towards the 2% target before lowering interest rates.

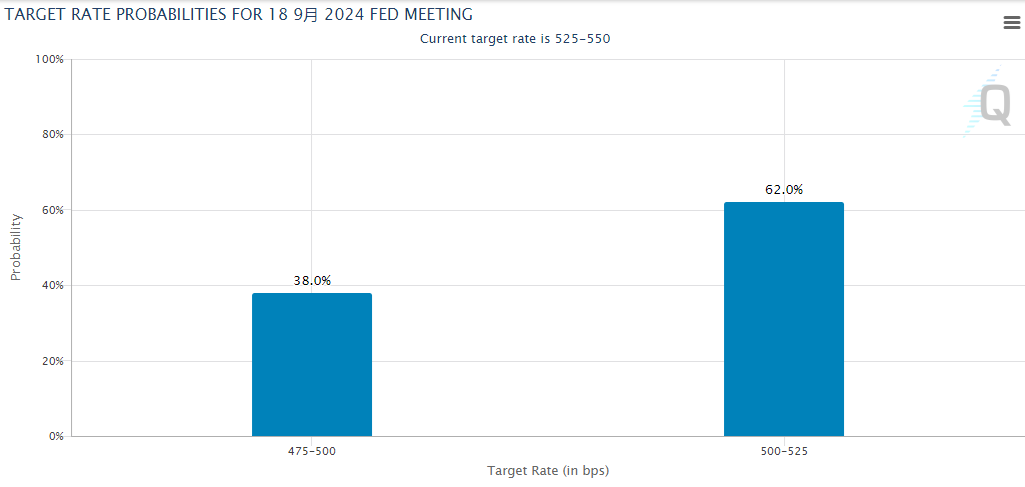

Judging from the latest betting changes in the interest rate market, the interest rate swap market overnight priced the Fed's interest rate cut during the year to 106 basis points. At the same time, it is expected that the Federal Reserve will cut interest rates by a total of 214 basis points before the end of next year.

The interest rate futures market continues to fully absorb the possibility of interest rate cuts in September. According to CME's US Federal Reserve's observation tool, traders' bets on cutting interest rates by 50 basis points rose to 38% from 29% on Tuesday, while the probability of cutting interest rates by 25 basis points fell to 29% from 71% on Tuesday.

“My general feeling is that the Federal Reserve may want to cut interest rates by 50 basis points instead of 25 basis points in September, because this will be the first time it will cut interest rates, and it may want to continue the process of cutting interest rates and then cut interest rates by another 25 basis points in November and December, respectively,” said Tom di Galoma, managing director and head of the fixed income department at Curvature Securities.

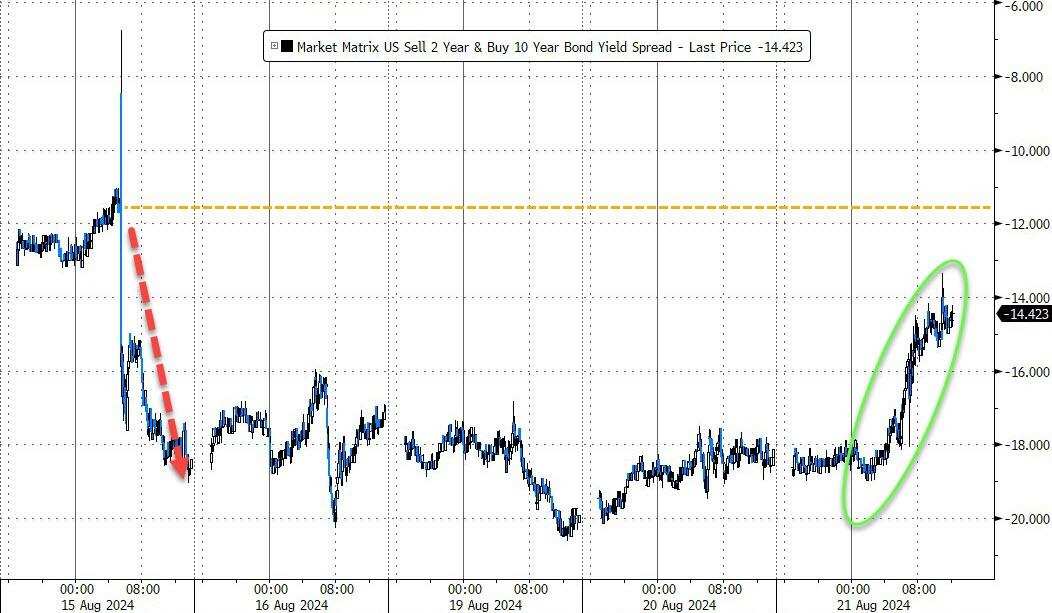

In terms of US bond yields for various maturities, as of the end of the New York session, the 10-year US Treasury yield fell 0.2 basis points to 3.808%, falling to a two-week low of 3.761% during the intraday period. US 20-year and 30-year Treasury yields also fell to their lowest level in two weeks. At the front end of the interest rate curve, the two-year yield, which better reflects changes in interest rate expectations, fell 4.7 basis points to 3.945%.

The US Treasury yield curve continues to be steep — the degree of inversion has decreased. The two-year and 10-year yield spread was negative 14 basis points, lower than negative 18.1 basis points at the end of Tuesday.

Before the Fed's easing cycle, the yield curve usually steepens, that is, short-term interest rates fall more than long-term interest rates. Because people think that interest rates at the front end of the curve have peaked, the next step for the Federal Reserve will be to cut interest rates.

美国劳工统计局周三宣布,在截至2024年3月的12个月内,非农就业数据初步下修81.8万人。此前公布的非农数据显示,涉及调整的报告期内总共新增290万个就业岗位,平均下来每个月24.2万人。扣掉81.8万人后,月平均增速将下降至17.4万人。

美国劳工统计局周三宣布,在截至2024年3月的12个月内,非农就业数据初步下修81.8万人。此前公布的非农数据显示,涉及调整的报告期内总共新增290万个就业岗位,平均下来每个月24.2万人。扣掉81.8万人后,月平均增速将下降至17.4万人。