After the Bank of Japan's interest rate hike and Governor Haruhiko Kuroda's release of a hawkish signal, Kuroda will face close scrutiny from the market on Friday.

He will start the questioning session in the House of Representatives at 9:30 a.m. on Friday, followed by another hearing in the Senate at 1 p.m. Each session will last for two and a half hours.

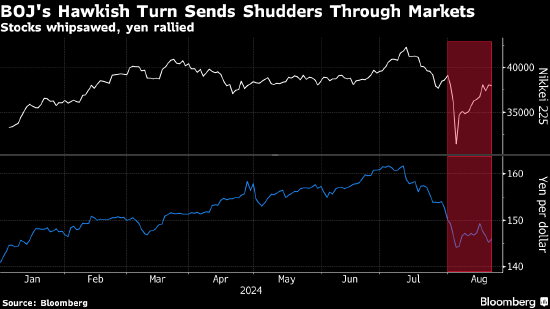

This unusual hearing is taking place during the parliamentary recess because lawmakers have insisted on the Bank of Japan explaining its actions. The bank's hawkish stance has caused a $6.4 trillion loss in global stock market capitalization this month and the Nikkei 225 index has recorded record declines. The market has since recovered, with the S&P 500 index returning to near its mid-July high and the Nikkei index rebounding by about 20% from its earlier lows this month.

Considering that Bank of Japan Governor Haruhiko Kuroda's speech at the Jackson Hole Symposium was just a few hours before Federal Reserve Chairman Jerome Powell's, Kuroda may try to avoid making news or market fluctuations as much as possible. Observers say he may not make any policy commitments but will ensure that interest rates are not increased during financial market instability.

Considering that Bank of Japan Governor Haruhiko Kuroda's speech at the Jackson Hole Symposium was just a few hours before Federal Reserve Chairman Jerome Powell's, Kuroda may try to avoid making news or market fluctuations as much as possible. Observers say he may not make any policy commitments but will ensure that interest rates are not increased during financial market instability.

"Kuroda's ultimate goal is to avoid causing any shocks," said Tsuyoshi Ueno, senior economist at the NLI Research Institute. "The reason for convening this hearing is the global market turbulence following the Bank of Japan's hawkish turn. If Kuroda's speech causes further chaos, it will be a nightmare for the Bank of Japan."

Kuroda's trusted deputy Masakazu Ueda tried to calm the market earlier this month by stating that interest rates will not be increased during financial market instability. He also stated that the Bank of Japan will maintain the current interest rate level "temporarily".

Although the market has regained some calm since Masakazu Ueda's speech on August 7th, the conflicting signals from him and Kuroda have caused unease. Observers are closely watching if there will be any subtle changes in Kuroda's attitude. Many of them still expect some risk of interest rate hikes this year and believe that market turbulence will only persist for so long.

UBS Securities expects the Bank of Japan to raise interest rates again in October, while Nomura Securities and Deutsche Securities expect it to be in December. Barclays moved the timing of the interest rate hike forecast from April next year to January last week.

On July 31, the Bank of Japan's Monetary Policy Committee raised the benchmark interest rate from 0%-0.1% to 0.25%. A few hours later, Governor Haruhiko Kuroda emphasized that as long as the central bank's economic outlook is achieved, further interest rate hikes will be made, which caused panic among market participants.

In addition to the concern over US corporate profits and the outlook for the US economy, the hawkish stance of Kuroda and the sharp rise of the yen pushed the Nikkei 225 index sharply lower, while the surge of the yen triggered a large-scale unwinding of global arbitrage trades.

"He is unlikely to change his stance or characterize the central bank's actions as a mistake," said Charu Chanana, forex strategy director at Saxo Markets. "Instead, he is expected to emphasize that Japan's inflation and wage growth momentum can prove the justification for further interest rate hikes, but his tone may be more balanced to avoid shocking the market."

Difficult balance.

Fearing the depreciation of the yen, Kuroda is also unlikely to appear too dovish. Days before the July policy meeting, a sharp drop in the yen had prompted calls from politicians and corporate executives for an interest rate hike.

"If he explicitly takes a hawkish stance again, it could push up the yen, and the stock market will fall again," said NLI's Ueno. "If he sends a dovish signal, it could lead to a sharp depreciation of the yen, reigniting various old concerns."

A few hours later, the market's focus will shift from Kuroda to Powell. The Federal Reserve chairman will speak at the Jackson Hole Symposium, and the market will carefully observe it to find clues related to the outlook of the Fed's policy.

考虑到与美联储主席杰罗姆·鲍威尔在杰克逊霍尔年会发表讲话仅相隔几小时,植田和男或许会尽可能避免制造新闻或市场波动。观察人士称,他可能不会做出任何政策承诺,但会保证不在金融市场不稳定时加息。

考虑到与美联储主席杰罗姆·鲍威尔在杰克逊霍尔年会发表讲话仅相隔几小时,植田和男或许会尽可能避免制造新闻或市场波动。观察人士称,他可能不会做出任何政策承诺,但会保证不在金融市场不稳定时加息。