Production difficulties still persist in the 2023 annual report to date.

As of the close on August 22, *ST vtron group co.,ltd., has hit the limit down, closing at 0.37 yuan, and has been below 1 yuan for 20 consecutive trading days. *ST vtron group co.,ltd. has been limit down for 34 consecutive days.

According to the Shenzhen Stock Exchange regulations, if the closing price of a company's stock is lower than 1 yuan for 20 consecutive trading days, the company's stock will be delisted from the Shenzhen Stock Exchange.

Previously, *ST vtron group co.,ltd. received a delisting risk warning from the Shenzhen Stock Exchange because it failed to timely disclose annual reports for 2023 and first-quarter reports for 2024 that were confirmed as true, accurate, and complete by a majority of directors.

Previously, *ST vtron group co.,ltd. received a delisting risk warning from the Shenzhen Stock Exchange because it failed to timely disclose annual reports for 2023 and first-quarter reports for 2024 that were confirmed as true, accurate, and complete by a majority of directors.

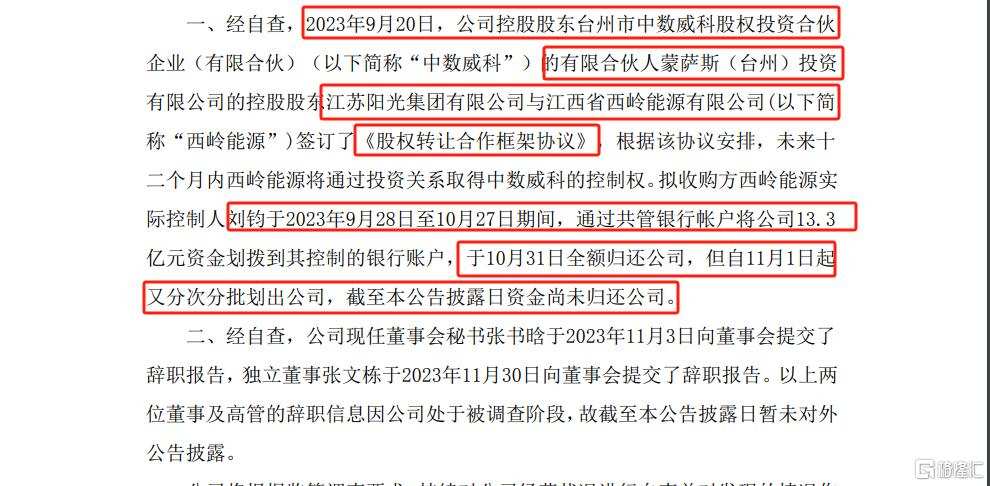

In addition, the company encountered issues of fund occupation, with 1.33 billion yuan of funds transferred earlier not yet returned to the company, further exacerbating the company's financial difficulties.

Significant losses in performance in recent years.

Information indicates that vtron group co.,ltd. was established in 2002, mainly engaged in the research and development, production, sales, and services of ultra-high-resolution digital display wall systems and interactive digital platforms, as well as kindergarten operation and management services.

The company was listed on November 27, 2009, with an issue price of 23.8 yuan per share and an issuance of 53.45 million shares, raising a net capital of 1.207 billion!

In 2015, the company entered the early education industry and successively acquired Red Threads Education, Golden Cradle, KE Er Education, Dingqi Education, and other education companies.

According to incomplete statistics, from 2015 to 2018, the company spent over 2.1 billion yuan on mergers and acquisitions, which also brought in high goodwill. By the end of 2018, the company's goodwill exceeded 1.7 billion yuan!

In 2019, vtron group co.,ltd. suffered a performance collapse! Due to impairment losses of over 1.2 billion yuan on goodwill formed from previous mergers and acquisitions, the company recorded a loss of 1.231 billion yuan in net income for the period.

Since then, vtron group co.,ltd. has suffered consecutive years of non-net income losses.

In 2021, the company suffered a loss of 0.396 billion yuan.

The performance forecast for 2023 shows that the company is expected to achieve a net loss attributable to shareholders of 50 million to 70 million, a year-on-year decrease of 219.26% to 266.96%.

Vtron group co.,ltd. explained that the decrease in revenue was mainly due to the significant drop in the unit price of LED products and the impact of factors such as project delays or budget cancellations.

Production difficulties still persist in the 2023 annual report to date.

On December 22, 2023, vtron group co.,ltd. suddenly issued a self-inspection announcement, with 1.33 billion yuan of the company's funds being embezzled and still not returned.

After the embezzlement of 1.33 billion yuan, on December 22, 2023, the China Securities Regulatory Commission initiated an investigation into vtron group co.,ltd., and initiated an investigation into the acquirer, Liu Jun, and on December 23, an investigation was conducted against vtron group co.,ltd.'s controlling shareholder, Lu Keping.

On March 26 of this year, vtron group co.,ltd. disclosed an announcement that the company received a letter of urgency jointly submitted by three independent directors. According to the letter of urgency, the 1.33 billion yuan embezzled from vtron group co.,ltd. has not been returned, and the company is facing the risk of the annual report being 'difficult to produce'. As expected, in the latest announcement, the mysteriously embezzled huge sum of money has also become a key reason for the inability to disclose the annual report on time.

The company was unable to disclose the annual report for 2023 and the first quarter report for 2024 within the statutory period. The stock has been suspended from trading since May 6, 2024, and the above-mentioned reports have not been disclosed within the two months of the stock suspension.

After two months of suspension, trading resumed on July 9, and the company's stock price opened directly at the limit down. After 33 consecutive limit down days, the stock price plummeted from the pre-suspension price of 1.97 yuan to 0.37 yuan.

此前*ST威创因未能及时公布得到过半数董事确认为真实、准确、完整无误的2023年年度报告、2024年第一季度报告,遭到深圳证券交易所的退市风险警示。

此前*ST威创因未能及时公布得到过半数董事确认为真实、准确、完整无误的2023年年度报告、2024年第一季度报告,遭到深圳证券交易所的退市风险警示。