With the recent resolution of the liquidity crisis in the U.S. stock market and the easing of recession fears, the market has gradually stabilized and rebounded. Technology stock prices have rebounded, and as of August 22, $NVIDIA (NVDA.US)$ has rebounded nearly 30% from its low point of $102.

As NVIDIA's earnings report approaches next Wednesday (August 28), investors have options beyond trading earnings through options—they can also trade using single-stock ETFs.

How Do Single-Stock ETFs Work?

Unlike other ETFs that track a basket of stocks, bonds, commodities, or other assets, Single-Stock ETFs focus on tracking the price performance of a single publicly traded company.

Similar to other leveraged ETFs, issuers of Single-Stock ETFs typically use complex financial instruments, like derivatives, to achieve leverage or shorting effects. Their performance is tied to the daily returns of the underlying stock.

Similar to other leveraged ETFs, issuers of Single-Stock ETFs typically use complex financial instruments, like derivatives, to achieve leverage or shorting effects. Their performance is tied to the daily returns of the underlying stock.

Options have traditionally been the primary tool for investors to achieve these goals. Unfortunately, options trading is relatively complex and requires certain skills, which many novice investors lack. ETF issuers provide leveraged and inverse single-stock ETFs, allowing investors to profit from declines in the underlying stock or amplify gains.

They avoid many issues and complexities associated with direct options trading and can be bought and sold directly from brokerage accounts. Whether aiming to amplify returns, hedge risks, or profit from market volatility, single-stock ETFs offer investors a convenient way to lower the barriers associated with using complex derivatives.

Introducing Single-Stock ETFs Using NVIDIA as an Example

Single-stock ETFs for NVIDIA can be broadly categorized into three types: long, short, and covered call ETFs. Here’s an overview of these ETFs and how to choose a NVIDIA single-stock ETF based on different strategies.

NVIDIA Single-Stock ETF Product Overview

Single Stock ETFs | Direction | Objective |

|---|---|---|

GraniteShares 2x Long NVDA Daily ETF(NVDL) | Long | Achieve twice the daily performance of NVDA |

Direxion Daily Nvda Bull 2X Shares (NVDU) | Long | Achieve twice the daily performance of NVDA |

T-Rex 2X Long Nvidia Daily Target ETF(NVDX) | Long | Achieve twice the daily performance of NVDA |

Direxion Daily NVDA Bear 1X Shares(NVDD) | Short | Deliver the inverse daily performance of NVDA |

Graniteshares 2x Short NVDA Daily ETF (NVD) | Short | Achieve twice the inverse daily performance of NVDA |

Tradr 1.5X Short NVDA Daily ETF(NVDS) | Short | Achieve 1.5 times the inverse daily performance of NVDA |

T-Rex 2X Inverse Nvidia Daily Target ETF(NVDQ) | Short | Achieve twice the inverse daily performance of NVDA |

YieldMax NVDA Option Income Strategy ETF(NVDY) | Covered Call Strategy | Seek to generate monthly income by selling/writing call options on NVDA |

If You Are Bullish on NVIDIA’s Short-Term Stock Price

When you have strong confidence in NVIDIA's short-term stock price and anticipate an increase in value, you can use leveraged ETFs to amplify potential gains, achieving leveraged returns without financing.

Currently, the main bullish single-stock ETFs tracking NVIDIA in the market include $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$, $Direxion Daily NVDA Bull 2X Shares (NVDU.US)$, and $T-REX 2X LONG NVIDIA DAILY TARGET ETF (NVDX.US)$ .

Among them, $GraniteShares 2x Long NVDA Daily ETF (NVDL.US)$ is an ETF that aims to track NVIDIA's daily stock price performance to achieve 2x leverage. If NVIDIA's stock price rises by 1%, NVDL will rise by 2% on the same day, and if NVIDIA's stock price falls by 1%, NVDL will fall by 2%. Benefiting from NVIDIA's significant increase, this ETF's asset scale has reached $5.749 billion (as of August 21, 2024), and it is also one of the most actively traded ETFs in its category.

If You Are Bearish on NVIDIA’s Short-Term Stock Price

Conversely, if you are skeptical about NVIDIA’s future stock price and expect it to decline, you can opt for short strategies, also known as inverse ETFs. Inverse ETFs can be leveraged or unleveraged. For example, $Direxion Daily Nvda Bear 1X Shares (NVDD.US)$ is an inverse single-stock ETF tracking NVIDIA’s stock price.

$GraniteShares 2x Short NVDA Daily ETF (NVD.US)$ is a 2x leveraged inverse single-stock ETF, meaning if NVIDIA’s stock price drops by 1%, NVD will rise by 2% on the same day, and vice versa. If NVIDIA’s stock price rises by 1%, NVD will drop by 2%.

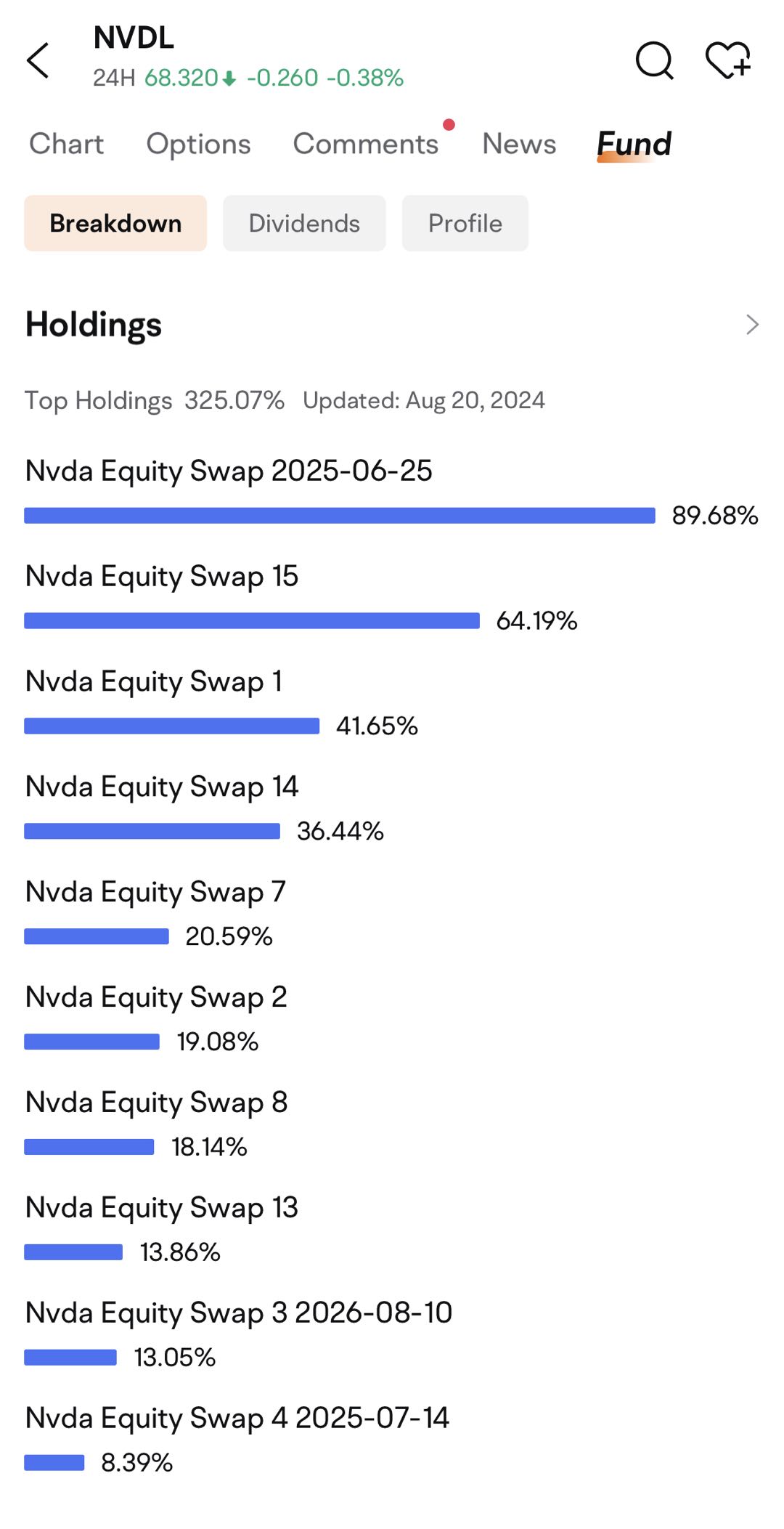

So how do these single-stock ETFs achieve leveraged returns and inverse effects? You can find out from each ETF's holdings. On the moomoo app, search for the ETF name, select "Fund" from the top navigation bar, and you can view the "Holdings" details of that ETF.

For instance, in the image below, you can see that NVDL primarily uses equity swap agreements to achieve its 2x positive leverage.

If You Believe NVIDIA’s Stock Price Will Be Volatile in the Short Term

Leveraged and inverse ETFs are based on the daily performance of stock prices. These ETFs perform exceptionally well in one-sided markets but may not meet expectations when the stock price direction is unclear or when there is sideways volatility. They are more suitable for capturing investment opportunities in short-term one-sided trends and carry a relatively higher risk if held long-term.

If you believe that NVIDIA's stock price may be volatile in the short term, you can opt for a Covered Call ETF. The Covered Call strategy consists of buying the underlying stock and selling an equivalent number of call options. The advantage of this strategy is that, under the premise of being optimistic about the long-term performance of the stock, it can be used to hedge against the risk of short-term price declines. When the underlying stock price falls or consolidates, you can earn a premium by selling call options. Applying the Covered Call strategy to fund management results in a Covered Call ETF. Through such ETFs, even if you do not trade options, you can achieve similar hedging effects, making it more convenient.

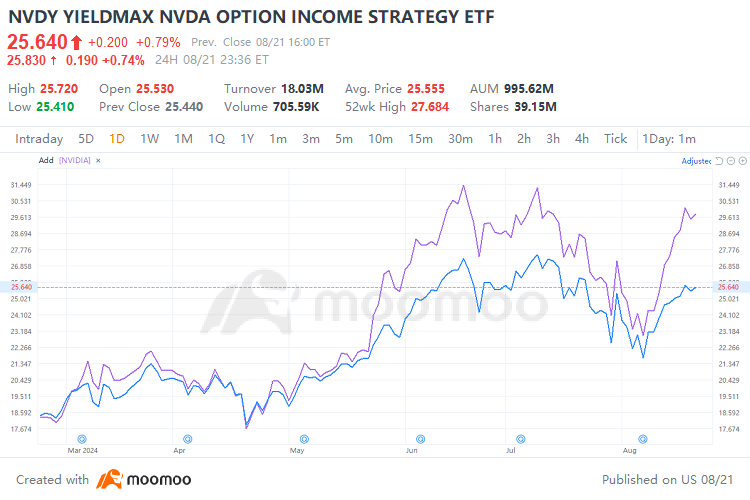

The overall direction of a single-stock Covered Call ETF is still consistent with the underlying stock. When the stock is in a one-sided upward trend, most single-stock Covered Call ETFs do not perform as well as the individual stock. However, when the underlying stock price is uncertain or even fluctuates downward, it may exhibit better performance than the individual stock.

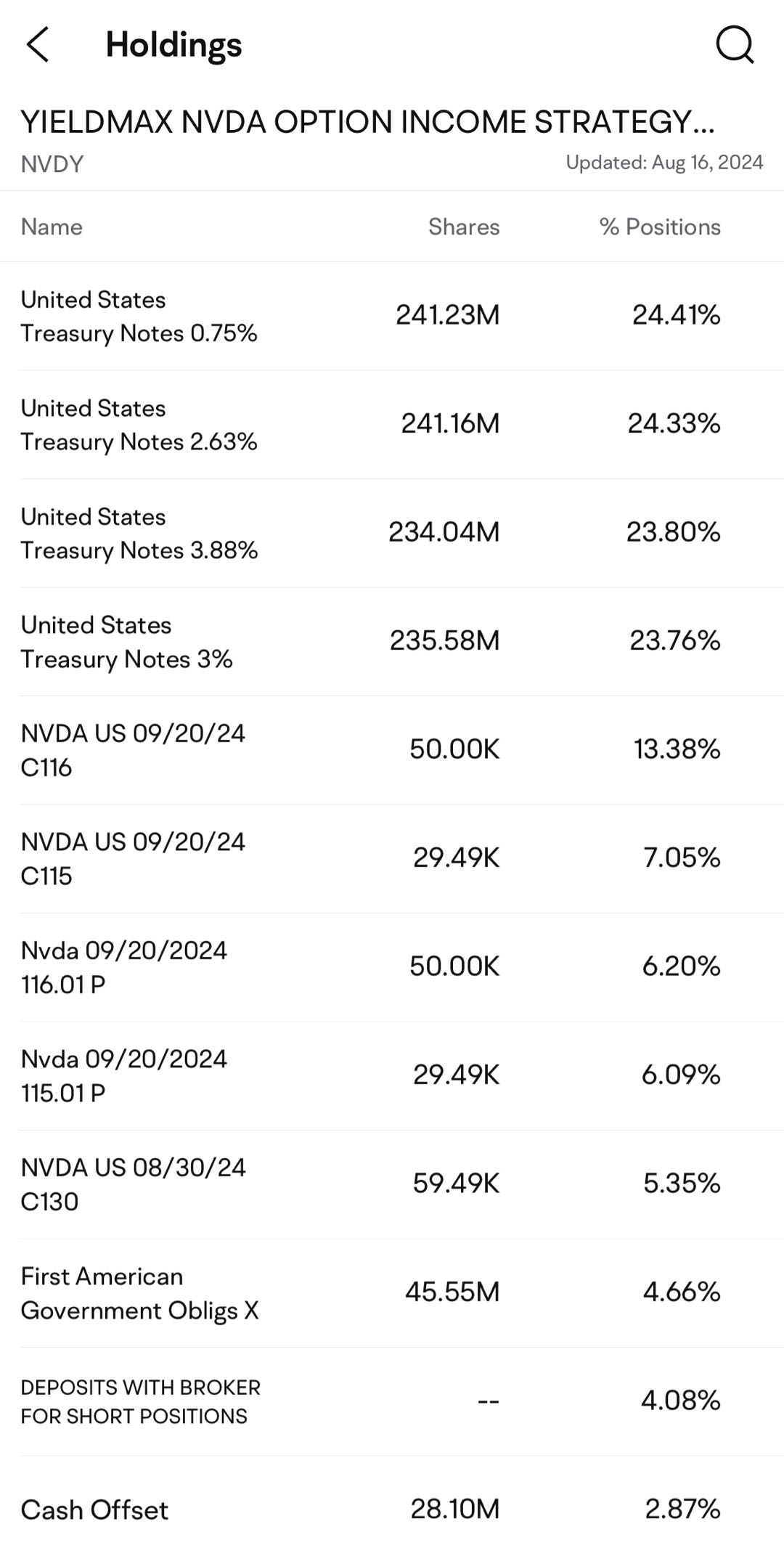

Typically, Covered Calls involve holding the underlying stock, but many single-stock Covered Call ETFs do not hold the underlying stock. Instead, they hold a large amount of low-risk fixed-income assets such as government bonds or treasury bills. Their option holdings are not limited to call options; they may also include put options.

According to the issuer, NVDY is an actively managed ETF that seeks to generate monthly income by selling/writing call options on NVDA. NVDY pursues a strategy that aims to harvest compelling yields while retaining capped participation in the price gains of NVDA.

For instance, if you have a neutral to slightly bullish stance, then NVDY would be ideal. Finally, even if shares of NVDA drop, the stock often carries high implied volatility, so you can make gains even if NVDA falls modestly over a given period.

By searching NVDY’s holdings details, we can see that as of August 22, NVDY holds a large amount of U.S. government bonds and other low-risk fixed-income assets. It also holds both call and put options, and you can discern the strike prices, expiration dates, and directions from the names of the options.

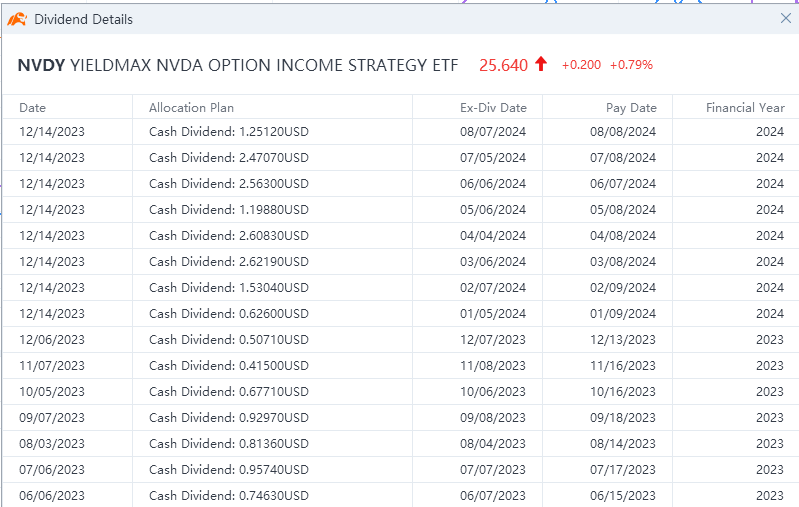

Additionally, most of these options pay monthly dividends, with the specific amount depending on the ETF’s performance in the previous month. The high dividend yield has attracted many investors. Take NVDY as an example, the fund pays a high 67.86% dividend yield (TTM), but investors must understand that almost all of the dividends are generated from selling call options on shares of NVIDIA, so it does not work like a traditional yield that would come from a company paying out cash flow to shareholders.

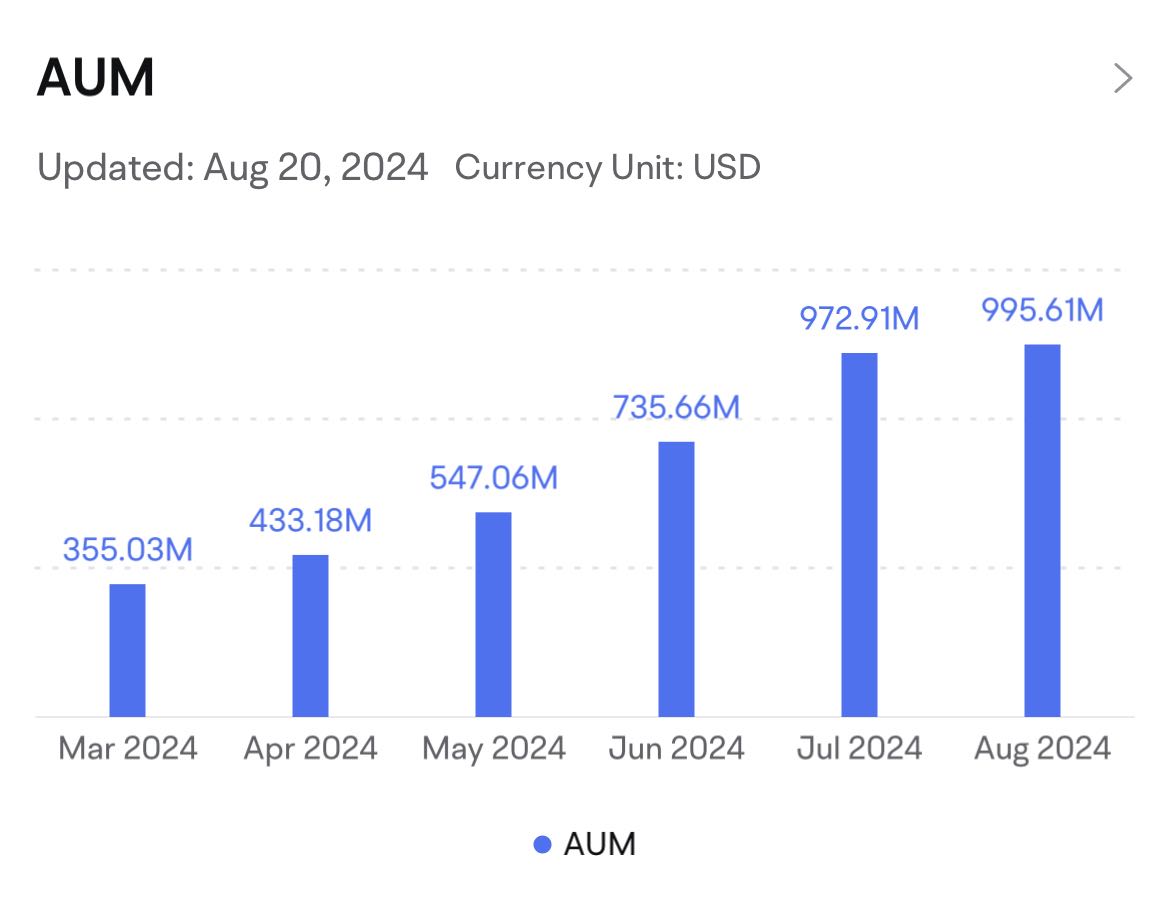

NVDY's assets under management are rapidly soaring, growing from $350 million in March 2024 to $996 million now, demonstrating its strong growth momentum.

Single-stock ETFs of Other Tech Stocks

Apart from NVIDIA, we have also selected other highly-followed prominent tech companies and chosen some single-stock ETFs with significant assets under management for your reference.(As of August 21, 2024.)

Stock | ETF Name | Ticker | Type | AUM(USD) |

|---|---|---|---|---|

TSLA | Direxion Daily TSLA Bull 2X Shares | TSLL | Leveraged ETF | 17.8 billion |

YieldMax TSLA Option Income Strategy ETF | TSLY | Covered Call ETF | 7.13 billion | |

META | GraniteShares 2x Long META Daily ETF | FBL | Leveraged ETF | 1.09 billion |

YieldMax META Option Income Strategy ETF | FBY | Covered Call ETF | 989.56 million | |

AMZN | Direxion Daily AMZN Bull 2X Shares | AMZU | Leveraged ETF | 1.82 billion |

YieldMax AMZN Option Income Strategy ETF | AMZY | Covered Call ETF | 1.74 billion | |

MSFT | Direxion Daily MSFT Bull 2X Shares | MSFU | Leveraged ETF | 1.16 billion |

YieldMax MSFT Option Income Strategy ETF | MSFO | Covered Call ETF | 750.22 millon | |

AAPL | Direxion Daily AAPL Bull 2X Shares | AAPU | Leveraged ETF | 1.31 billion |

YieldMax AAPL Option Income Strategy ETF | APLY | Covered Call ETF | 843.27 million | |

GOOGL | Direxion Daily GOOGL Bull 2X Shares | GGLL | Leveraged ETF | 1.18billion |

YieldMax GOOGL Option Income Strategy ETF | GOOY | Covered Call ETF | 606.26 million |