自己の営業は利益を生み出します

母会社の国盛金融控股が半期報告を発表するに伴い、国盛証券の業績も開示されました。

報告期間中、同社は総収入8.6億を実現し、前年同期比4.24%減少しました。上場会社の株主に帰属する当期純利益は4.5億元で、前年同期比55.04%減少しました。

その中で、この証券会社の仲介業務と売り手研究業務の収入が大幅に前年比で下降しました。

その中で、この証券会社の仲介業務と売り手研究業務の収入が大幅に前年比で下降しました。

しかし、幸いにも国盛証券は上半期に自己営業に力を入れ、多様な資産と戦略を駆使してリスクを制御し、収益を増やしており、これが同社の利益を生み出す核心となっています。

自己営業は本当に利益を生み出します

国盛証券の半期報告書には、非常に重要な文章があります。

「その他の収入の割合が低下する中、証券自己営業は証券会社にとってますます重要な利益源となり、優れた資産管理業務も証券会社の収入の重要な源となるでしょう。」

言い換えれば、国盛証券は自己投資の重要性を高めました。

自己営業とは、証券会社が自己資金を使用して、利益を追求し、それに伴うリスクを引き受けるために、一次市場や二次市場で証券の売買を行うことを指します。

半期報告書によると、国盛証券の自己営業は前年同期比で累計収益(投資収益および公正価値変動損益も含む)が15.42%増加しました。

投資銀行と販売業務は調整期にあります

また、国盛証券のいくつかのビジネスは従来よりも負担が大きくなっています。

IPO新規株式公開とリファイナンスのリズムが鈍化する中、投資銀行の業務は明らかに難しいです。

手数料削減の背景において、セールスリサーチ業務も比較的厳しい状況です。2024年上半期、国盛証券のリサーチ部門は累計で1.80億元の席位手数料収入を実現し、前年同期比で15.09%減少しました。また、リサーチアドバイザリーサービスは0.09億元を実現し、前年同期比で52.78%減少しました。

自己営業の「突破口」

guosheng証券はさらに、2024年6月末までの会社の総資産は373.08億元で、初期と比べて14.78%増加し、主に当期の自己営業活動の規模拡大によるものです。

自己営業活動の範囲が、この財務報告書で何度も示されています。

1つ目に、会社の貨幣基金の割合は、前年末の30.22%から最新の24.77%に減少しました。これは、当期の自己営業活動への投資資金の増加と、同時に顧客資金の減少によるものと国盛は説明しています。

2つ目に、取引金融資産の割合が29.87%に上昇しました。これは、当期の自己営業活動の規模拡大によるものです。

3つ目に、営業活動によるキャッシュフローの純額が261%減少しました。これは、当期の自己営業活動への投資資金の増加によるものです。

資産管理ビジネスの成長率が最も速いです

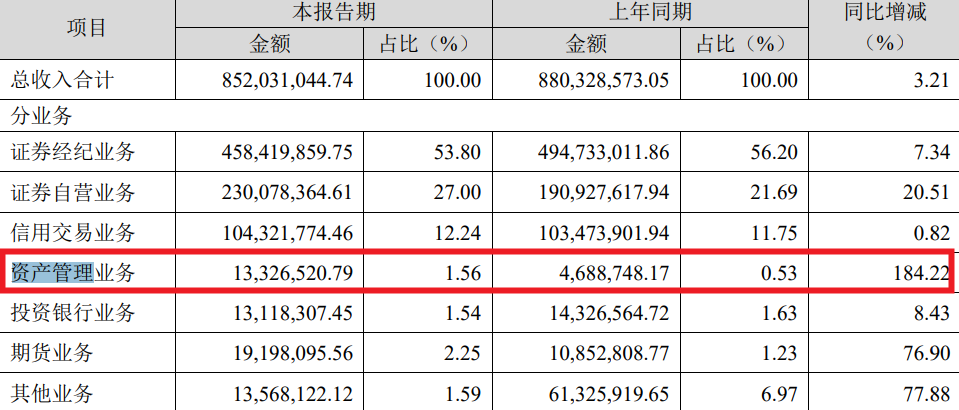

guoshengの半期報告書によると、資産管理ビジネスの収入は前年比184.22%増加し、第一位になりました。

根據報導,証券会社の資産管理業務は、顧客のニーズに応じて対応する製品を開発し、管理料、業績報酬、および関連収入を得るものです。国盛証券は、集合資産管理業務と定向資産管理業務に主に関与しています。

上半期末の顧客数は638件で、信託された資産規模は21.42億円です。そのうち、個人顧客は603件であり、個々の個人顧客の実力は侮れません。

其中,这家券商的经纪业务、卖方研究业务收入有着显著的同比下滑。

其中,这家券商的经纪业务、卖方研究业务收入有着显著的同比下滑。