Alcon Inc. (NYSE:ALC) reported mixed second-quarter results, after the closing bell on Tuesday.

Alcon reported quarterly earnings of 74 cents per share which beat the analyst consensus estimate of 73 cents per share. The company reported quarterly sales of $2.48 billion which missed the analyst consensus estimate of $2.52 billion.

"We are pleased with our solid second-quarter results, which were driven by robust demand for our innovative products, our balanced geographic footprint and strong execution by our team. These factors contributed to another quarter of sales and earnings growth and robust cash generation," said David J. Endicott, Alcon's Chief Executive Officer. "As we look to the second half of the year, our focus will be on preparing for product launches that will position us well for our next phase of growth in 2025 and beyond."

Alcon said it sees FY24 earnings of $3.00 to $3.10 per share on revenue of $9.9 billion to $10.1 billion.

Alcon said it sees FY24 earnings of $3.00 to $3.10 per share on revenue of $9.9 billion to $10.1 billion.

Alcon shares gained 0.9% to trade at $95.50 on Thursday.

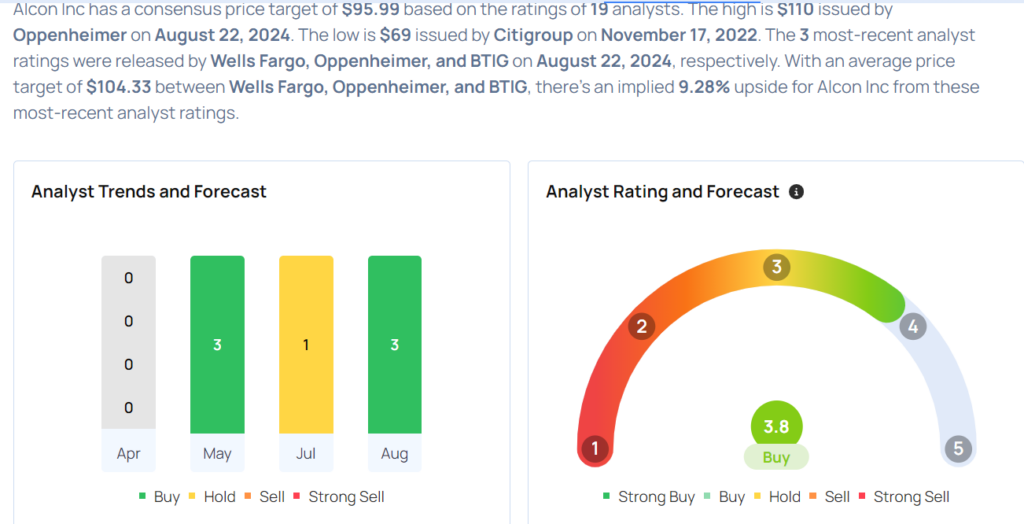

These analysts made changes to their price targets on Alcon following earnings announcement.

- Needham analyst David Saxon maintained Alcon with a Buy and raised the price target from $101 to $107.

- Baird analyst Jeff Johnson maintained the stock with an Outperform and raised the price target from $104 to $110.

- BTIG analyst Ryan Zimmerman maintained Alcon with a Buy, while increasing the price target from $96 to $98.

- Oppenheimer analyst Steven Lichtman maintained the stock with an Outperform and raised the price target from $103 to $110.

- Wells Fargo analyst Larry Biegelsen maintained Alcon with an Overweight rating, while raising the price target from $94 to $105.

Considering buying ALC stock? Here's what analysts think: