Artificial intelligence server company Super Micro Computer, Inc (NASDAQ:SMCI) stock is trading lower Thursday in sympathy with the broader semiconductor selloff led by its clients, including Nvidia Corp (NASDAQ:NVDA) and Advanced Micro Devices, Inc (NASDAQ:AMD).

Despite the selloff, analysts continue to hail Nvidia as the critical AI play, implying the continued potential for the AI frenzy. The selloff has rendered the valuation of the semiconductor companies as more attractive entry points.

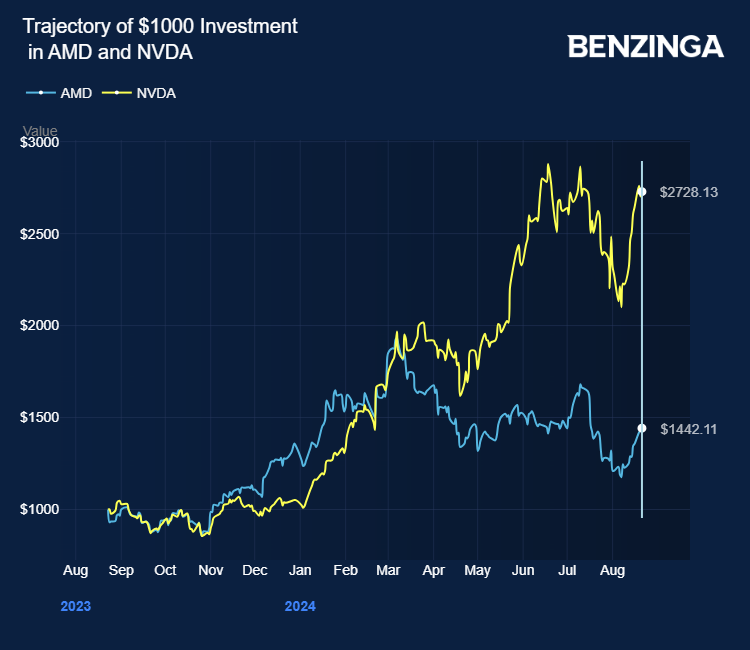

Super Micro Computer stock has increased 136% in the last 12 months and is currently trading at a price-to-earnings multiple of 13.73x. Nvidia, up 176%, is currently trading at a 33.16 PE multiple.

Recently, Taiwanese rail kit supplier Nan Juen International Co, a Super Micro Computer partner, inked a deal with Nvidia to ramp up rail kit production for GB200 AI servers.

The market value of AI servers has the potential to surpass $187 billion in 2024, implying a growth rate of 69% driven by the demand for advanced AI servers from major CSPs and brand clients, as per TrendForce.

The market potential for AI servers backed by demand from Big Tech giants, including Nvidia, AMD, Amazon.Com Inc (NASDAQ:AMZN), Amazon Web Services, and Meta Platforms Inc (NASDAQ:META) explains Super Micro Computer's stock price trajectory.

Super Micro Computer reported a topline growth of 144% in the fourth quarter. Analysts expected the AI server company's margin weakness to recover by fiscal 2025, easing the competitive pricing environment.

Investors can gain exposure to Super Micro Computer through Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), and SPDR S&P 500 (NYSE:SPY).

Price Action: SMCI shares traded lower by 2.77% at $606.50 at the last check on Thursday.

Photo via Company