The headline news that was jointly reported by global financial media last night and this morning mainly included:

The impact of the collective balance sheet reduction by the central banks of the United States, Japan, Europe, and the United Kingdom is difficult to predict. Everyone can only feel their way across the river by touching the stones.

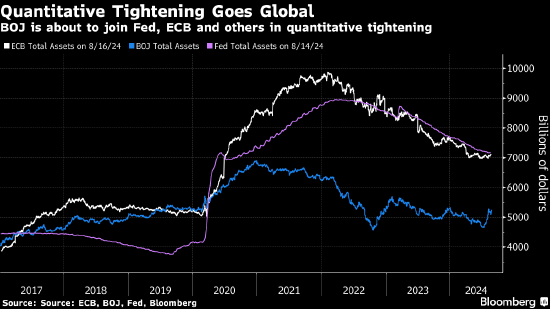

After exploring multiple unknown areas in the past twenty years, central banks in developed countries are entering a new phase: implementing quantitative tightening policies jointly for the first time.

The Bank of Japan decided last month to steadily reduce its holdings of bonds over the next few years, meaning that it will be reducing its balance sheet at the same time as the Federal Reserve, the Bank of England, and the European Central Bank.

The Bank of Japan decided last month to steadily reduce its holdings of bonds over the next few years, meaning that it will be reducing its balance sheet at the same time as the Federal Reserve, the Bank of England, and the European Central Bank.

When the Federal Reserve first started to shrink its balance sheet in 2019, the currency market suddenly fell into chaos, catching policymakers off guard. Although Powell has stated that the Federal Reserve has learned from this experience and promised to pause before trouble arises, no one can guarantee smooth sailing, especially in a situation where investors are facing global liquidity exhaustion.

Steven Barrow, Head of G-10 Strategy at Standard Bank with 40 years of experience in foreign exchange and fixed income strategies, said, "The Federal Reserve may encounter problems again, while other central banks have not been tested."

Apple will allow the deletion of default applications such as Safari to comply with EU requirements.

Apple says it is making changes to the browser selection screen, default apps, and app removal feature for iOS and iPadOS users in the European Union to comply with the EU Commission's Digital Markets Act.

All EU users who set Safari as their default browser will see an updated selection screen.

Some iOS users will have a section for default apps in their settings.

The fifth body was found on Lynch's luxury yacht, Morgan Stanley International Chairman Bloomer confirmed the death.

The Italian rescue team has found the fifth body in the sunken yacht near Sicily. It is feared that British tech tycoon Mike Lynch and other passengers on board may have perished.

Morgan Stanley International Chairman Jonathan Bloomer's children said in a statement on Thursday that Bloomer and his wife Judy were among the victims. The couple was invited as guests to board the super yacht Bayes to celebrate Lynch's acquittal in the trial. Bloomer is a defense witness in the case.

Authorities said that when the Bayes yacht was hit by a tornado near Porticello on the island of Sicily, six people may have been trapped and killed on the ship. The coast guard said the sunken yacht had a "narrow interior space" and "numerous objects," which exacerbated the complexity of the search task.

At a time of uncertainty for the core electric car business, there is another wave of Tesla executive departures.

Various signs indicate that while the world's richest man, Musk, is passionate about rockets, AI, and actively participating in the US elections, the executives who have fought alongside him for more than a decade to build the kingdom of Tesla's electric cars are leaving the company one after another to seek new challenges.

The latest case is Sreela Venkataratnam, Tesla's Vice President of Finance and Operations. She posted on a professional social media platform on Wednesday that she has left the company after 11 years at Tesla.

As a Tesla executive, she participated in the capacity expansion and global expansion of Model S, Model X, Model 3, Model Y, and Cybertruck, as well as the growth of new energy products.

Venkataratnam said that after leaving the company, she plans to take some time off and spend quality time with her family. Then, when the time is right, she hopes to find another rare opportunity like Tesla to drive influential change.

It is reported that with the departure of Jerome Guillen, there is now only one female vice president, Laurie Shelby, responsible for health, safety, and security in Tesla's executive team.

Former Fed economist: There is definitely a reason to cut interest rates by 50 basis points.

Claudia Sahm, Chief Economist of New Century Advisors and former Fed economist, believes that there is definitely a reason for the Fed to cut interest rates by 50 basis points in September.

"There is definitely a reason to cut interest rates by 50 basis points, especially if you think that the rate should have been cut by 25 basis points in July," said the creator of the Sahm rule.

She believes that it is not fair to criticize the Fed for not having access to certain information or data at a previous point in time, especially now that it can be seen in retrospect that the slowdown in the US labor market is greater than previously estimated. Therefore, cutting rates by "50 basis points may not necessarily be wrong", but rather a "re-calibration" of policy to bring it back on track.

European Central Bank Committee Member Kazaks: has a "very open" attitude towards interest rate cuts in September.

European Central Bank (ECB) governing council member Martins Kazaks has stated that he is ready to discuss another interest rate cut at next month's meeting. He also expressed confidence in the inflation rate returning to 2% and concerns about the economy.

The Latvian central bank governor said at the Jackson Hole Fed annual meeting on Thursday, 'Given the data we currently have, I would be very willing to discuss another rate cut in September.'

"But we still need to wait. We still need to see the new forecasts, we still need to see the inflation data for August," he said. 'Overall, even if inflation continues to flatten out in the coming months, it is consistent with further rate cuts.'

The European Central Bank will make new interest rate decisions three weeks from now. After the milestone rate cut in June, investors expect a second rate cut in September, especially as the eurozone economy, led by German industry, shows signs of weakness.

日本央行上个月决定在未来几年稳步缩减债券持有量,意味着该行与美联储、英国和欧洲央行将在同一时期缩表。

日本央行上个月决定在未来几年稳步缩减债券持有量,意味着该行与美联储、英国和欧洲央行将在同一时期缩表。