Jointly produced by China Thailand International and Finance Association

Market reviews

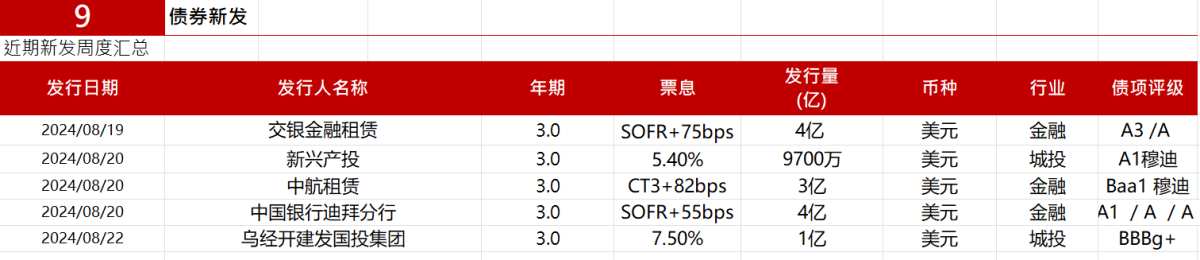

In terms of the primary market, the Ukrainian Economic Development Development and Development China Investment Group participated in the new issuance of US dollar bonds;

In terms of the secondary market, the investment grade trend of Chinese dollar bonds is divided. In the state-owned enterprise sector, CNOOC broadened by 7 bps; in the technology sector, Meituan and Xiaomi narrowed by 2 bps; in the financial sector, the Bank of China widened by 5 bps, and the Industrial and Commercial Bank of China narrowed by 4 bps. The overall high-yield market for Chinese dollar bonds was relatively light. Wanda fell about 3 points, while Lu Jin and Wanda fell 0.5-1 pt.

In terms of the secondary market, the investment grade trend of Chinese dollar bonds is divided. In the state-owned enterprise sector, CNOOC broadened by 7 bps; in the technology sector, Meituan and Xiaomi narrowed by 2 bps; in the financial sector, the Bank of China widened by 5 bps, and the Industrial and Commercial Bank of China narrowed by 4 bps. The overall high-yield market for Chinese dollar bonds was relatively light. Wanda fell about 3 points, while Lu Jin and Wanda fell 0.5-1 pt.

Performance of the bond market

New message

• China Economic Development and Development China Investment Group issues high-grade unsecured notes with a period of 3 years, with an interest rate of 7.5% and a scale of 0.1 billion US dollars. Debt rating: BBbG+ China Chengxin Asia Pacific.

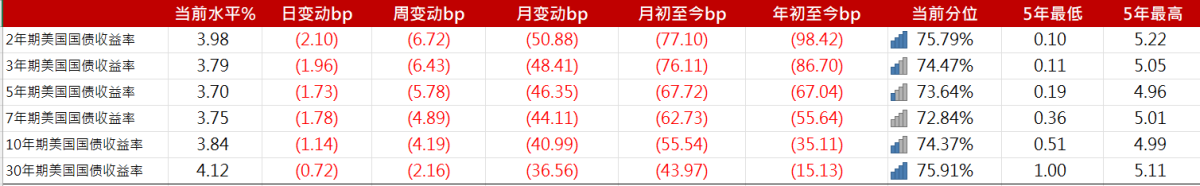

Global bond market performance data

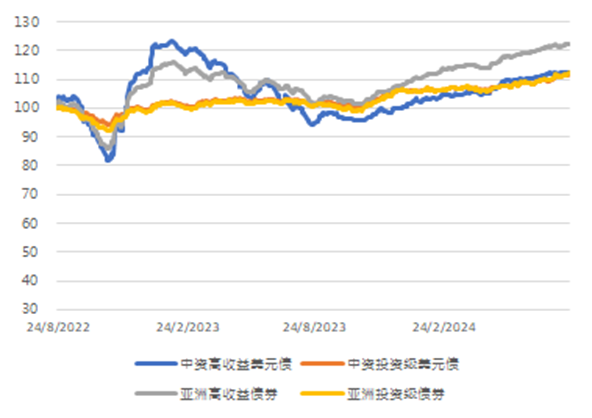

Figure 1. Trends in the Chinese and Asian dollar debt indices (benchmark=100)

Figure 2. Trend of the US dollar debt index in the Chinese real estate and urban investment sector (benchmark = 100)

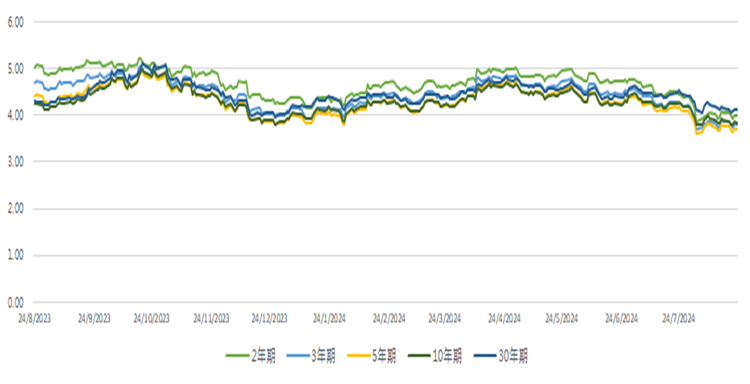

Figure 3. Interest rate trend on US Treasury bonds (%)

Market news summary

• COSCO Group: On August 22, COSCO Group issued an announcement stating that the company is pleased to announce that as of the date of this announcement, holders accounting for 72.5% of Group A debt have joined the restructuring support agreement. According to the company's understanding, many other creditors support the reorganization plan and are undergoing internal procedures to join the restructuring support agreement.

• Yuzhou Group: On August 21, Yuzhou Group Holdings Co., Ltd. issued an announcement announcing the latest developments in its overseas debt restructuring plan. The announcement stated that the Cayman Islands Supreme Court and the Hong Kong Special Administrative Region High Court have issued orders requesting that a meeting of plan creditors be convened to discuss and vote on the debt restructuring plan.

• Lingnan Co., Ltd.: Lingnan shares announced that on August 21, 2024, the company received a notice from Zhongshan Talent Innovation and Entrepreneurship Ecological Park Service Co., Ltd., clarifying that the acquirer will acquire part of the “Lingnan Convertible Bonds” from “Lingnan Bonds Transfer” holders.

• Longguang Holdings: Shenzhen Longguang Holdings Co., Ltd. announced that according to the relevant resolution on the “Credit Enhancement Proposal” made by the “H Dragon Holdings 04” and 9 other bonds (“Credit Enhancement Bonds”), the issuer coordinated Shenzhen Mingxun Investment Co., Ltd.'s 100% shares held by Shenzhen Jujing Investment Co., Ltd. and all proceeds corresponding to the above shares to pledge and increase credit on the credit enhancement bonds.

New bond issuance

(Jointly produced by China and Thailand Finance Association. Data sources are Bloomberg, bond trading platform summaries, and corporate announcements)

二级市场方面,中资美元债投资级走势分化。国企板块,中海油走阔7bps;科技板块,美团、小米收窄2bps;金融板块,中国银行走阔5bps,中国工商银行收窄4bps。中资美元债高收益市场整体较为清淡,万达下跌3pt左右,路劲、万达下跌0.5-1pt。

二级市场方面,中资美元债投资级走势分化。国企板块,中海油走阔7bps;科技板块,美团、小米收窄2bps;金融板块,中国银行走阔5bps,中国工商银行收窄4bps。中资美元债高收益市场整体较为清淡,万达下跌3pt左右,路劲、万达下跌0.5-1pt。