In the second quarter, the cost of goods sold and operating expenses of Zhihu both decreased by more than 16%, and the net loss decreased significantly. Zhihu's AI search product, Zhihu Zhi Da, has been well received by users and has further improved user retention rate.

With the well-received AI search product "Zhihu Direct Answers", the user retention rate and daily active user duration continue to increase, making the second-quarter financial report of Zhihu impressive. The gross margin has increased, and the net loss has dropped significantly by 71.1% year-on-year, making it the lowest loss quarter for Zhihu since its listing.

After the financial report was released, Zhihu's stock price fell by 0.75%.

On Friday, August 23, Zhihu announced the second-quarter financial report for 2024:

On Friday, August 23, Zhihu announced the second-quarter financial report for 2024:

Key Financial Data

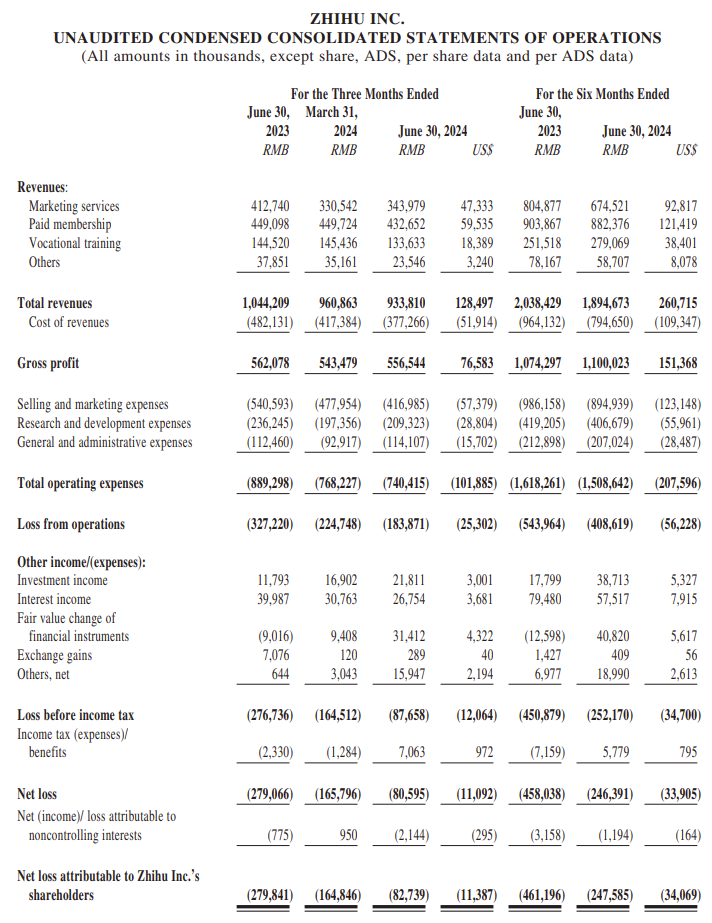

Revenue: Total revenue in the second quarter was 0.934 billion RMB (0.129 billion USD), lower than the 1.044 billion RMB in the same period last year;

Cost of Goods Sold: Cost of goods sold in the second quarter decreased by 21.8% year-on-year to 0.377 billion RMB (0.052 billion USD);

Gross profit: The gross profit in the second quarter was 0.557 billion RMB (0.077 billion USD), lower than the same period last year of 0.562 billion RMB;

Gross margin: The gross margin in the second quarter was 59.6%, higher than the same period last year at 53.8 %;

Net loss: The net loss in the second quarter was 0.081 billion RMB (0.011 billion USD), a year-on-year decrease of 71.1 %;

Adjusted net loss (non-GAAP): The adjusted net loss in the second quarter was 0.045 billion RMB (0.006 billion USD), a year-on-year decrease of 79.9 %;

Average monthly active users (MAU): 0.081 billion;

Average monthly subscription memberships: 0.015 billion.

Share buyback plan

The company established a new share buyback plan (the "2024 Buyback Plan") in June 2024, which will be valid until June 26, 2025. The total number of shares that can be repurchased under the "2024 Buyback Plan" (including the shares represented by American depositary shares), plus the remaining number of shares that can be repurchased under the 2022 buyback plan (including the shares represented by American depositary shares), will not exceed 10% of the total number of issued shares of the company as of June 26, 2024 (excluding any treasury shares).

"Zhihu Direct Answers" received positive feedback, with a net loss reduction of over 70%.

In the second quarter, the paid reading business remains Zhihu's largest source of revenue, followed by marketing services revenue of 0.344 billion RMB and vocational training services of 0.143 billion RMB.

The artificial intelligence search product "Zhihu Direct Answers" launched by Zhihu received positive user feedback, leading to further improvement in user retention rate. According to the financial report, the revenue from paid memberships in this quarter was 0.433 billion RMB (59.5 million USD), slightly lower than last year's 0.449 billion, as a result of the marginal decrease in revenue from each subscription member. Zhihu's founder, chairman, and CEO Zhou Yuan stated:

"Zhihu continues to enhance the core user experience, with ongoing increases in user retention rate and daily active user duration. With the growing credibility of our community, we launched Zhihu Direct Answers at the end of June, marking a significant advancement for us in the field of artificial intelligence search. The further improvement in user retention rate and the positive user feedback received by Zhihu Direct Answers demonstrate our unique strengths and our ability to capture the enormous opportunities in this field."

At the same time, reduced revenue led to lower content costs and operational expenses.

In the second quarter, both Zhihu's operating costs and operating expenses declined by more than 16%, with net losses decreasing significantly by 71.1% year-on-year. R&D expenses decreased by 11.4% to 0.209 billion RMB (0.029 billion USD), mainly due to more efficient spending on technical innovation. Zhihu's CFO Wang Han stated:

"The second quarter recorded the lowest loss since our initial public offering in the USA. This quarter, we achieved a higher return on investment in all business lines while maintaining moderate expenses. Looking ahead, we will continue to strengthen strategic execution, while pursuing long-term sustainable profitability."

8月23日周五,知乎公布了2024年第二季度财报:

8月23日周五,知乎公布了2024年第二季度财报: