In the first half of 2024, CIMC Vehicles (301039.SZ) demonstrated strong resilience and stable operational capabilities in the face of ongoing industry adjustments and a weakening external macro environment, with sustained market competitiveness.

As an important strategy of the company's third entrepreneurial venture, the Starlink Plan has effectively enhanced the company's core competitiveness through innovative design, technological application, organizational change, and resource optimization. Since the top-level design of this plan was completed at the beginning of the year, it has been rapidly promoted and implemented, and the company has achieved significant results in improving production efficiency and expanding the market.

Specifically, through digital transformation, CIMC Vehicles has optimized the entire process from procurement to production, improving production efficiency and product quality. At the same time, the company has promoted modular products, reduced product variety, improved production standardization, and accelerated market responsiveness. In addition, the optimization of the organizational structure has also enhanced decision-making efficiency and execution, enabling the company to better respond to market changes.

Looking ahead, CIMC Vehicles will continue to adhere to technological innovation and organizational reform, continuously enhance its competitiveness, and continuously create new productive forces to adapt to the new normal of macroeconomic development. CIMC Vehicles is expected to lead the semi-trailer industry into a new stage of development.

Looking ahead, CIMC Vehicles will continue to adhere to technological innovation and organizational reform, continuously enhance its competitiveness, and continuously create new productive forces to adapt to the new normal of macroeconomic development. CIMC Vehicles is expected to lead the semi-trailer industry into a new stage of development.

First, the gross margin for the first half of the year reached 14.91%, maintaining an upward trend.

According to the announcement, CIMC Vehicles achieved operating revenue of 10.7 billion RMB in the first half of 2024, with a net profit attributable to shareholders of the listed company of 0.563 billion RMB and a net profit after deducting non-recurring gains and losses of 0.551 billion RMB. At the same time, the company disclosed the mid-term profit distribution plan for 2024: based on a total of 1.874 billion shares, a cash dividend of 2.80 RMB (tax included) will be distributed to all shareholders per 10 shares.

Although net profit has been affected by the return of North American business to normal levels and the high-base investment income in the same period last year, resulting in a slight decline in net profit, the core indicator of the company's profit quality, the gross margin, has performed exceptionally well.

In the first half of the year, the company's gross margin reached 14.91%, surpassing the average gross margin of the same period in the past three years of 13.53%, and roughly reflecting the upward trend of CIMC Vehicles' gross margin during the first half of 2021-2024, demonstrating the company's advantages in refined management and product pricing.

The gross margin of CIMC Vehicles has maintained an upward trend, which is the result of the company's efforts in production, product, and market. The company improves efficiency through technological innovation, optimizes product structure to meet market demands, and accurately positions the market. These efforts have laid a solid foundation for the company's sustainable development and consolidated its leading position in the industry.

Second, analyze the three major alpha growth points of CIMC Vehicles.

According to Wind data, a total of 8 analysts have given CIMC Vehicles a "buy" or "increase holding" rating in the past year. Judging from the consistency of expectations, industry analysts uniformly hold similar positive views or opinions on the future development of the company.

Against the backdrop of no apparent signs of recovery in the industry as a whole and the external environment, analysts' optimism is not based on the beta effect of the industry trend, but comes from the unique alpha advantage of CIMC Vehicles itself, namely, the unique competitive strength that exceeds the market.

Logically speaking, the author summarizes it as follows:

First, in the field of semi-trailers and special vehicles, CIMC Vehicles has an unbeatable competitive advantage both in the entire main track and in multiple sub-tracks.

According to the "Global Trailer"'s "2023 Global Semi-Trailer OEM Ranking List", CIMC Vehicles was selected as the world's number one semi-trailer manufacturer, ranking first for eleven consecutive years.

In the first half of 2024, CIMC Vehicles' various business groups continue to achieve market-leading positions in their respective sub-segments.

Star Chain Lighthouse Pioneer Group, in the Chinese and Belt and Road markets, achieved counter-trend growth in sales and revenue through modular product upgrades and optimized operation of order centers, with a consecutive five-year market share ranking first in the Chinese market.

Qiangguan Business Group, through technological innovation and marketing model innovation, such as the development of integrated hybrid semi-trailer tanker-truck, continuously consolidates its market leadership position in the tanker truck market.

North American business, implementing the "Polar Bear Plan", actively exploring a new global supply chain development pattern for refrigerated semi-trailers in North America, and deepening localization operations.

European and other businesses, by optimizing manufacturing processes and flexible production lines, have improved production efficiency. SDC maintains its leading position in the UK market, while LAG continues to lead in the European tanker truck market.

Special vehicle upfitting business ranks among the top in China's dump truck modification industry, achieving significant market share growth in the urban construction waste truck market through lean management and the deployment of new energy products.

At the same time, CIMC Vehicles is also developing innovative business models in the new energy and autonomous driving scenarios, promoting its leading strategic layout in the fields of autonomous self-driving trucks and new energy intelligent logistics transportation.

Secondly, based on its leading advantages in multiple sub-segments, CIMC Vehicles has created a diversified and international growth source.

Unlike companies that rely on a single source of business, CIMC Vehicles relies on the growth potential of multiple business clusters, which are released at different times, laying a solid foundation for the steady expansion and sustainable growth of the company's business scale.

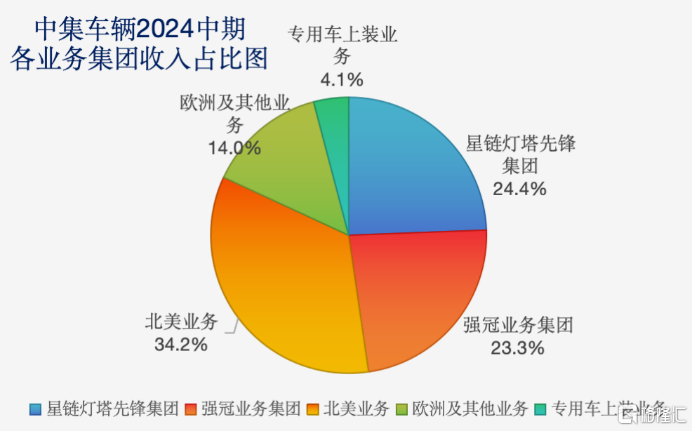

In the first half of 2024, the revenue proportion of each business cluster of CIMC Vehicles is shown in the following chart.

One thing that can be quickly captured is that the revenue proportion of the North American business is 35.8%, which is significantly lower than the 46.9% of the same period last year and lower than the 43.3% recorded at the end of last year. It is worth noting that despite the gradual return of the North American business to normal in the first half of the year, the company has shown other endogenous growth forces. This is mainly reflected in the rapid performance improvement of the Starlink Pioneer Group and the Strong Crown Business Group, as well as the maintenance of the basic position in the European and other businesses and the emergence of the Australian market.

This is also an important reason why the company's income and profits can continue to show resilience.

The third point is that building new high-quality productivity will inject a continuous source of power into the overall competitiveness of CIMC Vehicles.

Regarding how to build and strengthen its own new high-quality productivity in the future, CIMC Vehicles will closely follow its strategic planning and adopt differentiated and precise strategies based on the specific needs and focuses of each business cluster.

For the Starlink Pioneer Group, the key is to continue to promote the "Starlink Plan", accelerate the structural reform of semi-trailer production organization, seize the window of opportunity for the "scrappage-for-substitution" policy of transportation equipment, and achieve breakthrough growth in the domestic semi-trailer business; For the Strong Crown Business Group, it is necessary to actively promote product modularization, explore overseas markets, incubate innovative businesses, and strengthen the second growth curve.; For the North American business, the focus will be on the recovery and delivery of container skeletal trailers, the implementation of strategic planning, and the upgrade of the North American refrigerated semi-trailer business; The European and other businesses will leverage the advantages of global supply chain, improve LoM manufacturing plant layout, enhance production efficiency, and explore new business and products to embrace new development opportunities; The special vehicle upfit business will maintain its leading position in segmented markets, focus on cost reduction and efficiency improvement, leverage LTP+LoM delivery advantages, and improve market share and profitability.

3. Creating new quality productivity to achieve cyclical breakthroughs

Regarding the future path of new quality productivity for CIMC vehicles, the latest performance announcement also provides a detailed explanation. After summarizing, the following points can be considered for investors.

In the face of the new global economic normal and industry challenges, CIMC vehicles are breaking away from low-quality competition in the industry and achieving a leapfrog transformation from low-quality competition to high-quality development through the construction of new quality productivity. Whether this can be achieved depends mainly on the company's future ability to achieve breakthroughs in the following five areas:

1) Fully implement the "Star Chain Plan": With the "Star Chain Plan" as the core, the company improves production efficiency and market responsiveness through innovative design, technological innovation, organizational optimization, and resource allocation, consolidating and expanding its leading position in the market.

2) Deepen innovation in new energy products: Establish a new energy-powered integrated train platform, promote electrification R&D, achieve comprehensive improvement in economy, power, and safety, and lead the innovation of transportation modes.

3) Improve the efficiency of transoceanic operations: Adhere to the "Transoceanic Operation, Local Production" strategy, deepen global supply chain management, attract international enterprises to participate in the Chinese market, and improve the efficiency of transoceanic operations.

4) Reform of the Strongguard Business Group: Launch the "Strongguard Rise" plan, promote the structural reform of cement mixer truck production organization, optimize the allocation of production capacity resources, and consolidate the leading position in the tank truck market.

5) Upgrade the top-level design of organizational development: Conduct top-level organization design, build corporate governance architecture, set up a technical headquarters, enhance technological R&D and innovation capabilities, address the challenges of transoceanic operations, and ultimately provide organizational support for the comprehensive creation of new quality productivity.

Overall, the five series of CIMC Vehicles correspond to the underlying core capabilities of market adaptability, technological innovation, global strategy, resource allocation efficiency, and organizational execution power.

First, market adaptability. The key to the success of the company's strategy lies in whether it can accurately grasp market demand and respond quickly to market changes.

Second, technological innovation capability. Continuous technological research and development and innovation are the core for getting rid of low-quality competition and enhancing product competitiveness.

Third, global strategy: To effectively layout in the global market and achieve "cross-ocean operation, local manufacturing", the company needs to have cross-cultural management capabilities and global resource integration capabilities.

Fourth, resource allocation efficiency: Optimizing resource allocation and improving production and operation efficiency are crucial for reducing costs and enhancing profitability.

Fifth, organizational execution power: Strong execution power is needed to ensure the implementation of various plans through the optimization of organizational structure and the improvement of governance structure.

Once these capabilities are clarified and further summarized and attributed, they can not only help CIMC Vehicles reshape their moat and consolidate the company's core competitiveness in the new era, but also set a new benchmark for the high-quality development of the semi-trailer industry, indicating that the company will continue to lead the industry in the new development stage and achieve sustainable development and cyclical breakthroughs in the long term.

着眼未来,中集车辆将继续坚持技术创新和组织改革,不断提升自身竞争力,持续打造新质生产力,以适应宏观经济发展的新常态,中集车辆有望引领半挂车产业进入新的发展阶段。

着眼未来,中集车辆将继续坚持技术创新和组织改革,不断提升自身竞争力,持续打造新质生产力,以适应宏观经济发展的新常态,中集车辆有望引领半挂车产业进入新的发展阶段。