Lotus Health Group Company (SHSE:600186) shareholders might be concerned after seeing the share price drop 24% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 137% return, over that period. To some, the recent pullback wouldn't be surprising after such a fast rise. Of course, that doesn't necessarily mean it's cheap now.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

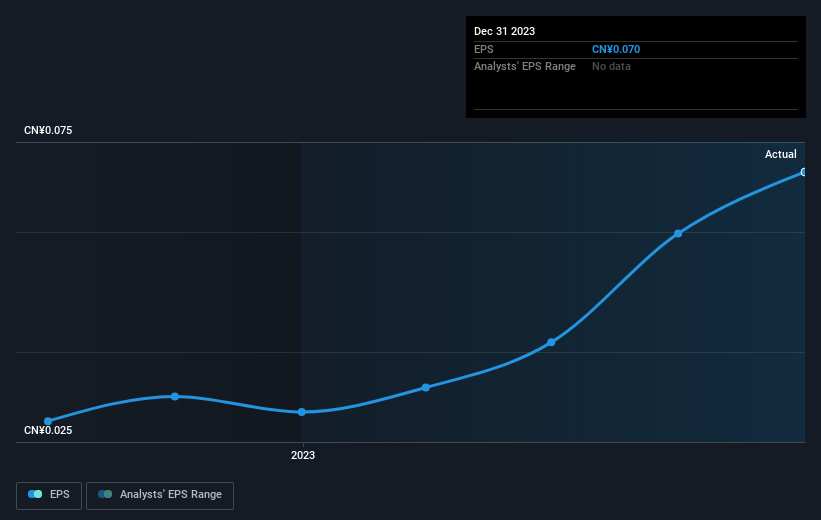

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Lotus Health Group became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. In fact, the Lotus Health Group stock price is 6.7% lower in the last three years. Meanwhile, EPS is up 22% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -2.3% a year for three years.

During the last half decade, Lotus Health Group became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. In fact, the Lotus Health Group stock price is 6.7% lower in the last three years. Meanwhile, EPS is up 22% per year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -2.3% a year for three years.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

While it's never nice to take a loss, Lotus Health Group shareholders can take comfort that their trailing twelve month loss of 9.5% wasn't as bad as the market loss of around 17%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 19% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. Before deciding if you like the current share price, check how Lotus Health Group scores on these 3 valuation metrics.

We will like Lotus Health Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.