Alibaba Group Holding Limited (NYSE:BABA) stock traded higher on Friday as it announced plans to allow mainland investors to start trading through changes to its listing status in Hong Kong.

Fund manager Dai Ming expects the move to infuse liquidity into the stock.

The Chinese e-commerce juggernaut posted a 4% topline growth in the first quarter, lagging the analyst consensus estimate as domestic e-commerce rivalry and a weak domestic economy played spoilsport.

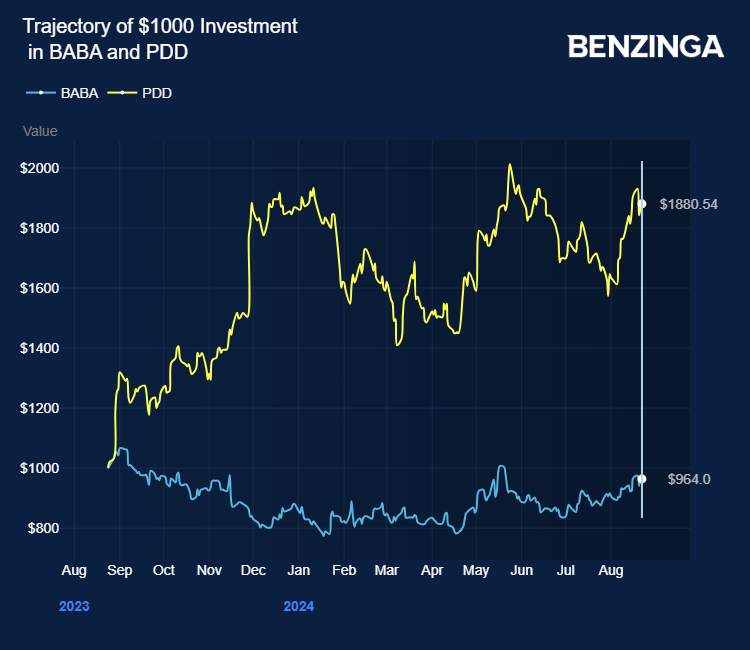

Alibaba, which has lost 7% in the last 12 months, trades at a forward price-to-earnings ratio of 8.91x. Arch rival PDD Holdings Inc (NASDAQ:PDD) gained 90% and trades at 9.45x.

Alibaba, which has lost 7% in the last 12 months, trades at a forward price-to-earnings ratio of 8.91x. Arch rival PDD Holdings Inc (NASDAQ:PDD) gained 90% and trades at 9.45x.

Alibaba's artificial intelligence aspirations met obstacles after the U.S. intensified its semiconductor technology embargo against China, which now encompassed Nvidia Corp's (NASDAQ:NVDA) sophisticated AI chips.

Alibaba has also started losing out on domestic AI clients as its AI models fail to generate the requisite computing power.

China's Shenzhen University, Yunda Technology, and Zhejiang Lab reached out to Amazon.Com Inc (NASDAQ:AMZN), Amazon Web Services, and Microsoft Corp (NASDAQ:MSFT) to fill the void left by the U.S. sanctions, as per Reuters.

Alibaba's Cloud Intelligence Group revenue grew by 6% to $3.65 billion in the first quarter.

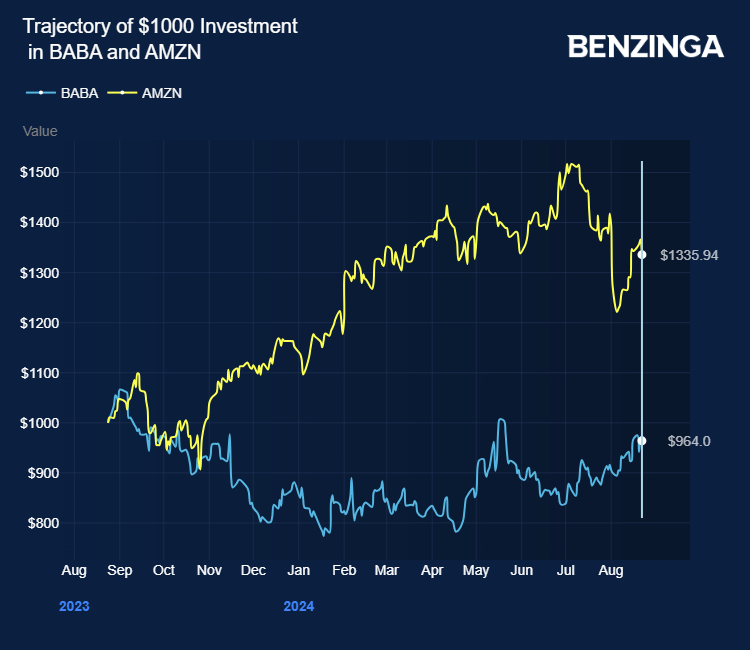

In the U.S., Amazon has gained over 31% in the last 12 months and trades at a forward PE multiple of 30.04x

Price Action: BABA shares traded higher by 2.80% at $85.28 premarket at the last check on Friday.

Photo via Shutterstock