After the end of May this year, Bilibili (NASDAQ: BILI, HKEX: 9626; hereinafter referred to as "B Station") handed in a higher-quality report card after the Hong Kong stock market closed on August 22, bringing some warmth to the currently stagnant financial market!

Compared to the previous quarter, the accelerated reduction of losses should be the biggest highlight of the quarterly financial report. The main reason for this is the accelerated commercialization of the platform and the cost reduction and efficiency improvement brought by the game strategy transformation. At this pace, it's almost certain that the next quarter will turn losses into profits.

In addition, thanks to the substantial improvement in profitability, Bilibili's operating cash flow has also improved, and there is more money in hand this quarter.

As for the quality of this report card from Bilibili and what the second half of the year will be like, we may as well take a closer look.

First, the revenue exceeded expectations, mainly driven by advertising and gaming.

The financial report shows that in the second quarter of 2024, Bilibili achieved revenue of 6.127 billion yuan (RMB, the same below), a 16% year-on-year increase. Among them, advertising revenue was 2.04 billion yuan, a 30% year-on-year growth, at the upper limit of the guidance range.

This is not only driven by the "618" e-commerce peak season, the clustering of new summer games preheating, and the increase in educational supply, but also benefits from the improved efficiency of Bilibili's advertising business. According to the company's management revealed during the conference call, the company has improved the advertising delivery system, optimized ad placement and conversion capabilities, thus attracting more advertising budgets.

Especially during "618", the number of Bilibili's advertisers increased by over 300%, and the sales volume of goods increased by over 140% year-on-year. In the fields of maternal and child care and daily household goods, the new customer rate exceeded 70%. In the first half of the year, the number of Bilibili's advertisers increased by over 50% year-on-year, with the number of advertisers in the internet services and education sectors increasing by over 100%.

Advertising remains strong, and games are also starting to show promise. The financial report shows that Bilibili's game revenue in this quarter reached 1.01 billion yuan, a 13% year-on-year increase, significantly higher than guidance, thanks to the combined efforts of new and old games. Games like 'FGO,' 'Azur Lane,' and 'Honkai Impact 3rd' continue to contribute steady revenue, while 'Three Kingdoms: Destiny of an Emperor,' launched at the end of the second quarter, brought in enough incremental revenue. Of course, this can also be considered as a self-confirmation of the success of Bilibili's game global strategy transformation.

It is worth mentioning that this new game, which has been online for less than a month, has both explosive potential and long-term prospects. It entered the top three in the iOS game revenue rankings on the first day and has since consistently been in the Top 10. It is also the fastest game in Bilibili's history to exceed 1 billion yuan in revenue. Currently, it can be considered as a 'test of the waters,' with the potential for further growth in the future, supporting the continuous growth of game revenue. The deferred revenue in this quarter increased by 25% month-on-month, providing solid evidence of profitability.

In addition, the performance of value-added services in the second quarter remained relatively stable, with a year-on-year growth of 11.5% to reach 2.57 billion yuan. This is quite remarkable given the macro pressure and the convergence of consumer confidence.

It can be said that the accelerated pace of monetization is the main driving force behind Bilibili's accelerated pace of loss reduction.

Secondly, the degree of loss reduction exceeded expectations, ensuring ample liquidity.

The financial report shows that in the second quarter, Bilibili's adjusted operating loss was 0.284 billion yuan, with an adjusted net loss of 0.271 billion yuan, significantly narrowing by 69% and 72% respectively compared to the same period last year. The adjusted net loss ratio dropped to about 4.5%, outperforming market expectations.

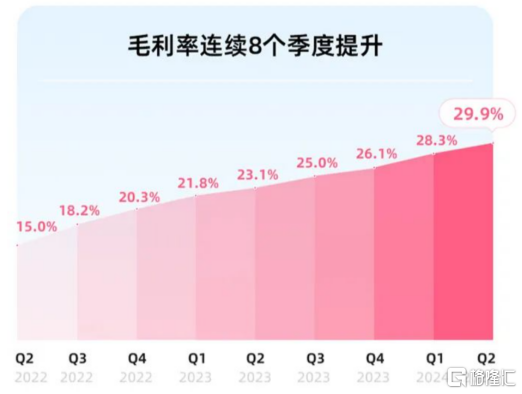

Given the above, with the proportion of game and advertising revenue increasing, it has further driven the overall gross margin of Bilibili to rise. The financial report shows that in the second quarter, Bilibili's gross profit increased by 49% year-on-year, with the gross margin rising to 29.9%, achieving an 'eighth consecutive rise.'

Thanks to the significant improvement in profitability, the cash flow of bilibili has also become healthier, and there is more money on hand. The financial report shows that in the second quarter, bilibili's net cash inflow from operating activities was 1.7 billion, an increase of 1.1 billion from the first quarter. This actually indicates that bilibili's business has entered a virtuous cycle.

As of the end of the second quarter, bilibili's total cash, deposits, and short-term investment balance on the books amounted to 13.9 billion yuan. Deducting short-term debts of 4.6 billion, the net cash reached 9.4 billion yuan, an increase of 1.4 billion from the first quarter. From this perspective, bilibili's liquidity in the short term should also be without worry.

Thirdly, the fundamental user base is still healthy.

As bilibili is quickly moving towards profitability, its traffic ecosystem behind it continues to maintain healthy and steadily growing. Whether it is platform user scale, user stickiness, or interaction efficiency, they are all moving forward, continuously setting new records.

The financial report shows that in the second quarter, bilibili's DAU reached 0.1023 billion, a 6% year-on-year increase; MAU grew to 0.336 billion; users spent an average of 99 minutes per day on the platform, an increase of 5 minutes year-on-year. By the end of the second quarter, the official membership of the company further increased to 0.243 billion, and the 12-month retention rate remained stable at 80%. In addition, the monthly community interaction frequency increased by 11% year-on-year, exceeding 16.5 billion times, maintaining high activity.

In the short term, improving monetization capabilities is indeed a key focus for bilibili, but in the medium to long term, sustained growth ultimately relies on its fundamental user base. Now, with bilibili sitting on the excellent "green hills," perhaps there is no need for too much forward thinking.

Epilogue

Under the premise of already good expectations, bilibili's performance in the second quarter is still impressive, with a significant trend of business development. Apart from the "dividend period," this actually reflects that bilibili has used its strengths properly. Although macro pressure continues to rise, considering the absolute revenue contribution of new games on bilibili and the marketing hype of the summer new games, it undoubtedly provides important support for bilibili's strong performance next quarter and further lays a good foundation for high-quality growth throughout the year.