Whales with a lot of money to spend have taken a noticeably bullish stance on Marvell Tech.

Looking at options history for Marvell Tech (NASDAQ:MRVL) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $141,940 and 5, calls, for a total amount of $246,078.

From the overall spotted trades, 3 are puts, for a total amount of $141,940 and 5, calls, for a total amount of $246,078.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $62.5 and $95.0 for Marvell Tech, spanning the last three months.

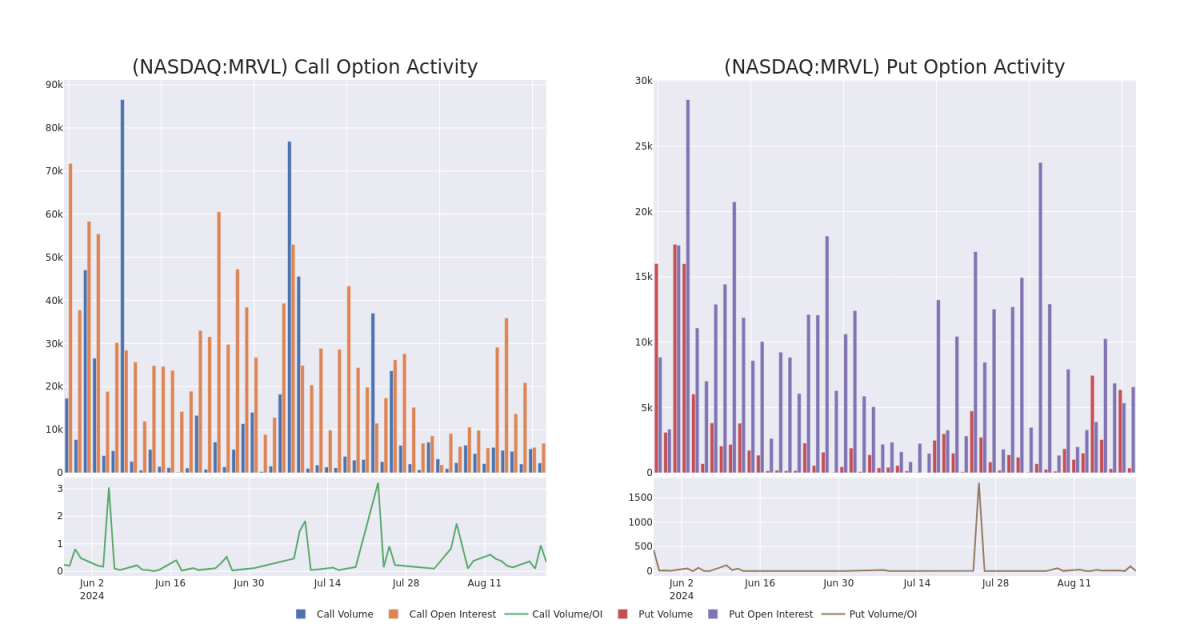

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marvell Tech's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marvell Tech's substantial trades, within a strike price spectrum from $62.5 to $95.0 over the preceding 30 days.

Marvell Tech 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BULLISH | 11/15/24 | $12.75 | $12.65 | $12.75 | $62.50 | $82.8K | 188 | 66 |

| MRVL | PUT | SWEEP | BEARISH | 02/21/25 | $5.8 | $5.7 | $5.8 | $65.00 | $69.0K | 106 | 119 |

| MRVL | CALL | SWEEP | BEARISH | 08/23/24 | $1.13 | $1.02 | $1.13 | $71.00 | $48.9K | 3.6K | 3.7K |

| MRVL | CALL | SWEEP | BULLISH | 08/23/24 | $1.15 | $1.02 | $1.15 | $70.00 | $45.3K | 1.8K | 1.5K |

| MRVL | PUT | SWEEP | BULLISH | 09/20/24 | $25.1 | $24.15 | $24.2 | $95.00 | $38.7K | 0 | 18 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

After a thorough review of the options trading surrounding Marvell Tech, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Marvell Tech

- Currently trading with a volume of 2,337,738, the MRVL's price is up by 4.95%, now at $72.06.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 6 days.

Expert Opinions on Marvell Tech

1 market experts have recently issued ratings for this stock, with a consensus target price of $100.0.

- Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Marvell Tech with a target price of $100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marvell Tech with Benzinga Pro for real-time alerts.