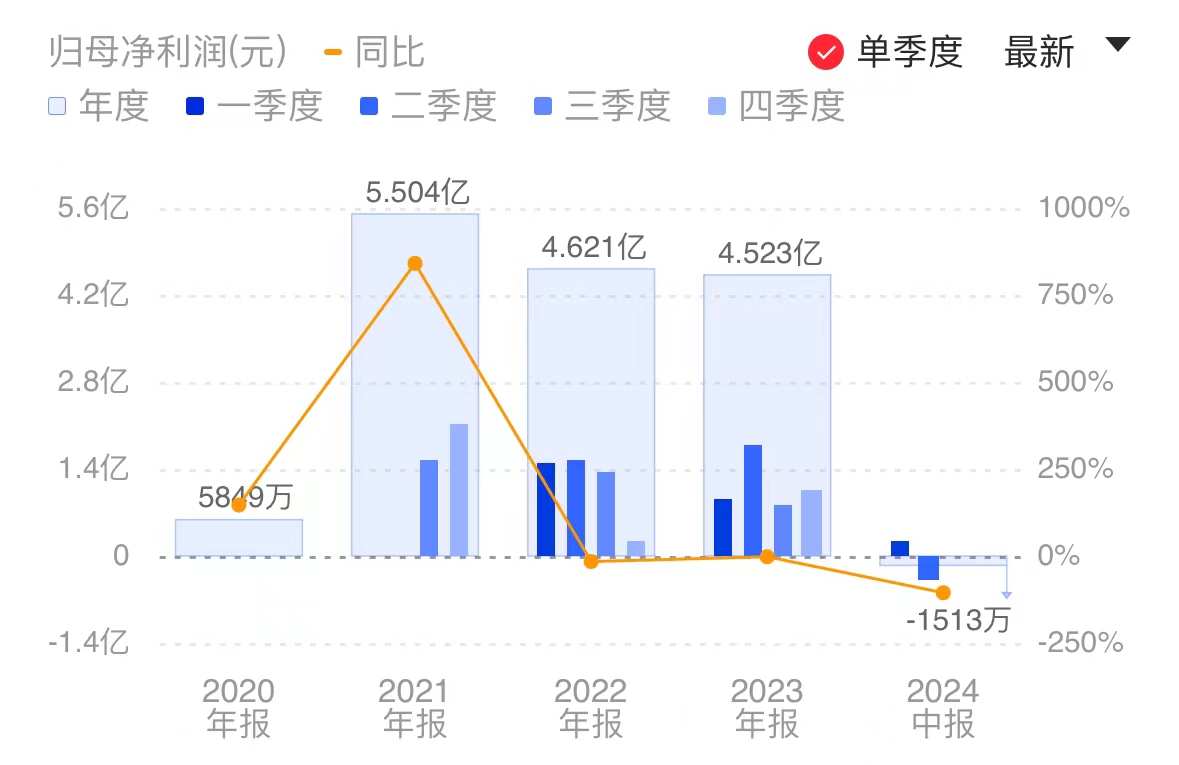

①燕東ウェイは2024年上半期の売上高が前年同期比で43.10%減少し、親会社の当期純利益は-1513万元で、前年同期に比べて赤字に転落しました。②燕東ウェイは、高密度パワーデバイスプラットフォームが開発され、複数の製品が少量生産され、12インチ製造ラインの良率が98.5%以上に達成されたと発表しました。

《科創板日報》8月23日の報道(記者: 郭辉)によると、燕東ウェイは本日(8月23日)夜に2024年上半期の財務報告を発表しました。

データによると、燕東ウェイは上半期において売上高61.7億元を実現し、前年同期比43.10%減少しました。親会社の当期純利益は-1513万元で、前年同期の26.8億元から赤字に転落しました。

燕東ウェイによると、業績の変化は主に市場の変化、一部の製品価格の下落、需要の減少に起因しています。

燕東ウェイによると、業績の変化は主に市場の変化、一部の製品価格の下落、需要の減少に起因しています。

燕東ウェイの製品とソリューションビジネスはIDMモデルで運営され、製品カテゴリは多岐にわたり、主に消費電子、車載電子、新エネルギー、電力電子、通信およびスマート端末、特殊分野に活用されています。今年上半期、この部門の売上収入は3.05億元で、前年同期比55.06%減少しました。

燕東ウェイによると、同社は積極的に市場の変化に対処し、新製品の開発を強化し、新製品および新顧客の拡大、技術及びリソースの蓄積を図り、市場の回復に対応する生産準備を整えています。今年上半期、こちらのビジネスラインは22種類のシングルチップ集積回路、15種類のハイブリッド集積回路の開発を累計し、5Vおよび40V SOI CMOS特殊製造プラットフォームを開発し、100を超える新しい顧客を獲得しました。

製造およびサービス分野では、燕東ウェイは主にパワーデバイス、電力管理ICなどのサービスを提供しています。上半期の製造およびサービス事業部門の売上収入は2.81億元で、前年同期比23.45%減少しました。

燕東マイクロは2022年下半期から、外部マーケット環境が持続的に低迷し、特に消費電子製品の価格変動が激しくなり、2024年上半期以降、消費市場は徐々に回復し、注文需要がわずかに増加しましたが、平均製品価格はまだ大幅に下げられ、消費製品の収益は同時期と比べて若干減少しました。

財務報告によると、燕東マイクロは上半期に8インチ生産ラインの主要生産機器をアップグレードし、8インチウェハ生産ラインのIGBTやFRDなどのプロセスプラットフォーム製品が国内の新エネルギー自動車トップ企業の信頼性認証を取得し、量産供給が実現しました。標準CMOS用ディスプレイ駆動回路も顧客の検証を通過しました。また、超高圧600V BCDプロセスプラットフォームを基にした13種類の製品が量産化されました。

12インチでは、高密度パワーデバイスプラットフォームの開発が完了し、数種類の製品が顧客の検証を通過し、小規模な量産が実現しました。燕東マイクロは、12インチライン全体で安定した量産を実現し、良率は98.5%以上に達しました。

初期投資プロジェクトの進捗に関しては、現在、この会社の「特色工法12インチ集積回路生産ラインプロジェクト」は、第1段階が今年の7月に稼働し、第2段階が今年の4月に試験生産が開始され、2025年7月にプロジェクトが完成する予定です。

シリコンフォトニックチップ製造の分野では、燕東マイクロは今年上半期に8インチ生産ラインと12インチ生産ラインの両方で進展を遂げました。

具体的には、8インチSiNプロセスプラットフォームは量産化され、市場での販売も実現し、月間生産能力は1000枚に達し、年間納入量は5000枚を超えると予想されています。また、8インチSOIプロセスプラットフォームは一部のキーデバイスの開発が完了しました。12インチSOIプロセスプラットフォームも一部のキープロセスの開発が完了しました。

燕東マイクロは、SiNシリコンフォトニックプロセスプラットフォームで突破を達成し、5種類の新製品を開発し、量産化して安定した供給を実現しました。製品の良率は95%以上で、LIDARや光通信の領域に応用されています。

今年上半期、燕東マイクロの資産価値の減少損失は4107万元で、前年同期を大幅に超過しました。

「科創板デイリー」によると、9月26日に燕東微は12111.33万株の制限株式を解禁し、総株式の10.10%を占め、すべては初公開原株主の制限株式であり、株主はYiZhuang GuoTou、JingGuoRui、ChangCheng ZiGuanなどからである。この解禁後には残り61840.19万株の制限株がある。

燕东微表示,

燕东微表示,